Little Lotus is a nobody in the beginning of the 2008 movie, Kung Fu Panda, other than being a panda with a ridiculous dream. He, with his wide girth, wants to be a martial arts champion aka the Dragon Warrior. But, he tires too soon, loves food and hates steep climbs. Just when it looks like the panda is off his rockers, imagine Bruce Lee and Jet Li making an appearance and saying that they want to bet on the panda. That they believe he will win against the dreaded leopard with the lightening moves, Tai Lung.

The world begins to look confusing, like it has slipped into another dimension. That’s what investors and industry watchers must be experiencing, watching the floundering Religare Enterprises (REL) and its subsidiaries attract the money of ace private equity firms and investors such as Kedaara Capital, Lucky Investment Managers’ Ashish Kacholia and Param Capital’s Mukul Agrawal. REL, a financial services group, has been taking many punches and hardly landing any recently. So, why have these investors bought in?

News behind the headlines

Usually, PE firms need certain boxes to be ticked before they invest. One is that the company has to be an established player; Second, a strong management and three, visible growth potential. But REL, at first glance, appears to score poorly on all these fronts, going by its past.

In 2017, its minority shareholders began getting antsy. They wanted a change in REL’s board, claiming that the company’s funds were being mismanaged and that loans issued by REL were being written off. The dissent grew louder with each passing month and, in 2018, the RBI pulled up REL’s NBFC Religare Finvest or RFL, which caters to micro, small and medium enterprises. Therefore, the central bank asked the NBFC to adhere to the bank’s corrective action plan (CAP) till a debt reconstruction plan could be put into place. Under the plan, RFL was not allowed to expand its credit/investment portfolio (other than invest in government securities) or pay dividends. RFL’s entire corporate loan book of Rs.24 billion was classified as NPA and rating agency ICRA mentioned in a May 2019 note that overall gross NPAs were as high as 53% in December 2018. While justifying the rating downgrade, it added, “The company has also reported a breach in the capital adequacy ratio with a total capital adequacy of 11.37% as on December 31, 2018, significantly lower than the regulatory requirement of 15%.”

Earlier in February 2018, REL’s earlier promoters Malvinder and Shivinder Mohan Singh resigned from the boards of REL and Fortis after they were accused of misappropriation of funds. This June, the ‘fraud’ word was being bandied about again, in relation to the company. Karnataka Bank informed the stock exchanges that four accounts, including that of RFL, were “fraud”. The bank said that it was concerned about the “diversion” of Rs.430 million credit extended to RFL.

The NBFC was quick to respond to the bank’s allegation, and said that the company had not cheated any lenders and that it itself was a victim of fraud because its earlier promoters had diverted funds. Gaurav Kaushik, CFO, Religare Finvest, says that Karnataka Bank has made the charge when a resolution was being worked out. According to the company, RFL was under debt restructuring (DR) and was working with the lending banks as per RBI norms and a plan had been submitted for approval. “Unfortunately, RBI did not accede to TCG acquiring RFL and the transaction could not be concluded. As a result, we had to approach the banks once more, for a revision in the DR. But, in the interim period, we obviously became an NPA because we were already facing asset liability issues.”

With these claims and counter claims, it is only natural that market sentiment has soured towards REL. When the stock listed in 2007, it opened with 75% premium at Rs.324, but over the years, the mismanagement took its toll. In March 2020, it hit a low of Rs.17 and now trades at Rs.36.

Whale shopping

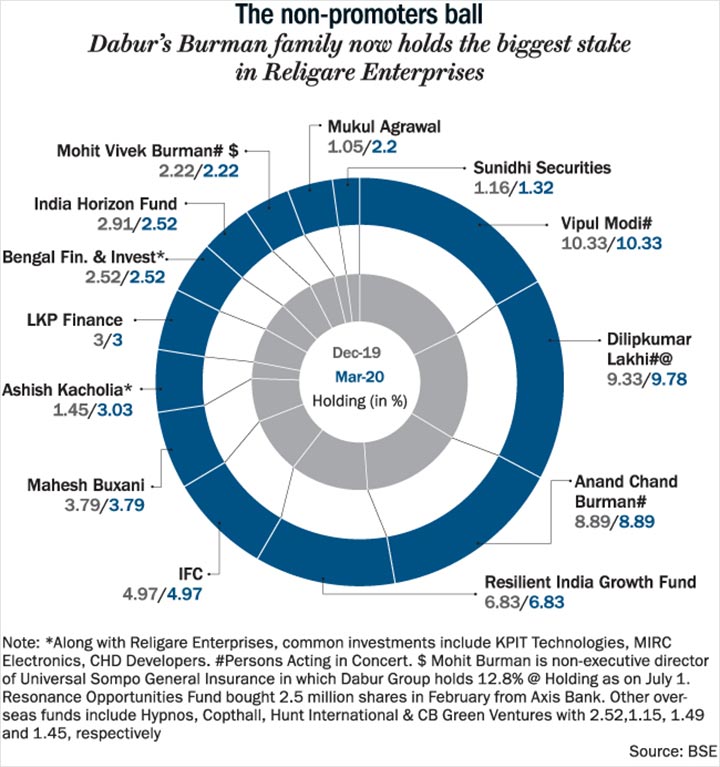

It was in December 2019 that Ashish Kacholia’s name popped up for the first time in REL’s shareholding. The reclusive ace investor is known to bet on turnaround stories in mid and small-cap companies. This February, he increased his stake at Rs.44/share when Axis Bank wanted to offload its holding. As of March 2020, he holds 3.03%. Mukul Agrawal also bought in around the same time and now owns 2.2% (See: The non-promoters ball).

The panda was on the radar of some biggies now. Kacholia when contacted refused to comment but another existing investor offered the following rationale. “Religare’s health insurance business (RHI) has been growing at 20-30%. Once they sell the NBFC Business, the broking business is hardly anything, and I will end up with a pure health insurance business.” Though the TCG deal did not go through, he believes REL will soon exit the NBFC. The promise it holds — the potential to turn REL into a pure play health insurance company — is hard for him to ignore.

Independent market expert, Ambareesh Baliga tells Outlook Business that the investor’s faith might be misplaced. He says the NBFC was going at a pittance for Rs.3 billion, and yet RBI blocked the deal. “It possibly points to major concerns regarding the balance sheet,” he says. The NBFC, in fact, is the most troubled part of the Religare pie. RBI has barred it from fresh lending; it owed about Rs.99 billion to lenders (management claims it has repaid more than Rs.64.5 billion since January 2018) and is engaged in litigation with the earlier promoters to recover misappropriated funds as well as with Lakshmi Vilas Bank for netting off fixed deposits worth Rs.8 billion against loans given to the earlier promoters.

The new management at REL has been trying to get banks to agree to a debt resolution, and the RFL sale to TCG for Rs.3.3 billion was part of that resolution process, where according to media reports, the banks agreed to take 49% haircut*. But after the sale was blocked, the central bank had asked RFL to approach the bankers with a fresh proposal, which the NBFC has done.

RBI’s corrective action means the NBFC can only collect its earlier loans; therefore, the revenue of the NBFC has been falling. “If you can’t lend more, your book will keep running down gradually,” says Mayur Dwivedi, head-strategy, M&A and investor relations at REL.

In these circumstances, REL trading at a huge discount should not be seen as a great bargain, according to Baliga. He says it is anyway difficult to make money from a holding in the parent company. “Holding-company investors benefit only when the investment is liquidated and a large payout is made to the investors, which is rare,” he says. Also, even if the sale happens, the management is not bound to distribute it among investors as was seen in Lloyd Electric two years ago. According to him, the REL business does not have much value except in the recovery of bad debts. “It’s more about winding down than generating new business,” he says.

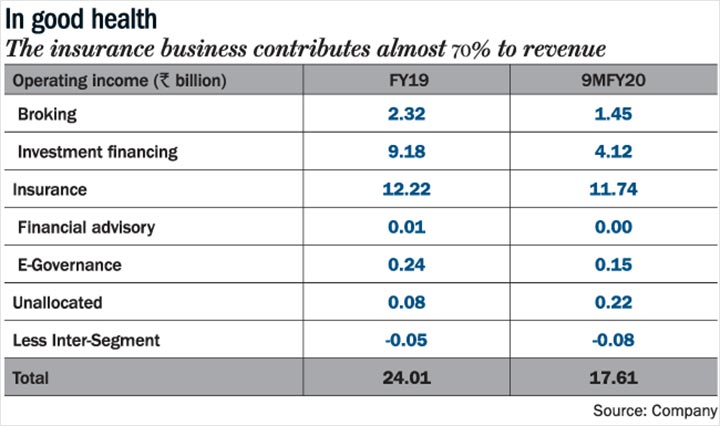

If the bank settlement and planned sale of RFL goes through, REL will be left with the broking arm and the health insurance business. For the first nine months of FY20, the insurance business contributed 67% of total revenue (Gross Written Premium (GWP) was Rs.17 billion) and the broking business about 9% (See: In good health). In FY19, RHI reported GWP of Rs.18.43 billion and profit before tax of Rs.0.57 billion. In essence, the future trajectory of REL is intertwined to the growth of the health insurance business and investor interest bears that out.

Manish Kejriwal founded Kedaara Capital recently invested Rs.5.67 billion in RHI and now owns 18%. The transaction included buying 6.39% stake for Rs.2 billion from REL. This effectively values the health insurance business at Rs.31 billion in comparison to Religare Enterprises’ overall valuation of Rs.10 billion despite it holding 72% in RHI. Earlier, in October 2019, RHI had raised Rs.340 million through a rights issue at Rs.34/share, valuing the health insurer at Rs.23.4 billion. REL’s Dwivedi says that the money will help grow the insurance business, which can be money guzzling. “We wanted to secure this business and it has come at a very good time, before the financial markets were hit by the COVID-19 pandemic,” he says. The Kedaara deal will increase its solvency ratio from 1.5% to 2.5% and ensure that Religare Health is well capitalised to grow profitably when financial markets are experiencing volatility.

Take my money

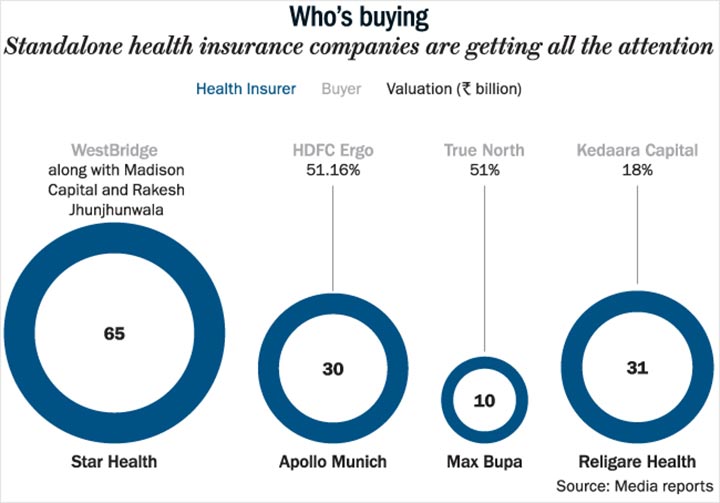

The prime reason for investor optimism is the growth potential in the health insurance space. Similar transactions that have occurred include the buyout of Star Health by a consortium of investors that included WestBridge AIF, Madison Capital and billionaire investor Rakesh Jhunjhunwala. The most recent one was that of HDFC Ergo acquiring Apollo Munich (See: Who’s buying).

“Health insurance is obviously one of the segments where there is under-penetration. There is also the possibility of very sharp growth in spite of competitive pricing,” Madhukar Ladha, research analyst with HDFC Securities highlights in his report. He says that usually people don’t like to buy health insurance thinking they will never have to use it and, contradictorily, never do want to use it. But with COVID-19, he says, “you will see people buying more health insurance over time”.

In the HDFC Ergo acquisition of Apollo Munich, the latter was sold for 1.3x GWP while standalone health insurance market leader Star Health fetched 1.5x GWP. Within the general insurance segment, standalone health insurance companies have seen steady growth over the years. Standalone health insurers have grown at 48% CAGR over FY08-19, while the health insurance industry overall has grown at 28% CAGR.

Divya Sehgal, partner, True North says, “In many standalone insurance companies, profitability is muted. We segregate any loss/investment into “good loss” and “bad loss”. Good loss or “investment” is acquiring long-term value accretive business today (which in the current year may be loss making). Bad loss is from poor underwriting. There also needs to be a sensible transition in place from “investment phase” to “profit phase”.”

True North is another private equity firm, which feels that the health insurance space can yield good return. It had earlier inked a deal to buy REL’s stake in RHI, valuing the health insurer at Rs.13 billion before the deal fell through. True North eventually bought Max’s 51% stake in Max Bupa at 1.3x GWP, having valued the company at Rs.10 billion.

Sehgal says when valuing an insurance business, they look at what cycle of growth the company is in. If it is in early stage, they look at customer acquisition cost and revenue. In mature businesses, they look at bottomline metrics (COR, PAT, PE, etc) in addition to growth. Besides these, they consider the value of the business five to 10 years from now.

Dabur Group’s Anand Chand Burman and Mohit Vivek Burman are the other prominent investors who bought in much earlier into REL through preferential warrants. While Anand Chand Burman’s office did not reply to the questionnaire sent, in an earlier interview to The Economic Times in April 2018 when the Rs.1.5 billion investment was committed, he had said, “Bay Capital has come in. They have appointed a whole host of independent directors, an acting CEO and a non-executive chairman. They are introducing norms of corporate governance.”

That investment clearly bet on a turnaround that would take place after Bay Capital’s oversight. That has not come to pass yet. Outlook Business reached out to Bay Capital’s Siddharth Mehta but he refused to comment for the story. Bay Capital’s stake through India Horizon Fund has declined over the past year but Mehta continues to be on the board of REL as non-executive chairman.

While the Burmans seemed optimistic about their investment when making it, some analysts are questioning if the new management can indeed deliver. An analyst, who spoke anonymously, raises concerns about the company’s board. He cites “a doctor chairing the board of a financial company” as his chief reservation. He also questions if the erstwhile promoters continue to hold a stake through overseas funds.

Baliga, who says that REL can only be valued on the basis of RHI and after deducting liabilities, believes that equity investors should ignore the stock (See: Let’s get moving). “It may make sense for Kedaara because for them it is a strategic play. They will be holding 18% stake in RHI, thus having some kind of oversight regarding the operations,” he says. But, “equity investors should keep away, unless REL is planning to sell RHI and distribute the proceeds to all shareholders,” he adds.

Existing investors in REL could make a bundle if the healthcare insurance business continues its rapid growth. Management could either do a trade sale, or spinoff the vertical and list it separately. Though market experts and investors are divided, the overall sentiment does seem to favour REL and its health insurance business. That optimism being rewarded will result in Kacholia and Agrawal scoring another home run.

*Post the story being published, Religare Enterprises sent the following clarification about Religare Finvest's initial Debt Resolution Plan: "Out of the entire debt of Rs. 5,852 Cr., 51% was sustainable debt. The unsustainable debt too was to be repaid to the banks over 5-10 years and the NPV losses of the banks would have been limited to less than 20%"