Weak same-store sales growth (SSSG), falling sales per square foot, shrinking profitability and investor aversion towards mid-cap stocks triggered a 34% drop in the stock price of V-Mart. The confluence of factors pushed the stock to a 52-week low of Rs. 1,698 in late August. The fashion store chain with a strong presence in Tier-II and Tier-III cities has been another victim of the slowdown in consumption.

With tepid macro conditions, the management has revised its SSSG guidance to 5-8% versus 7-8% earlier for FY20. At the same time, profitability has also shrunk, and the company has revised its Ebitda margin estimate from 9.5% to 9%. Higher promotional expenditure, along with an increase in employee cost, has dented profit.

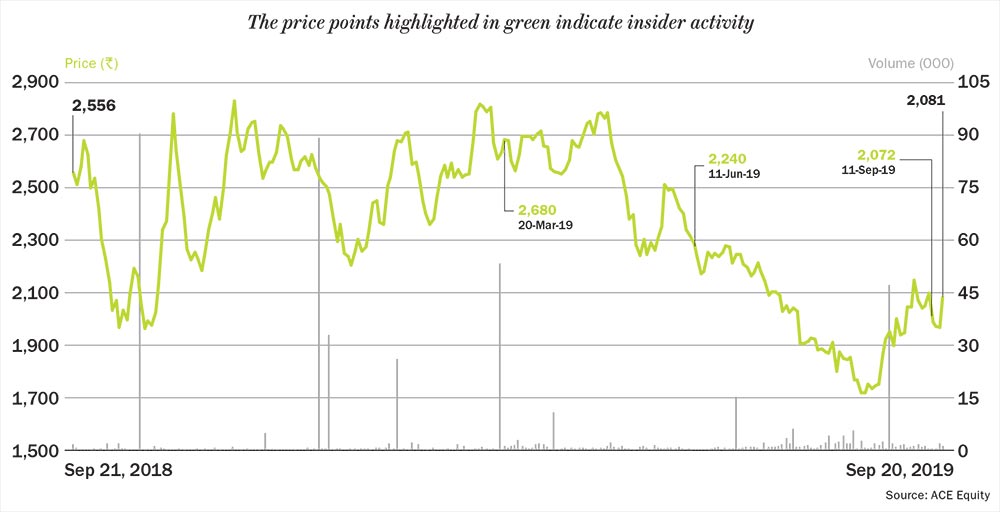

After hitting a 52-week low, the stock has since recovered to Rs. 2,080, and taking advantage of the pullback, promoter Hemant Agarwal has sold stock worth Rs. 117 million, reducing his holding in personal capacity from 0.3% to nil. Earlier, between March and June, he had disposed shares worth Rs. 173 million and Rs. 189 million, respectively. In sync, between December 2018 and June 2019, promoter stake has reduced from 53.95% to 52.46%.

Even as the promoter is trimming his stake, analysts believe this is a good time to buy into the stock. “We perceive the recent stock correction as a good entry point into a structurally sound and well-managed company at an attractive valuation — 19.1x FY21 EV/Ebitda versus the peak of 41x a year ago and 32x four months ago,” says a recent Edelweiss Securities report. It also expects “the company to bounce back from Q4FY20, riding on good monsoon recovery and the government’s policy push to boost liquidity and the economy.”

In tune with this positive outlook, mutual fund holding has been on the rise and stood at 5.68% in June 2019 compared with 4.65% in December 2018. While Aditya Birla MF has bumped up its holding from 0.42% to 1.19%, DSP MF has reduced its holding from 2.71% to 2.65%. FPIs have also increased their stake from 30.02% to 31.12% over the past two quarters. However, the largest FPI, Westbridge Capital’s Jwalamukhi Investment Holdings has sold down from 8.70% to 8.29%.