Besides a social transformation, the way Indian consumers spend is going to see a lasting shift, according to Kenneth Andrade. This will benefit certain sectors that will emerge stronger after the crisis. The founder and CEO of Old Bridge Capital emphasises that credit is key to kickstarting economic growth. In an exclusive interview with Outlook Business, he discusses the importance of understanding both debt and equity in a balance sheet, why pricing is crucial and which sectors will see growth in the coming years

What’s your prognosis of the current situation?

Today, most of the smaller corporates have just about two months of cash flow to meet fixed expenses. After this, they will need to dip into their reserves and increase borrowing. This could end up being a systemic risk, if the financial sector does not support their requirements. If we go through a phase where corporates have no revenue or billing, the problem could spill over to their ability to retain employees. Thus, whatever needs to be done on the fiscal side must be done within a month. There’s no economy that is in a different shape today. If India is falling off the cliff, the world is falling one notch lower.

Do you believe the system, including consumers, will alter their ways once this scare blows over, given that COVID-19 is once-in-a-generation phenomenon?

I don’t think the fear will go away soon, so yes, I do expect lasting change. For instance, with the fear of loss of income and jobs, we just might see a structural shift away from a consumption culture towards a saving one. And once consumption patterns change, behaviour will change too. In such a scenario, we need to spot businesses and structures that are conducive to where the opportunity lies. A good example of such an opportunity is the insurance or the asset management business. I’m reasonably sure about the adoption of insurance. Whether it is general insurance or life insurance, the number of people buying them will start inching up, and it will become a staple way of investing for a large part of the Indian population.

I also believe there will be a significant social shift in trying to cater to the bottom of the pyramid, which will include a lot of social benefits in terms of healthcare and sanitation, besides mobility or communication, just in case the pandemic occurs all over again. These areas would see massive investments going forward.

How do you see the macro scene playing out?

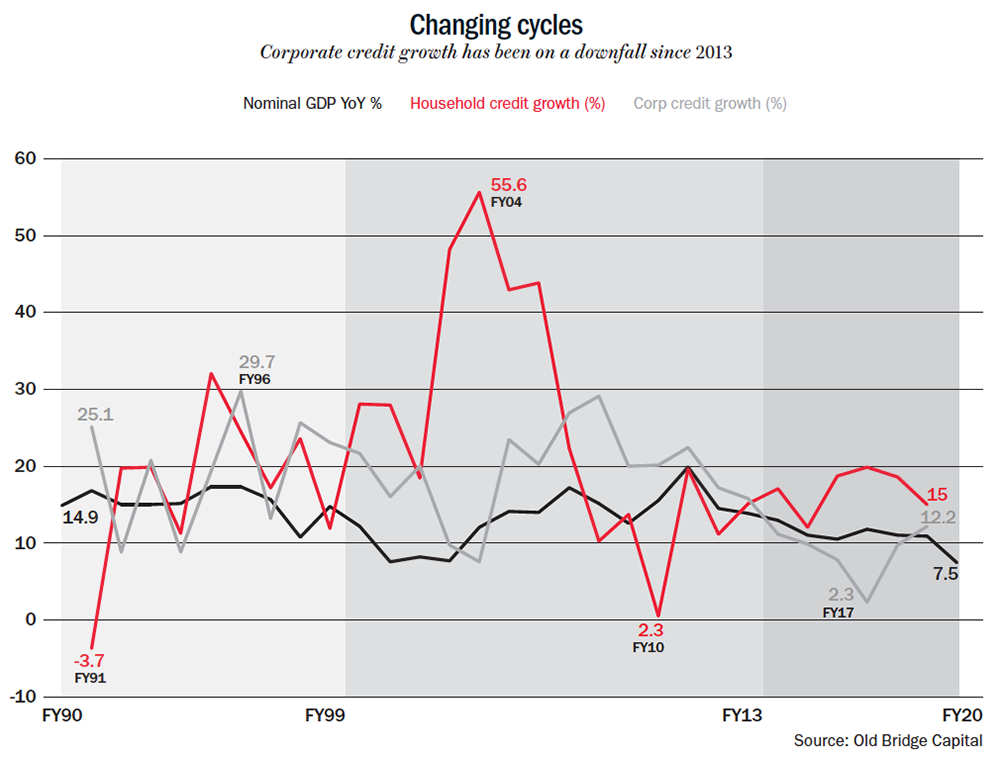

Starting from the ’90s, we looked at the three decades to try and capture what the corporate sector had done and how credit growth had impacted GDP. The previous decade (2000-2010) was driven by the expansion of corporate balance sheet and that trend continued till about 2013. Post that, credit to services and households started growing faster than corporate credit and that held up the entire economy (See: Changing cycles). While corporate balance sheets were deleveraging, household balance sheets were leveraging. Mid-size to large corporates were borrowing at 11.5-12%, but housing loan rates were available at 8.5-9%. So, in the latest decade, GDP held up on consumer spends. Today, corporate credit and retail credit are at the extreme ends of each other, the former is skimming close to its lows (as per debt-to-equity ratio) and we believe household leverage is higher than the last decade. On the other hand, household savings, as a percentage of GDP, has fallen below 17%, a number we have not seen in a very long time.

There could be two significant implications here. First, discretionary consumption will be off the table for some time now. That means there can’t be multiple winners in the same category anymore. For instance, in the automobile industry, the number of four-wheeler and two-wheeler manufacturers will narrow down to just one player cornering a lion’s share of the market. As the market consolidates, the player with access to the cheapest capital will win.

There could be two significant implications here. First, discretionary consumption will be off the table for some time now. That means there can’t be multiple winners in the same category anymore. For instance, in the automobile industry, the number of four-wheeler and two-wheeler manufacturers will narrow down to just one player cornering a lion’s share of the market. As the market consolidates, the player with access to the cheapest capital will win.

This is obviously bad news for the banking sector. The growth driver is at risk, delinquencies may rise further, and capital will become expensive…

The banking sector is taking it on the chin; this industry is always leveraged to the growth cycle of the country. Due to the nature of the business, balance sheets are always leveraged almost 9x. The market has been valuing them at their peak P/B ratio for RoE of 15-16%. Even though we will continue to see a shift from PSU banks to the private sector, many in the latter have lost the ability to raise growth capital, including the large players. Smaller and new-age banks have also been washed out. So, it will be interesting to see how some of the names rise up to the challenge. It will be a long drawn out one.

Meanwhile, when it comes to the PSU banks, they are still corporate bankers, and a lot of SMEs and corporates depend on these institutions to drive their growth. For now, they have lost the appetite for risk. Thus, in the current environment, it is important that there is some directed lending by the government as PSU banks are the only ones with capacity to lend, but are constrained by the availability of capital. Most of them are leveraged 15x and lack capital adequacy to grow their lending book.

If that were true, public sector banks would have easy access to capital by virtue of their ownership, and that would put them on a vantage point…

If we need to grow faster, the industry needs leverage. So, the underlying reality is that credit is important, because without credit, industry will be able to map only GDP growth. Thus, banks are critical to either leverage the consumer or the corporate. Today, with private sector banks getting risk averse, PSUs have to step in, directed lending or otherwise. They would need to bridge the cash flow gap of the SMEs. The stress on the economy will show up, but banks will have to navigate this course. The advantage is that their ownership protects them from solvency risks.

Do you see the retail credit cycle turning the way the corporate credit cycle did?

It will be critical to see what the banking risk appetite for retail credit is over the next six months or a year. I am not saying household credit is going to go, but we have to watch how banks behave. For instance, as of now, there is no stress in the home loans segment for banks. The other side of retail credit, which was discretionary, was largely funded by NBFCs. If the NPA cycle spikes in this segment, then banks will become extremely averse to lending to that part of the universe.

From a stock perspective, discretionary would be avoidable for some time. But what about consumer staples? Even after the recent fall, most are trading at rich valuations. Do you expect the polarisation to accentuate further?

When MNCs entered India in the mid-nineties, they were excited about the 200 million middle class population, which they never found! After two decades, their own presentations indicate 100 million middle class people. Yet, consumer companies trade at high valuation. When you are buying into companies, you have to be sure that you have got pricing (valuation) and opportunity on your side. Our investing style does not believe in ‘quality at any price’, because all businesses are cyclical and this changes across decades.

Between 1998 and 2008, we were in a growth market. This time (since 2008), we are in a quality cycle. The next one is something we need to figure out. We have to be very conscious about what the portfolio is tilted towards. Value has underperformed over the past three years. But it did outperform between 2013 and 2017, after which the quality bubble took over. So yes, all these cycles start off with one commonality, from an ignored part of the marketplace and where absolute valuations are affordable.

I have my reservations about consumer companies doing well over the next decade. Some companies may continue to do well, but the sector allocation may see a reasonable amount of diversion. The trigger could be anything — low volume growth or consumers trying to trade down in the aftermath of the crisis. When expectations are running high, it does not take much for stocks to take a beating.

Do you see further downside to the market?

We have fallen to 2014 levels. The small-cap index has breached even the 2008 level. Where does one make money if not from here? I don’t think anyone can forecast the future. I was slightly optimistic at the end of January and thought we would have this under control in March. But, here we are now, in a heavily risk-averse market.

We have to remember that equity and debt are one part of the balance sheet. Both need to have value for an ongoing organisation. Debt cannot keep expanding while equity value keeps contracting. If equity falls to zero, the debt has no value. In a falling market, this is where you have to assess where the mispricing is — equity or debt. If equity value continues to fall at the current pace, we will have larger solvency problems than just falling stock prices. Throughout history, we have seen valuation moving from P/B justification to P/E, which eventually moves to price to imagination, which is bubble territory.

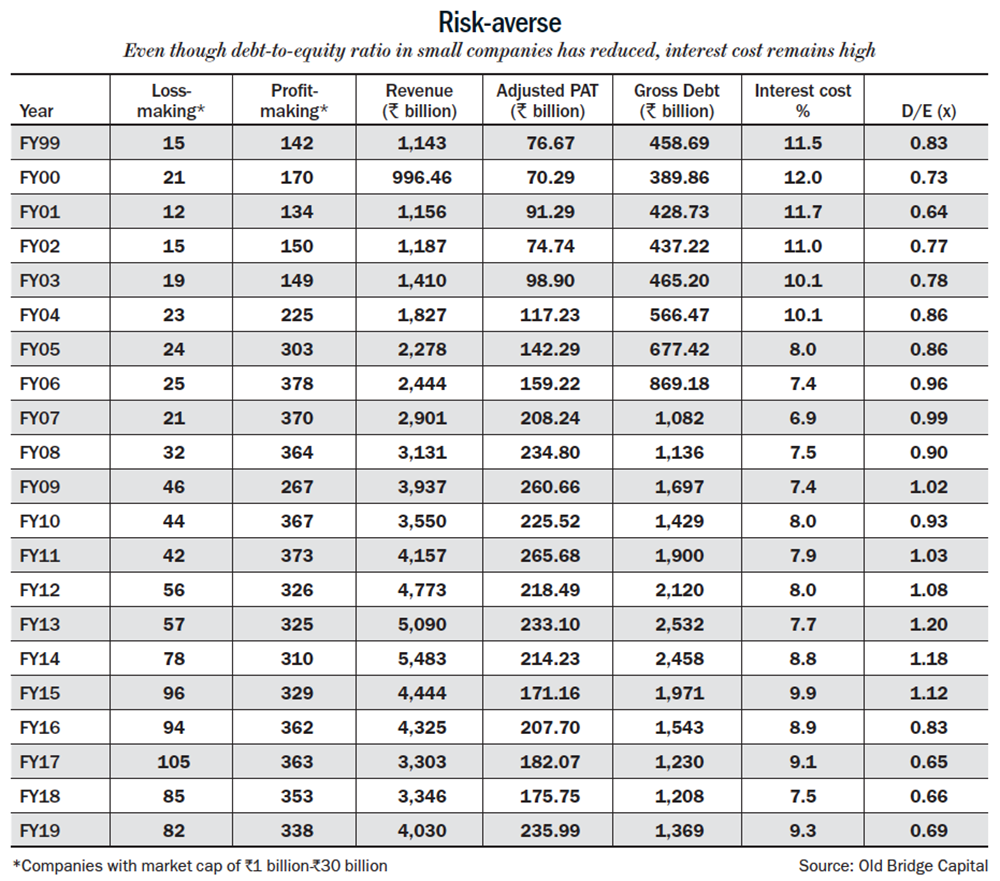

On the corporate side, when you look at companies with #1 billion to #30 billion-market capitalisation, you will notice that even while D/E has reduced, interest cost remains high, and that means the credit risk perception is still high (See: Risk-averse). There is high risk aversion in this segment, and this is where we have seen significant market-cap erosion over the past few years. This is a good place to hunt for value.

On the corporate side, when you look at companies with #1 billion to #30 billion-market capitalisation, you will notice that even while D/E has reduced, interest cost remains high, and that means the credit risk perception is still high (See: Risk-averse). There is high risk aversion in this segment, and this is where we have seen significant market-cap erosion over the past few years. This is a good place to hunt for value.

There is a caveat here: rising interest cost will continue to hurt for sometime. In fact, going forward, it will hurt companies of all sizes, since all banks are on record that they will protect their balance sheets rather than look for growth.

What kind of stocks are you eyeing now?

Except consumer names and financials, we are spread across segments. Our preference is for consolidators of individual businesses and industries. We have been long-term investors in companies addressing the farm economy. B2B businesses hold more interest to us than companies facing the consumer.

Where do you see pockets of undervaluation in the market?

Value is across a segment of companies. A lot of small-cap players are available at two-three-year paybacks, assuming they get back to 2020 profitability, which a lot of them will. All companies in the metals sector are trading below their book value and most manufacturing businesses have also flirted with that number. Utilities including PSUs are below their replacement cost. I believe the public sector holds a lot of value, but we don’t invest in it, because one would rather go with efficiencies of the solvent private sector than with the public sector. Further, those who have the government as their creditor are in a much better position right now. The list goes on. It’s like a dartboard there. The only unpredictable factor is the timeline. We are really not sure how long it will take to repair.

Which sectors, according to you, are comfortably placed to reignite their growth?

We can still establish dominance in some segments of manufacturing. Engineering, chemicals, pharmaceuticals, automotive and building materials — these are a few sectors where we have material and cost advantages. Some of them can play on the global stage. So, we should be able to scale the opportunity in manufacturing over the next decade.

Amidst the current crisis, the immediate sector that comes to mind is healthcare. Pharma is already significantly large in India. By volume, we are massive since we provide 45% of US generic drugs. We need to look at the entire value chain, which also includes insurance and hospitals. If we increase capacity during the pandemic, we can utilise it after this is over as well. So, rather than makeshift facilities, we must make world-class ones and monetise them in the future.