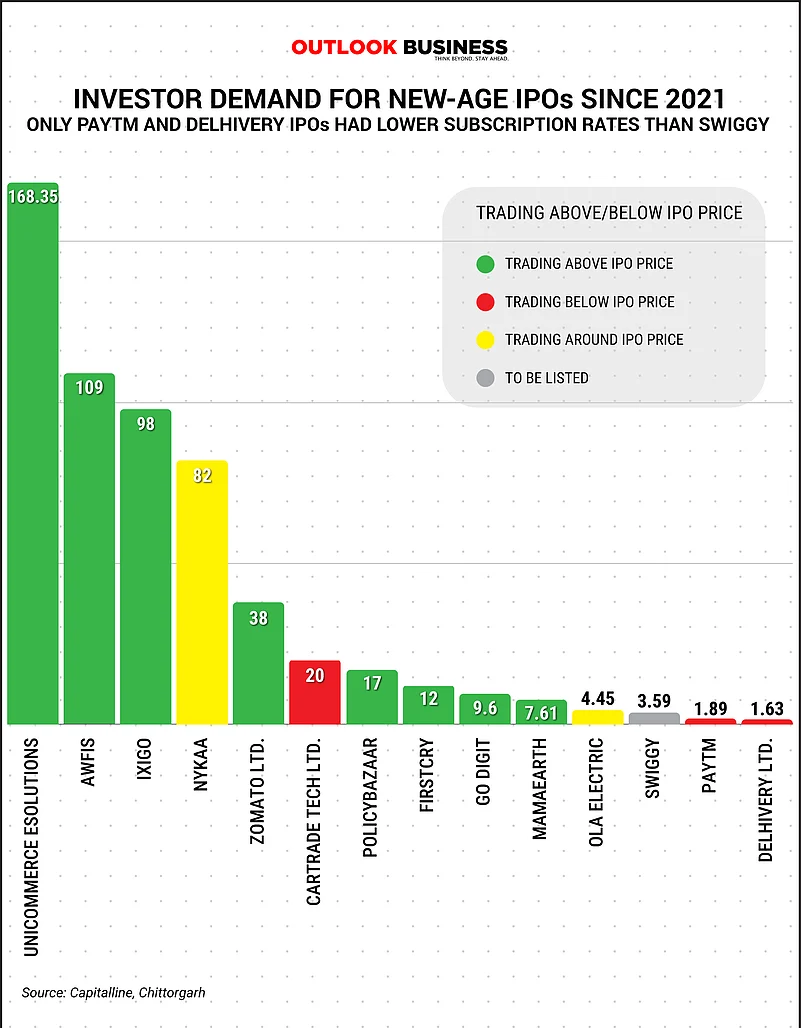

Swiggy’s initial public offering, the country’s second-largest this year, drew a lukewarm market response, compared to its new-age peers. At 3.59 times, the IPO’s subscription was the third-lowest of all new-age companies since 2021 when, led by Swiggy’s arch-rival Zomato, cash hungry start-ups began making a beeline for the bourses.

On the IPO subscription leader-board featuring 14 new-age scrips, only Paytm and Delhivery have fared worse than Swiggy in the last four years as per an Outlook Business analysis. Both these stocks are currently trading below their IPO prices.

The tepid interest in the Prosus and SoftBank-backed unicorn’s public issue is reflective of a wait-and-watch approach being taken by investors, according to market watchers. Despite its dominant presence as the country’s second-largest food delivery service, Swiggy’s lack of profitability and loss of market share to Zomato have tempered investor enthusiasm.

However, blockbuster IPOs do not necessarily foretell sustained market performance. Take for instance, Nykaa whose IPO was 82 times oversubscribed and yet trades around its issue price (adjusted to a stock split). Similarly, despite being oversubscribed 20 times over, the CarTrade stock is selling far below its offer price.

Swiggy is slated to list on the bourses on November 13. With an upper price band of Rs 390 per share in the public issue, its stock is expected to have a muted debut on the BSE and NSE, according to analysts.

Although a last-minute push from institutional buyers managed to carry Swiggy over the subscription line, it failed to enthuse high net-worth individuals, falling short of the full subscription mark of the portion reserved for this segment.

Domestic brokerages, including Motilal Oswal and Arihant Capital, recommended the scrip only to high-risk investors, while Aditya Birla Money asked investors to stay away altogether.

The Swiggy IPO comprises a fresh issue of Rs 4,499 crore and an offer for sale of Rs 6,828 crore from existing shareholders. Swiggy intends to use Rs 165 crore of the proceeds to repay or prepay debts of its subsidiary Scootsy, Rs 1,179 crore for expanding dark stores, Rs 703 crore for technology and cloud infrastructure, Rs 1,115 crore for marketing and brand promotion and the remainder for general corporate expenses.

Facing off with Zomato

Swiggy’s competitive pressures from Zomato are mounting. Kranthi Bathini, Director at Wealthmills Securities, explains that Zomato’s profitability is making it a preferred choice for investors, leaving Swiggy labouring in its wake. “Swiggy lacks a clear path to profitability, and its growth prospects are uncertain, which is making investors wary and taking a wait-and-watch stance,” Bathini notes. While Zomato has turned profitable, Swiggy continues to be awash in red ink.

Since its listing, Zomato has scorched the market, its capitalisation more than doubling to Rs 2.14 lakh crore by November 2024, reflecting its outperformance across all key metrics –average order value (AOV), gross order value (GOV), and overall profitability. Zomato’s 23 per cent compound annual growth rate in gross order value significantly outshines Swiggy’s 15 per cent. Not surprisingly, its shares have risen over 23 per cent in the past six months and more than 103 per cent in the last year.

Swiggy’s Persistent Losses: A Red Flag for Investors

Experts note that if Swiggy fails to control expenses and generate significant revenue growth, it may continue to post substantial losses. Although revenue surged from Rs 5,704.9 crore in FY22 to Rs 11,247.4 crore in FY24, Swiggy’s adjusted losses were still significant at Rs 3,628.9 crore in FY22, Rs 4,179.3 crore in FY23, and Rs 2,350.2 crore in FY24.

Swiggy’s growth relies heavily on retaining current users and attracting new ones cost-effectively. Analysts from Motilal Oswal caution that failing to do so could harm its business, financial condition, and operational results.

Expansion Strategy: Will It Pay Off?

Swiggy has ambitious plans for expansion, including scaling its dark stores and investing in technology. However, analysts like those from Arihant Capital are cautious. Although Swiggy is a top brand, Arihant’s report flags concerns about the pressures of maintaining high-quality services across a range of offerings through a single “all-in-one” app. While Swiggy has a large share of consumer spending, that doesn’t guarantee customer satisfaction, especially with increasing competition.

Arihant Capital notes that relying on cross-selling and low-cost user acquisition may not be sustainable if services don’t continue to attract and retain users. Discounts, a key customer acquisition strategy, might need to be pared to support profitability, potentially impacting customer loyalty. Heavy reliance on advertising and premium services may also fall short of driving long-term growth.

Motilal Oswal Financial Services suggests Swiggy still has room to carve a unique niche, operating in an oligopoly market that’s just beginning to mature. Swiggy’s ability to innovate, such as with its recent 10-minute delivery offering, could help it regain traction. However, with profitability still a distant goal, it recommends only high-risk investors consider subscribing for the long term.

Investor Sentiment Turns Cautious

More broadly, investor wariness stems from the high degree of market volatility of cash-guzzling new-age start-ups. Take, for instance, Nykaa, Zomato and PolicyBazaar: All of these stocks faced considerable price corrections post-listing, with the last named rising 22.74 per cent on debut only to slump to an all-time low of Rs 356.2 in 2022.

Swiggy’s listing is expected on November 13, following the completion of its IPO on November 11. The grey market premium has dropped over recent weeks, initially starting at Rs 25 per share on October 29 and falling to Rs 1-2, signalling a minimal premium under 1 per cent in the unlisted market. On the first day of bidding, the GMP was Rs 12, a modest 3 per cent premium above the issue price.