Saddled with bad loans, Indian public sector banks have been posting weak results over the past five years. Deteriorating asset quality and higher provisioning had clipped their wings. Profitability was dented, and capital erosion meant that the power to lend was stifled. Barring the retail-oriented private sector banks such as HDFC Bank, every large corporate bank — public and private — was struggling amid a stagnation of private investment. And just as the NDA government takes over once again, economic growth has hit a 20-quarter low of 5.8% in March 2019.

But a strong and stable government at the Centre is expected to revive the sector. Through its 2019 election manifesto, the ruling Bharatiya Janata Party (BJP) said it “recognises that investment-driven growth requires a cheaper cost of capital.”

The credit scene has started seeing some traction. Data released by RBI in March 2019 shows that there has been an improvement. In March, non-food credit increased by around 13% YoY, driven by personal (16.4%) and service (17.8%) loans. Similarly, industrial credit also continued to grow, at 6.9% in March 2019 against 5.6% in February 2019.

While credit growth continues to pick up, public sector banks (PSBs) — capitalised by the government — are also on the recovery track. Their net NPA ratio could come down, allowing them to lend more freely in a benevolent economic climate.

But, mutual fund managers warn investors not to paint all PSBs with the same brush. Sorbh Gupta, associate fund manager-equity of Quantum AMC, sees the current opportunity as a cyclical, and not a structural one. “PSBs may have reached a cyclical bottom, since credit cost as a percentage of advances is reducing,” says Gupta. Credit cost is provisioning done largely for bad loans. “Since the banks are also capitalised, they can grow again,” he adds. However, public sector banks may lose market share to private sector in the long run.

He also tells investors to be wary of the narrative about a complete economic revival. “In 2014 as well, the narrative was similar. Investors believed that, with a decisive mandate, public capex would pick up, and eventually, private capex would follow. While the government started pumping money into the economy, private capex didn’t pick up,” says Gupta.

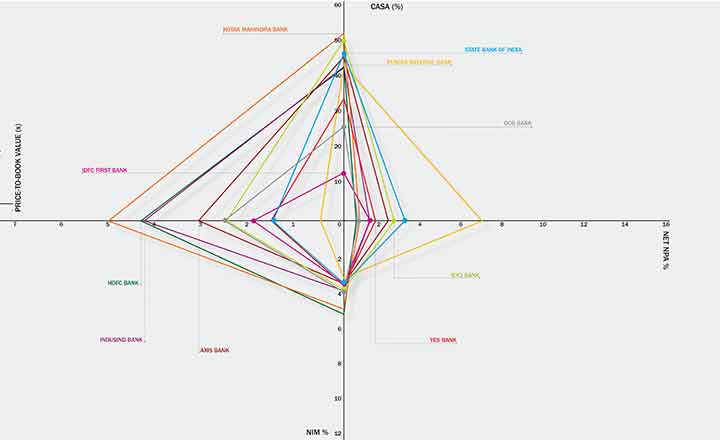

Currently, corporate banks are trading at compelling valuations. But they will need a helpful economy to give them a boost. Private sector banks, such as HDFC Bank and Kotak Mahindra Bank, on the contrary come at stiff valuations as they are better capitalised and have a stable asset quality. So, are you racking your brains over the right spot to park your money? Here’s a ready reckoner. These banks have compelling valuations at a decent growth pace.

SBI bank

India’s largest lender — State Bank of India (SBI) — is the bellwether of the banking industry. The bank’s poor performance in FY19 was a signal of a slowdown in credit growth and erratic economic activity. After three consecutive quarters of loss, the bank was back in black in the September 2018 quarter. The management had claimed that the losses incurred had been due to higher provisioning, caused by wage revision, mark-to-market (reflecting market price) losses on its bond segment, and lower trading income.

Since then, SBI has staged a turnaround. The fourth quarter results of FY19 gave investors a reason to cheer. Special-mention accounts (SMA) — where dues are not paid for 30-90 days after the repayment date — went down by 54% QoQ, from Rs.170.6 billion to Rs.77.6 billion. This was due to a large power-sector account being classified ‘standard’ from the earlier ‘SMA’. The net NPAs also came down from 3.9% in Q3FY19 to 3% in Q4FY19. The bank has taken huge write-offs of Rs.589.05 billion in the past financial year, reducing its bad loans.

SBI has also increased its provisioning aggressively. It set aside Rs.103 billion for three accounts that were referred to the National Company Law Tribunal (NCLT) — Essar Steel, Bhushan Power and Alok Industries. All this means that the cost of credit is expected to reduce in FY20 and result in a decent net interest margin (NIM) growth. A bank’s NIM measures how much a bank earns from its interest generating assets (such as loans); it factors in the difference between what it earns (from its loans) and what it pays (its lenders). “NIM expansion will take place as NPAs will come down. SBI will have more assets that contribute to the income,” says Abhishek Murarka, lead analyst at IIFL Institutional Equities. He also states that there are several levers to NIM expansions such as better loan-deposit ratio (LDR), stable CASA ratio (44.2%) and redeployment of balance sheet liquidity into loans.

The loan growth, which had also stagnated, is on a path to recovery. It reached its peak in Q4FY19, over the past 21 quarters. The loan book grew by 14% YoY, driven by corporate loans (15%) and retail loans (19%). And if the economy picks up, SBI, which provides large loans to corporates across sectors, will be a key beneficiary. Another major boost for the bank’s profitability is expected to come from the recovery of Rs.160 billion from three NCLT accounts and Rs.40 billion from the sale of two subsidiaries.

Revival in growth, stable asset quality, potential write-backs and attractive stock valuation make SBI a perfect bet. The stock is currently trading at 1.54x price-to-book value on a 12-month trailing basis and 1.1x for FY20 (See: Large value). SBI has seven non-banking subsidiaries including SBI Life Insurance and SBI Fund Management, which are highly valuable. The bank uses its 22,000 branches to distribute products such as insurance and mutual funds of these subsidiaries, and in return, gains fee income. Analysts at Elara Capital ascribe Rs.92 per share for the subsidiaries with an FY20 target price of Rs.380 for SBI.

ICICI bank

ICICI Bank is another colossal lender with a strong brand and an impressive customer franchise. And it has also survived a rough patch. In Q1FY19, the bank reported its first-ever quarterly loss of Rs.1.20 billion due to higher provisioning for bad loans. The bank had doubled provisioning to Rs.59.71 billion in June 2018 from Rs.26.09 billion in June 2017. It was a historic loss for the lender after its MD and CEO Chanda Kochhar was sent on leave over allegations of non-disclosure of conflict of interest. With the new management taking over, the lender laid bare the bad accounts in a bid to meet RBI’s norms on old NPAs, which were in the NCLT court. The provisions coverage of NCLT accounts rose to 87.9%. But as problems mounted, the stock hit a 52-week low of Rs.256.50 in July 2018.

Under the new management, the bank has introduced changes that have piqued investor interest. The stock hit an all-time high of Rs.438 on May 27 (See: The worst is behind). With the appointment of Sandeep Bakhshi as CEO of ICICI Bank, Deepak Jasani, head of retail research, HDFC Securities, states that the cloud of management-related uncertainty has been lifted. “ICICI Bank’s management has articulated its endeavour to deliver a consolidated return on equity (RoE) of 15% while improving net NPA ratio to 1.5% and maintaining provision cover of over 70% by June 2020,” says Jasani.

Some improvement is visible. Net NPAs have reduced to 2.29% — the lowest in the past 13 quarters, while provisions coverage has risen to 70.7%. “Investors can expect much lower NPA formation and normalised credit cost in FY20. Incremental provisioning would be less on an Expected Credit Loss (ECL) basis unless macroeconomic conditions or borrower-specific conditions deteriorate significantly,” says Jasani. ECL are probable losses from defaults over the life of an asset.

ICICI Bank is also focusing more on growing its retail loan book, which will help maintain a better asset quality. “It had once built its corporate book in a hurry and then faced slippage or NPA issues in a big way, and so the bank is likely to change tack,” says Jasani. The retail segment today accounts for 60% of the overall advances compared to 37% in March 2015. “Retail book is normally expected to be less prone to write-offs unless there is a general slowdown in income levels in the urban and semi-urban areas; however imprudent lending via loan against property (LAP) and personal loans could bring banks to grief even in retail lending,” opines Jasani.

With a CASA ratio of around 50% and capital adequacy of 17%, ICICI is well capitalised to lend. It has also been showing consistent improvement in loan-book growth and NIM. Advances grew by 14% YoY in the fourth quarter led by domestic and retail loans. NIM also expanded by 48 bps YoY to 3.72%.

The lender is showing progress on most of the parameters, but its asset quality is not yet irreproachable. After dipping in Q3, slippages increased 70% QoQ to Rs.35.5 billion. But Jasani believes the risk-reward seems favourable, with ICICI Bank trading at a large discount to its closest corporate-lending peer facing similar asset quality issues. “Investors could look to buy on inexpensive valuations and a visible turnaround in the NPA cycle for decent gains over the next one year,” says Jasani. The lender is currently trading at price-to-book value of 1.94x for FY20. And its subsidiaries are attributed a price of Rs.109 per share out of target price of Rs.454 by analysts at HDFC Institutional Research.

DCB bank

Riding high on small-ticket, retail and agriculture loans, the private lender has built a strong balance sheet and a solid asset portfolio. And the fourth quarter of FY19 was no different for DCB Bank. Cost of credit remained steady, and operational expense was muted. With lower provisioning and restrained opex, profit after tax (PAT) jumped by 50% to Rs.963 million.

“DCB Bank has relatively higher cost of funds owing to its lower CASA mix and high-term deposit rates, which makes it difficult for the bank to do business with best-rated corporates. The bank typically lends to entrepreneurs, MSMEs, small businesses, restaurant or hotel owners and kirana shop owners. DCB also has other retail product lines such as mortgage, commercial vehicle and gold loans,” says Nitin Aggarwal, analyst at Motilal Oswal Financial Services, adding that, hence the lender’s margins have been healthy despite lower CASA of 24%.

In Q4FY19, the bank’s loan book grew by 16% YoY, led by agriculture and inclusive banking (29%), MSME (16%) and mortgage (16%) segments. Consistent loan growth has resulted in a stable NIM at 3.8%. “DCB has witnessed consistent loan growth of more than 20% over ten years. Although growth slowed in FY19, we expect loan growth of 24% CAGR over FY19-21 and credit cost to remain in control due to the higher proportion of secured loans,” says Aggarwal.

DCB Bank has been a complete outlier in terms of asset quality. While the net NPAs are at 0.65%, fresh slippages also declined to 1.6% in Q4FY19 against 2.5% in the previous quarter.

The bank has also been prudent with its running expenses. With DCB Bank adding just two branches to a total of 331, the cost-to-income ratio dropped slightly by 152 bps to 53.7%. “With controlled branch expansion and calibrated addition of employees, we expect the cost-to-income ratio to improve over the next three years,” adds Aggarwal.

Strong performance means the stock is not trading at a cheap valuation. Currently, it trades at 2.5x price-to-book value (See: Quality at reasonable price) on a 12-month trailing basis, 1.8x for FY20 and 1.6x for FY21. While valuations are high, analysts believe it should be able to justify them at the current pace of loan growth and sound asset quality.

IDFC first bank

Following the merger of beleaguered IDFC Bank and Capital First on December 18, 2018, the re-christened IDFC First Bank quickly became investors’ favourite lender. The stock rallied to Rs.56 from Rs.41. However, its Q4FY19 results failed to match investor expectations with the stock correcting to Rs.45.50.

A dent in the bank’s profitability for the second straight quarter was a major factor for the plunge in IDFC First Bank’s stock price.The lender’s profit was adversely impacted due to provisioning for incremental stress of around Rs.18 billion, emanating from large financial service providers. According to the management, repayment by these companies has been on schedule and there has been no default so far. “However, as both companies have faced credit rating downgrades recently, the bank has made provisioning on these exposures of Rs.2.67 billion as a prudent measure,” stated the management in its Q4FY19 press release. Overall, its provisioning for stressed assets is at 56% as of March 2019. IDFC First Bank also has a strong capital adequacy ratio of 15.5%.

The bank’s net asset quality deteriorated marginally to 1.27% in the past quarter compared to 0.95% in December 2018, which it attributes to a rise in wholesale NPAs and alignment of NBFC NPA norms with bank NPA norms.

Despite the hit to its profitability, IDFC First Bank is a dark horse at current valuation of 1.3x for FY20 with the downside priced in. Its NIM expanded to 3.3% compared to 2.40% in March 2018 as the bank continued to better its asset mix. Its retail book increased to 37% in March 2019 from 35% in December 2018. As the retail book expands, the bank is reducing its exposure to corporate borrowers with wholesale loans dropping by 5% QoQ to 49%.

“The bank’s loan book is likely to increase to 50% in two years and 70% in five years, keeping yields high. We see strong shore-up in deposits from increased network presence and existing retail franchise, with high focus on retail deposits helping lower cost of funding,” says Pritesh Bumb, analyst at Prabhudas Lilladher.

The bank is also trying to improve its retail presence on the liability side. The bank has a CASA ratio of around 12.9%, of which, retail share is at 48%. But it aims to hit 30% CASA ratio in 5-6 years with robust network expansion. It also plans to install around 600-700 branches.

While provisioning and expansion plans may put pressure on profitability, strong focus on increasing retail loan book and deposit is expected to yield results in the long run. And with a management that is experienced in building a strong retail business, the lender is an attractive bet for the long haul, with compelling valuations.