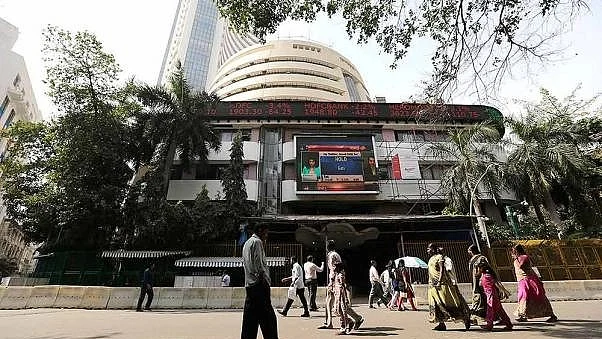

Stock exchanges National Stock Exchange (NSE) and BSE will conduct a special live trading session on Saturday, 20 January to switch to the Disaster Recovery (DR) Site

There will be two trading sessions the first from 9:15 am to 10 am for live trading from the primary site and from 11:30-12:30 pm from the disaster recovery site.

Securities including stocks having futures and options (F&O) contracts will have upper and lower circuit limits fixed at 5 per cent. Securities with a 2 per cent upper and lower circuit limit will continue to have a 2 per cent limit.

The price bands for equity and futures contracts in the equity segment set at the beginning of the day will apply to the Disaster Recovery site.

According to circular issues by exchanges, the switchover of trading systems from the PR location to the DR location started on 13 January.

Anand James, Chief Market Strategist at Geojit Financial Services said, “Investors do well to note that Saturday’s trading dynamics will be different for a variety of reasons. For one, a shorter time frame as well the truncated nature of the session would mean that traders would not have enough time to get their eyes in”.

“Volatility may be limited, as the daily operating range would be restricted to 5% for all stocks and derivatives for the day while those already in the 2% band will continue to remain so. Also important to note that pending orders from the first session would be flushed out before the start of the second session," he added.

The exchanges have assured a smooth transition from the primary site to the Disaster Recovery site within specified timeframes. This aligns with SEBI discussions on ensuring Market Infrastructure Institutions are well-prepared to manage operational disruptions and meet Recovery Time Objectives at the DR site.

The transition aims to ensure that trading activities continue and all data remains secure in the event of a major disruption or failure on the primary site.