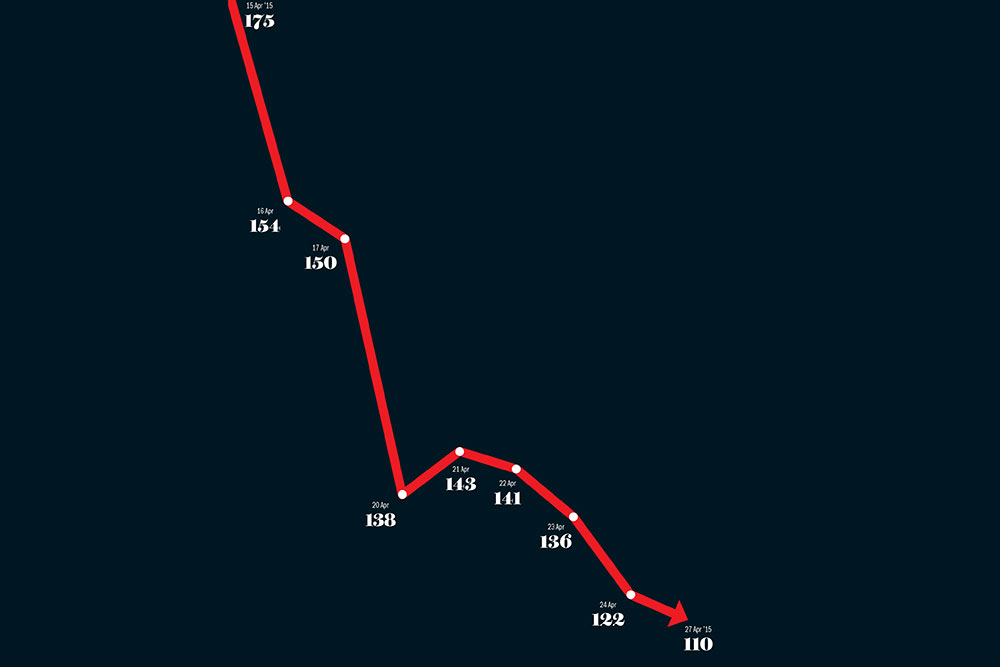

Mathew Wiechert is no George Soros or Bill Ackman but the self-proclaimed short-seller — who runs a boutique hedge fund in California — has stirred a hornet’s nest on Dalal Street by allegedly calling Rolta’s bluff. The mid-cap IT company, which specialises in geospatial information systems, engineering and design services to enterprises and defence forces, tanked 37% in eight sessions to ₹110 (April 27) after Glaucus Research Group — named after the Greek god of the sea blessed with the power of prophecy — came out with a 32-page report indicating that the ₹2,733-crore (9MFY15 revenue) Mumbai-based company had perhaps cooked its capital expenditures over the years in order to hide its Ebitda overreach.

“Based on the evidence and analysis presented in this report, we believe that Rolta has fabricated its reported capital expenditures in order to mask the fact that it has materially overstated its Ebitda. The margin for error is narrowing: Rolta’s net debt has risen from $319 million in FY11 to $740 million in Q32015 and the company has almost nothing to show for its highly suspicious spending,” says the report.

The company has mopped up over $500 million — $300 million in 2014 and $200 million in 2013 — by issuing bonds to foreign investors. Glaucus has recommended a ‘strong sell’ on the bonds, which are due to mature in 2018 and 2019, by pointing out that the company does not generate free cash flow and, hence, would not be able to repay its offshore bondholders without refinancing.

The hedge fund has set a price target of $0.16 for the bonds, whose prices fell 14% to $85 (2019 bond) and 15% to $87.5 (2018 bond) on the Singapore Exchange. Although Rolta challenged the allegations in a point-by-point 37-page rebuttal, Glaucus responded to it on April 23 with a 27-page-long counter-attack, sending the stock 3.5% lower. Rolta got back with another 25-page rebuttal on April 27. Though the jury is out on which way this tussle will go, Glaucus seems to have drawn first blood.

Point counterpoint

Digging deep into Rolta’s financials, Glaucus’ primary observation is that Rolta has little to show for its reported capex of ₹7,000 crore incurred between FY08 and FY14, given that its fixed asset turnover ratio is a dismal 0.7X (over FY12-FY14), which is 93% less than an average of its putative peers. In its rebuttal, Rolta said Glaucus had presented misleading figures and instead compared the ratio with Tata Power, Tata Power Strategic Engineering Division (SED), L&T Defence Related Subsidiaries, Hexagon AB and ITI. As a result, the company’s fixed asset turnover ratio of 0.7X appears second-highest.

However, Glaucus has countered this view by stating that this response attempted to distract investors from the company’s figures by offering a peer group that included a power utility, a manufacturer of ships and submarines and a maker of telecom equipment, whose businesses are nothing like Rolta’s. “The only peer offered by Rolta in the IT solutions space was Hexagon but Rolta appears to have deliberately manipulated the calculation of Hexagon’s fixed asset turnover ratio by including intangible assets to make it falsely appear that Hexagon was as bad as Rolta at capital investments. Calculated properly, we estimate that Rolta’s fixed asset turnover ratio is actually 92% less than Hexagon’s. Such deceptive tactics are massive red-flags to bondholders and only underscore the point that compared [with] other IT solutions firms, Rolta receives almost nothing for its substantial capital expenditures,” mentions Glaucus.

Rolta, in its response, says that the first page of Glaucus’ report itself identifies Tata Power and Larsen & Toubro as “rivals” of the company. The company said it was aware that Tata Power is a utility company and therefore it had identified the SED division (which is the defence division of Tata Power) in its comparison. On the allegation of manipulating Hexagon’s fixed asset turnover ratio by including intangibles, Rolta says the value of Hexagon’s intangible assets (€4,998.8 million) far exceeds the value of its tangible assets (€311.9 million). This indicates that Hexagon’s revenue is primarily generated from its intangible assets, as is typical in a software product company.

Between FY11 and FY14, Rolta spent ₹3,100 crore ($594 million) on computer systems, representing 64% of the Company’s total capital expenditures during this period. “Suspiciously, during this same period, Rolta disposed or scrapped ₹2,110 crore ($396 million) of computer systems (including over ₹590 crore ($108.1 million) of recently purchased equipment) and in return received only ₹7.72 crore ($1.3 million),” states the Glaucus report.

On a gross basis (i.e., ex-depreciation), as of FY14, Rolta’s balance sheet had $99,873 (₹60 lakh) in computer systems per employee, which is 45 times more than a broad group of Indian-based IT companies, thereby indicating that such purchases were not authentic, feels Glaucus. In its rebuttal, Rolta has disputed the cash-loss figure of ₹2,550 crore that Glaucus alleges the firm incurred during FY08-FY14 by purchasing and quickly disposing of computer equipment.

Rolta claimed that the loss — after factoring in depreciation — stands at ₹88.42 crore for FY08-FY14 and added that computer resources and technology-related products by their very nature are highly depreciable. It said that according to a leading technology research firm, which Rolta didn’t name, a two-three year replacement cycle is ideal for high-performance users. Glaucus’ report, however, points out that the company fails to address evidence that it appears to have fully depreciated disposed systems on an even quicker timeline — one year in some cases. Rolta buys computer systems only to depreciate and dispose of them shortly thereafter for an almost total loss.

In FY13, Rolta appears to have fully depreciated the brand new computer systems it purchased in FY12 for ₹580 crore ($108.1 million) and disposed of them for ₹1.2 crore ($222,000), according to Glaucus. “What exactly did Rolta buy? Why were such systems disposed of so quickly? To whom were they disposed,” asks Glaucus in its report. Hiranya Ashar, joint MD and group CFO, Rolta, says, “There is no single vendor. These are different vendors for hardware, different vendors for networking, different vendors for software, different vendor for security and firewalls.”

Rolta in its response says that depreciation of the computer systems is not an “accounting gimmick”. The company alleges that Glaucus is ignoring basic accounting principles by claiming that loss on the sale of a capital asset (such as the company’s computer systems) is merely cost price minus selling price, “assuming no depreciation”.

On why Rolta doesn’t adopt the same practice followed by other IT companies like Tech Mahindra and Infosys of taking computer systems on lease as they are highly depreciable, Ashar says, “Some companies have a more conservative strategy, where they lease systems because the projects are of one or one-and-half years. In such companies, employees often visit clients and use their infrastructure, including their systems. We think that we are in this business for the long run. We also need to buy rugged computer systems in order to provide solutions to the defence industry.”

Dissecting the capex spent further, Glaucus points out that between FY10 and FY14, Rolta spent ₹950 crore ($ 185 million) on buildings. Yet, during that time, Rolta did not disclose the acquisition or construction of any new buildings or real property.

According to Rolta, during FY06-FY14, it had undertaken capital expenditure to demolish certain existing building and re-construct newer and modern facilities in their place. Glaucus in its response states that in FY12 and FY13, Rolta reportedly spent ₹660 crore on buildings and, according to Rolta’s response, the only active project during those years was the demolition and rebuilding of Rolta Tower 1. “But on Rolta’s FY11 conference call, its CFO said the Rolta Tower 1 redevelopment would only cost ₹100 crore, meaning ₹560 crore is missing and not accounted for.”

Rolta in its response has said that all the expenditure of the company in relation to redevelopment of the company’s properties is accounted for and disclosed. The company says that Glaucus initially alleged that Rolta’s buildings were missing and has now conveniently modified its stance to allege that the ₹560 crore is missing (instead of mentioning missing buildings). It said that Glaucus has misconstrued the responses of the management on the FY11 conference call and has presented some of the information out of context. The company said that a facility like Rolta Tower I will take around three to four years and cannot be redeveloped in less than a year.

In FY14, Rolta also spent ₹840 crore ($139.4 million) of capex on the development of prototypes. According to Glaucus, this is suspicious because Rolta’s maximum expenditure for prototypes for its two most significant prospective procurement contracts is $23.4 million (because the Indian ministry of defence covers 80% of the cost of such prototypes). “If Rolta spent a maximum of $23.4 million on its two most salient prospective contracts, we are highly suspicious that it spent another $112.1 million in FY14 on prototypes for projects not disclosed to investors,” states the hedge fund’s report.

Rolta says that the company has already explained that the figures of ₹90,060 lakh ($150.1 million) and ₹83,790 lakh ($139.4 million) quoted in the prospectuses of the bonds are not expenditure on prototypes alone but the entire capital expenditure (including acquisition costs) of the company for the entire period.

It claimed that Glaucus has ignored all of its responses and is attempting to distract the reader by misconstruing statements made by the management (in context of the 80% reimbursement entitlement by the MoD). As previously explained, the reimbursement by the MoD is only after selection as a development agency for development of project prototype.

Rolta’s capital spending on office furniture, too, has come under the lens. As of FY14, states the Glaucus report, Rolta’s balance sheet showed $10,493 worth of furniture and fixtures per employee, which is 7.1X greater than Google, which has some of the most lavish corporate facilities of any business. Again, such capital expenditures simply appear fabricated. In its rebuttal, Rolta points out that Glaucus incorrectly compares the gross furniture and fixture (FF) value per employee against net FF value per employee of other companies. It added that the company’s facilities are not only for its employees but also subcontractors.

Ashar also points out that number of subcontractors are not stable. “There will be a point when you will require 1,000 subcontractors and there will be a point when you will need just 200 subcontractors. The number of employees keeps changing on a regular basis but this is the approximate number, plus or minus 100 people,” says Ashar, adding that this capacity is built keeping in mind future growth.

Rolta in its latest statement adds that Glaucus has ignored the company’s response that the entities used by Glaucus in its comparison are incomparable as the business model of such entities is different. The company’s competitors (as identified by Glaucus) typically second/outsource their employees to external client locations. Accordingly, the seating capacity of these competitors is typically designed to cater to only a portion of their work force.

That Rolta planned to spend ₹150 crore on a new facility at Gurgaon but did not disclose the fact that the Gurgaon facility was owned by chairman KK Singh’s private company, too, has come under the scanner. The Glaucus report added that Rolta appears to be paying the chairman ₹15.6 crore per year to lease the facility. “Why would a company pay to construct a facility that it does not own and then also pay to lease it? We believe that either such spending is fabricated or is simply a naked transfer of wealth to the chairman,” states the report.

Rolta has conceded that the Gurgaon facility was in the name of a company closely held by the chairman and his family but says that the listed entity has taken two floors under a lease arrangement entered into in 2008. “The company pays rental amounts to Rolta for leasing the Gurgaon facility. The company denies that it is paying any monies to the chairman directly or that it is an attempt to transfer wealth to the chairman,” Rolta stated.

The company has now also alleged that Glaucus has ignored the company’s response that ₹150 crore was not just expenditure on furniture and fit-outs but also air-conditioning, power-generators, computer systems and setting up a defence demo and R&D testing laboratory at the company’s Gurgaon facility.

According to Glaucus, since FY09, Rolta spent an average of 178% more on capital expenditures per year than the figures the management conveyed to analysts in Q1 or Q2. Rolta’s report says that the cost includes acquisitions but Glaucus counters that even if the effect of acquisitions is taken out, the figures stay constant. Glaucus Research Group’s director of research Soren Aandahl points out that if such capital investments are legitimate, they should be reasonably foreseeable.

“If they are fabricated, guidance would be useless because such reported expenditures are simply concocted at year-end to offset dubious Ebitda reported by the business. In our opinion, Rolta’s reported spending suggests the latter, not the former.” Rolta in its latest response reiterates that its capital expenditure has been duly accounted for and disclosed.

The company alleged that Glaucus has since changed its stance on the percentage of variance from 178% to 167.7% (which is also incorrect), as it has implicitly admitted that it had previously disregarded that the cost of acquisitions are not included in the capital expenditure guidance.

Further, it says the cost of acquisition now included is also incorrect as Glaucus has conveniently only included cost of acquisition of subsidiaries and not other acquisition costs for assets and intangibles. There is a variance of 586% between figures reported in the company’s annual report and figures used by the Glaucus report for its calculations.

Loose ends

Incidentally, Rolta’s working capital to turnover ratio has been erratic over the past five years, data from Ace Equity shows. From 2.18X in FY11 to 4,951.7X in FY13 and -99.08X in the nine-month period ending FY14, the ratio has seen wild swings. When asked to share some numbers on the company’s capex utilisation plan, Ashar points out that the capex cycle is “behind us” and it is going to be largely maintenance capex and capex in a few areas in defence that Rolta wants to expand.

“We don’t need any more capital expenditure for furniture. For the plant and machinery, other maintenance capex will be around ₹300 crore-350 crore per annum.” Says forensic auditor and chartered accountant Abhishek Asthana, “With an estimated ₹300 crore-350 crore capital expenditure plan with insignificant addition of buildings and peak manpower requirement (employed plus outsources) of around 4,500 per person, the additional capital expenditure planned just for assets such as computers and furniture comes to around ₹7.5 lakh. In my view, Rolta should come out and justify its proposed plan of expansion duly supported by relevant details in a more transparent manner.”

A fund manager with one of the largest Indian AMCs says that he has stayed away from Rolta India as it seems to have too many debtors and a high working capital for a services company. Data from Ace Equity shows that the average receivable days for Rolta during the FY10-FY14 period are 114 days. In case of other IT companies such as Tech Mahindra, HCL Technologies, Hexaware, Infosys, Mindtree, NIIT Technologies, TCS and Wipro, the average receivable days for the same period are 56-72 days. Ashar, however, attributes that to Rolta being not just a services company but a solutions and services company. “We bill clients when we reach their milestones, which could be every two or two-and-a-half months. Our business model is different from other IT companies. Apart from this, business with the government is another reason behind the extended payment cycle.”

As of FY14, Rolta’s total consolidated debt stands at ₹4,056 crore, as against ₹3,650 crore in FY13, data from Ace Equity shows.

Full Monty

Although Glaucus in its report has said it is biased and it will financially gain from any decline in Rolta’s Delaware-issued bonds, the research group has also said that it does not mean it is wrong. Following the report, a New-York based legal company Rosen Law Firm has even started preparing a class action lawsuit against Rolta. The company has asked Rolta’s bondholders to come forward and join the class action suit.

Phillip Kim, partner at Rosen, said that prima facie, the Glaucus report appears credible. While Rolta questioned Glaucus’ methodology for preparing the report without even once visiting the company, Phillip says it doesn’t matter whether Glaucus has contacted Rolta or not. “They have issued several reports in the past and the group has been found correct in all those reports. Also, a lot of the information presented in the report is easily verifiable. Besides, under the US law, we don’t have to prove everything. For instance, if the company has failed to make adequate disclosures in the bond prospectuses, then it will be penalised. The penalty in this case would be tied to the drop in value of the bonds due to the report,” says Kim.

On the other end of the spectrum, investment advisors and rating agencies who have so far held stable-to-positive views on the IT services and solutions provider are now questioning Glaucus’ credentials. Randy Durig, CEO at the Oregon-based Durig Capital, which called the 2018 Rolta bonds a “superior opportunity” in 2014, says Glaucus Research Group’s founders are known to be “shady and back-alley”.

As per Glaucus’ website, Matthew Wiechert, its principal and founder, has a background in capital markets and investment banking, while Aandahl, its director of research, has a background in corporate finance and law. Wiechert is a short-seller who has, in the past, worked with the California-based boutique investment bank Roth Capital.

A day after Glaucus came out with its scathing report on Rolta, Deutsche Bank upgraded its recommendation on Rolta’s 2019 bonds from ‘hold’ to ‘buy’. The bank said it agreed with the company’s response that Glaucus had made factual errors in its report and that the report had very little new information. Incidentally, Deutsche Bank was one of the lead managers to the 2018 five-year senior notes issue and also the trustee and security agent. Additionally, it is the depository bank to Rolta’s GDRs.

In an e-mail response on whether Deutsche Bank disclosed this in its report, its spokesperson said, “Deutsche Bank research is an independent function that issues clear, fair, objective research and operates with the highest levels of integrity and compliance. All required and relevant disclosures were made.” However, the firm hasn’t responded to a request for sharing the report.

To Durig, Rolta bonds still looks promising and his team is considering whether they should buy more bonds, given its sharp correction post the crash. Back home, an analyst with a domestic rating agency, which recently removed Rolta from its negative watch, said he didn’t find any reason to review their rating. “Free cash flow (FCF) is negative for most emerging market companies as they are chasing growth. The company’s books are being audited by Grant Thornton since last year, which is a reputable auditor. A research entity can have an adverse view on the firm but analysts must meet the company before issuing a report. There seems to be malicious intent in the report,” he said, on condition of anonymity.

Meanwhile, Fitch, which had earlier given a ‘stable’ outlook for Rolta, has changed its mind following Glaucus’ response to Rolta’s rebuttal. Glaucus had contended Fitch’s decision to give a -BB rating to Rolta’s bonds and had called its analysis ‘rubbish’. The report said bondholders and ratings agencies have fallen for the myth of Rolta.

On April 24, the rating agency said that due to higher working capital requirements, Rolta’s leverage and FCF will be worse than our previous expectations despite higher forecast Ebitda. It added that Glaucus’ report was one of the triggers for the downward revision and expected a further response from the company, while affirming its -BB rating. “Our analysis relies on information provided by Rolta… This includes discussions that we have had and that are ongoing with management and their auditors with regard to the allegations that have been made,” it said. In an e-mail response to Outlook Business on Glaucus’ remarks, a Fitch spokesperson said the company did not wish to make any comments.

The slip is showing

This is not the first time that Rolta has come under a cloud. In 2004, markets regulator Sebi had concluded that Rolta had inappropriately inflated its reported revenues by 12-34% each year from 1996 through 2001 by including the cost of capital equipment in its top line revenue figures. “Neither Rolta’s independent directors on its audit committee nor its auditor were fired or resigned,” states Glaucus.

The allegations made by Glaucus have also raised questions on the role of the auditors — Grant Thornton — in this case. “In the position that Rolta currently is, I think the role of independent directors and statutory auditors become extremely important. They must extend the horizon of performance review of Rolta so that they can ensure propriety, integrity and transparency of company operations,” says Asthana. An e-mail query sent to Grant Thornton India for their comments elicited no response.

Proxy advisory firms say independent investigation is the need of the hour. “With charges, the company’s defence and more accusations, this has become muddy. What you need is an independent agency to help separate the wheat from the chaff. If the accusations are true, go after Rolta, if not, take Glaucus to task. Meanwhile, it will be helpful to have Grant Thornton, the auditors, step up and re-verify the data regarding receivables and bank deposits,” says Amit Tandon, managing director at Institutional Investor Advisory Services.

Though Rolta is said to be exploring legal options, Glaucus has issued recommendations on Rolta’s bonds issued in the US and not its local shares and, hence, may not come under Sebi jurisdiction. Aandahl, though, believes they have not erred in their analysis. “We spent five months and 500-600 hours analysing Rolta. We’d like to think that we know as much, if not more, about the company than any other analyst or investor. As for the fruitlessness of contacting Rolta directly, I think Rolta’s response says it all. I believe that any contact with the company would have yielded more of the same.” The market seems to concur: the stock continues to slide even as this issue goes into print.