The Oracle of Omaha, Warren Buffett, once said, “Banking is a very good business, unless you don’t do anything dumb.” By the looks of it, Mumbai-headquartered DCB Bank has not done anything dumb for quite a while now. The numbers tell us the story. Over the last five years, the bank’s interest income has grown at 24%, while its profit has grown 37% every year. Its net interest margin (NIM) at 3.9% stands higher than the industry average of 3.3% and gross NPA and net NPA of 1.6% and 0.7% indicates that the bank has a tight leash on its asset quality.

And what’s more, at the end of FY16, the bank’s management set itself a target of doubling its loan book in the next three years through rapid branch expansion and cross-selling of its products. While things are looking pretty for the bank, it has survived through some really rough times to get here.

Back from the brink

In 2008, the bank was in so much trouble that the current CEO, Murali Natrajan did not want to associate with it when headhunters initially approached him. “When I was approached for the job, I didn’t even want to consider the idea,” he recalls.

He was not wrong in being wary. The asset quality was in shambles due to the aggressive bumping up of its loan book through personal loans prior to FY08. At the end of FY08, the gross NPAs stood at 1.5% and net NPAs stood at 0.7%. A year later when the financial crisis imploded, gross NPAs had climbed to 8.8% and net NPAs were at 3.9% by the end of FY09.

The headhunter who had approached Natrajan told him to at least meet the board before reaching any decision. Natrajan checked out the bank’s board members and the impressive list included Nasser Munjee, Tony Singh and Narayan Seshadri. Singh, his former boss at American Express was not sure if Natrajan was the right man to take the bank forward. “Tony told me given that I have worked only with foreign banks and had no experience of managing the board, he wasn’t sure if I would be able to handle it. He wanted me to make a presentation on what I’d be doing with the bank,” recalls Natrajan. Until then, he had only worked for foreign banks such as Standard Chartered and Citibank, besides the American Express stint.

It was 2008 and there was a three-day holiday in Singapore on account of the Chinese New Year. Natrajan sat in his apartment and spent 40 hours preparing the presentation. He then mailed it to the board. In January 2009, he met the board and presented his ideas. At the end of it, both parties were mutually impressed with each other and Natrajan was given the tough job of cleaning up the operations. “I knew some people working in DCB. All of them were shaken up and didn’t know if the bank will survive,” he says. But he had a game plan to set the house in order.

House cleaning

One of the first things he did was to get rid of the risky unsecured loans from the bank’s unwieldy loan book. At the end of FY08, unsecured loans made up 29% of the Rs.4,069 crore book. Of this, personal loans, which was a major stress point for the bank, constituted Rs.726 crore.

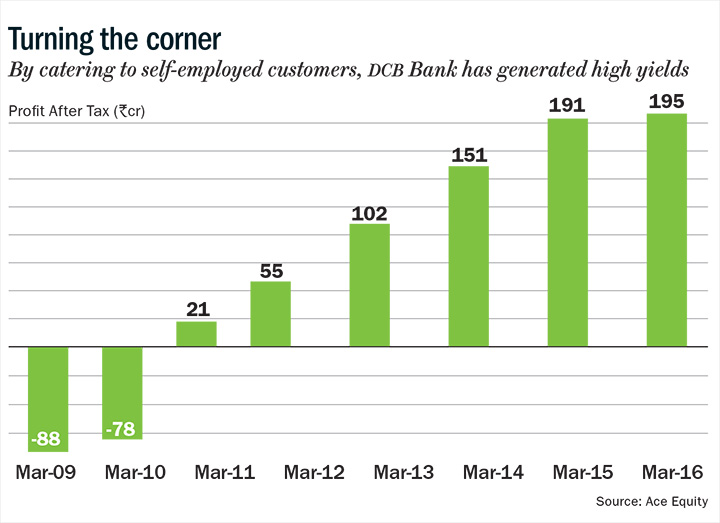

The bank adopted stringent provisioning norms. All unsecured personal loans over 90 days due were provided at 50% and unsecured personal loans over 180 days due were fully provided for. This meant that the bank made provisions to the tune of Rs.102 crore in FY09 and that meant the bank posted a loss of Rs.88 crore during the financial year. By the end of March 2009, the net unsecured personal loans were down to Rs.330 crore. During FY10, the bank made a recovery of Rs.105 crore and also took a write-off of Rs.58 crore. At the end of FY10, gross NPAs stood at Rs.319 crore.

Even the bank’s name couldn’t escape Natrajan’s pruning exercise. Towards the end of 2013, the bank’s name was officially changed from Development Credit Bank to DCB Bank.

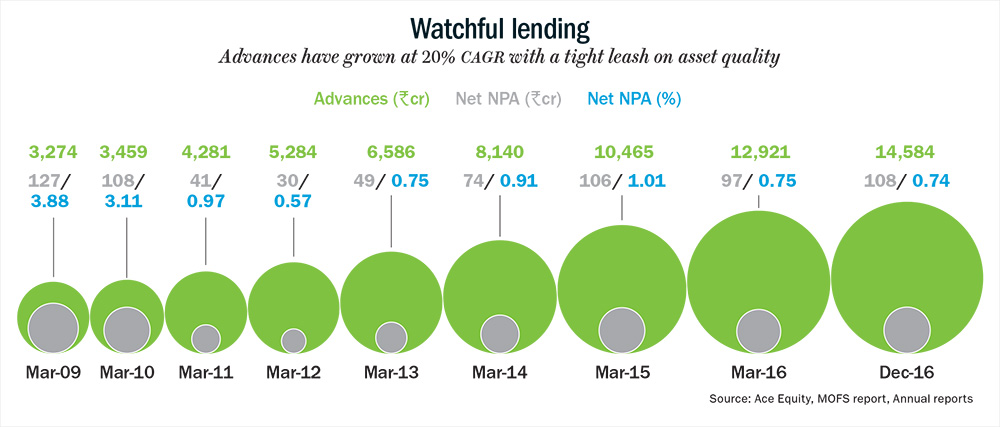

Over the years, the bank has reduced its risky credit portfolio and increased its exposure to mortgages. At the end of FY09, advances stood at Rs.3,274 crore. Since then, the loan book which currently stands at Rs.12,921 crore has grown at an average of 21.66% every year from FY09 to FY16. It consists of mortgage loans which make up 44%, SME loans (11%), corporate loans (16%) and the agri and inclusive banking segment (17%). The balance is spread across commercial vehicle loans, construction finance loans, auto loans, personal loans and gold loans. The unsecured loan book is presently negligible at 3.6%.

The focus on retail and SME started soon after Natrajan’s arrival. “We have been consistently positioning ourselves as a retail and SME bank. Broadly, there are two segments that banks go after — the self-employed and salaried. We target the self-employed segment. There are 50 million SME units in India. Anybody could be our customer,” he says.

The focus on self-employed customers has helped DCB structure a loan book that generates high-yields, which can be seen from its high NIM of 3.9% (only the likes of HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank and IndusInd Bank have a NIM of close to 4%).

On the growth path

With excesses of the past well-contained and a sustainable growth strategy, the bank was back in expansion mode. It announced its plan to double its branch network from 160 branches at the end of September 2015 to 300 branches by December 2017.

After it incurred losses during FY09-10, RBI had placed restrictions on DCB’s branch expansion. So, the bank didn’t add any new branches during FY10-11. Once the restrictions were lifted, the bank added 14 branches in the next two years. In FY14, the bank shifted gears adding 36 branches. In FY15 and FY16, 68 more branches were added. As on 3QFY17, the number of branches stood at 248.

The bank is focusing on semi-urban and rural markets with the new branches. Natrajan believes that if India grows at about 6-7%, the bank should be able to double its balance-sheet in the next 36-42 months. “When the economy was growing at a slower pace, we were growing. We are confident that with a reinforced branch network in place, we would be able to double our loan book,” he says.

However, the competitive landscape is getting more intense with the entry of small finance banks. In 2015, the RBI gave in-principle approval to 10 entities to set up small finance banks. These new entrants operate in the same retail and SME segment that is DCB’s mainstay. So, is the bank ready for more competition? Analysts believe they are. “DCB has been aggressive in opening branches. They want to capture a significant market share before small finance banks and payment banks get into the thick of things,” says Rajiv Mehta, banking analyst at IIFL. Over the past three years, the retail mortgage loans business, which caters largely to the self-employed segment, has grown at an average of 33% every year. Analysts believe that small finance banks will take time before they can start offering the complete product suite offered by banks. “Over the next two-three years, small finance banks will be focusing on building a sustainable deposit base, rather than looking to expand their product suite,” observe analysts at SBI Cap Securities in a note. This would give DCB enough time to build on the lead that they have over the new entrants in the sector.

Natrajan acknowledges the competition from small finance banks, but adds that DCB is ahead of the curve. “We will need to be open to learnings from our competition. But we are nimble and adapt quickly to any change in the business environment,” he says.

As the bank looks to double its loan book, a larger book could pose asset quality challenges. However, analysts believe DCB Bank has got the right processes in place to mitigate any such risks. “Despite aggressive expansion, DCB Bank has good risk management practices in place and that should help them maintain their asset quality,” says Alpesh Mehta, deputy head of research, BFSI at Motilal Oswal Financial Securities (MOFS).

Natrajan says the bank uses analytics to track its borrowers’ asset quality. “We have a concept called Early Warning Signal (EWS). We look at several data points to see if we can get an early warning on a customer. For instance, say we have an SME customer, whom we have given a loan of Rs.2 crore and let’s say it is an overdraft. The overdraft is meant for business-related expenditure. Suddenly, he buys a luxurious car. We will know that he will get into trouble. We look at about 40 data points to keep track of our borrowers’ asset quality,” explains Natrajan.

Besides a good tracking system, the bank has strict internal controls to keep its asset quality in check. The bank, as a practice, maintains small-ticket loan sizes and most of the loans are below Rs.3 crore. While, small ticket-loans means larger number of accounts, Natrajan believes that with the help of analytics and its 350-odd fleet of collection agents, the bank should be able to maintain its asset quality.

DCB has also chosen to steer clear of the restructuring window. “They have a small restructured book of around Rs.30 crore, which is just 0.2% of their loan book,” says Darpin Shah at HDFC Securities. A smaller restructured book translates to lesser risk of slippages. The bank has also been off-loading some of their roadkill to asset reconstruction company, ARCIL. In Q3FY17, the bank sold Rs.30 crore worth of assets in their third such tranche.

In a recent earnings call, Natrajan told analysts that once they have tried to collect for six, nine or 12 months depending upon the customer, they pass on the NPA accounts to ARCIL. As on December 2016, the bank has Rs.70 crore worth of security receipts. When a bank sells an NPA to the asset reconstruction company, it gets part of the value of NPA in cash and remaining in the form of security receipts which are redeemed as the NPA is recovered.

Bright future

Natrajan shares the road map of how and when the benefits from the new branches will start reflecting in the bank’s overall performance. “In 22-24 months, every branch has to breakeven and by 36-40 months, each branch has to be at 50% cost-to-income ratio. Except for a few branches, most of them are sticking to this trajectory or doing better. By March 2019, we should see cost-to-income ratio coming down to 55% and return on equity of 14%,” he says.

At the end of the December 2016 quarter, the bank’s cost-to-income ratio stood at 60%. From 68.58% in FY13, the cost-to-income ratio has seen a considerable improvement. While it has moved up from 58% at the end of FY16 given its expansion plans, it still remains well within the FY17 guidance of 63% given by the management. Its return on equity slipped from 11.6% at the end of FY16 to 10.7% at the end of the December 2016 quarter due to expansion costs but is expected to bounce back once the new branches breakeven.

The bank would also need to raise capital if it wants to pursue its ambitious plan of doubling its loan book but Natrajan says that shouldn’t be a problem. “We raised tier-I capital of Rs.86 crore in March and we raised another Rs.150 crore of tier-II capital in November. Between August and September, we will try to raise another Rs.300-400 crore. As long as we are able to give good returns to investors, we should be able to raise capital,” he says.

Analysts believe there is still a lot of steam left in the DCB story given bank’s expansion plans and cautious approach. “We take comfort in Natrajan’s track record and the way in which he has led the bank so far. The bank is investing in growth and the strategy of adding branches should drive the future growth of the bank over a sustained long-term period. The operating leverage will start to kick in from FY19,” says IIFL’s Mehta.

As DCB’s new branches start to mature, the bank should also see improvement in its CASA ratio. “We have already done quite well on savings accounts. Without paying more than 4% interest, our savings accounts have grown 18-20% every year. We believe that when branches start to mature, we will be able to report a CASA ratio of 25%,” says a confident Natrajan.

The bank’s CASA ratio has remained stable at around 23-25% over FY14-16. Thanks to the demonetisation effect, its CASA ratio moved up to 26% during the December 2016 quarter. Banks like RBL Bank (Rs.21,229 crore) or City Union Bank (Rs.21,056 crore) with a bigger book have a CASA ratio of 23% and 20% respectively. DCB Bank’s CASA ratio definitely looks better in comparison with other banks. The rise in CASA should lead to lower cost of funds, pushing up its NIM further. Its cost of funds has remained more or less stable at 7% over FY13-16.

Natrajan understands that banking is like any other commodity business. “To differentiate ourselves, we put a lot of emphasis on providing quality service. We don’t consider technology adoption as a competitive advantage. Technology is important, but everyone can copy it. However, no one can copy your culture of delivering customer satisfaction and it takes time to build it,” says Natrajan.

Since he took over, the stock has steadily moved up from around Rs.24 in April 2009 to Rs.157 now — a nearly six-fold increase. At the current valuation, the stock is trading at 2x FY18 book value and 1.8x FY19 book value, cheaper than Ujjivan which is presently trading at 2.7x and 2.4x its FY18 and FY19 book value. Meanwhile private banks such as City Union Bank and RBL Bank trade at 1.1x and 3x respective one year forward book values.

Analysts expect the bank’s interest income and profit to grow at CAGR of 17.6% and 23.4% respectively over the next two years. They feel that the current valuation is attractive as the market is yet to price in the likely improvement in profitability after the new branches reach breakeven. It looks like good times for DCB Bank are here to stay.