If the world right now was a Mission Impossible movie, global stock markets would be the helpless victims, free falling from a helicopter thousands of feet above the ground. Caught in the crossfire of policies, regulation and geopolitics, they would await the invincible and elusive Ethan Hunt to show up and save some (and lose some). Unfortunately for the market, reality doesn’t offer that luxury. There’s neither a knight in shining armour, nor a sneaky well-trained spy who survives even after falling off helicopters, mountains and sky-high towers. But the villains are aplenty.

One of the biggest victims here — Dalal Street — has been languishing since the Union Budget on July 5. Benchmark indices Nifty and Sensex have slipped by 9% and 8% respectively since, and BSE 500 companies have lost nearly Rs.15 trillion in market cap. Heavy foreign portfolio investor (FPI) outflow and dismal earnings growth are just the tip of the iceberg. The market is expected to remain under pressure from the economic slowdown and sluggish pick-up in private capex.

But at least some are getting a kick out of the situation, trying to find humour in distress. The government was celebrating its successful campaign to save tigers and value investor, Vijay Kedia, didn’t miss the opportunity to congratulate and diss them. The market veteran quipped that while the number of tigers has increased since last count, the number of ‘bulls’ has fallen by over 20 million, signing off with #SaveTheBull that left his Twitter followers in splits! Ace investor Samir Arora, too, joked about how large-caps have turned into mid- and small-caps, confounding investors that their mutual funds are focusing more on the latter. While they try to mask concern with witty remarks, there is no denying that the bear’s grip is tightening.

There’s only one question on each investor’s mind: Where should I park my money when nothing looks right, and of whatever is left? Some analysts say the answer lies in dividend-paying stocks with sound fundamentals and reasonable valuation. Amar Ambani, president and head of research, YES Securities, says, “With the broader market sentiment looking gloomy, there is a case for picking up sound companies which offer high dividend yield.” What’s the worst that could happen? The already sharp correction in the market, according to Ambani, provides a margin of safety, and limits the downside.

Dirt cheap

But if it were that easy, everyone would be making money hand over fist, not bleeding red. Since the latter is the ground reality, there are several factors that one has to keep in mind before buying these companies. “While net worth and cash equivalents indicate how much cash can be distributed by the company, investors can focus on trends in profitability and cash generation (after capex, working capital and debt servicing),” says Deepak Jasani, head-retail research, HDFC Securities. The sustainability of future dividend payouts depends on profitability and cash generation, he explains.

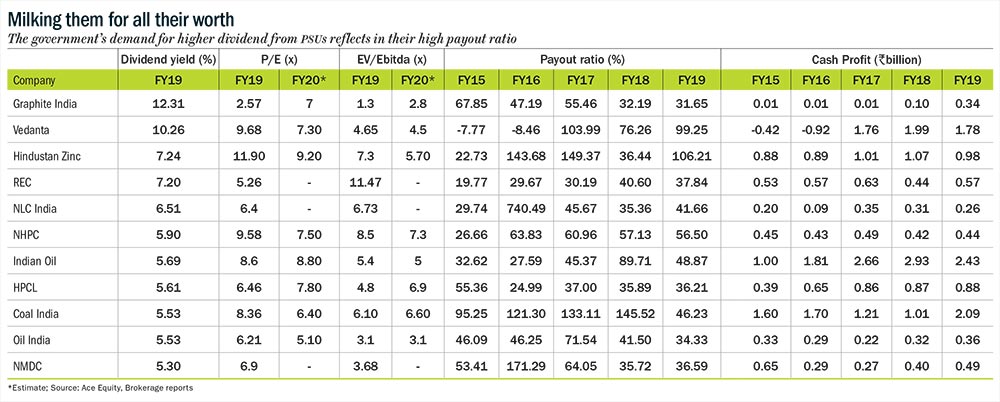

Looking at companies through three parameters such as maintaining payout ratio (dividends paid to investors compared to the firm’s net income) of 20% or above, decent profit for past five years and dividend yield of more than 5% in FY19 — eight PSUs along with Graphite India, Vedanta and Hindustan Zinc — make the cut. REC, NLC India, NHPC, Indian Oil, Hindustan Petroleum, Coal India, Oil India and NMDC have strong payout ratio for past five years. While their profit has fluctuated sharply in a year or two, the largest shareholder, the government has dipped into their cash reserves to enrich itself. (See: Milking them for all their worth)

Out of these companies, the largest coal mining company in the country, Coal India is an ideal dividend play, with average yield of 6.65% over the past five years, though it has been underperforming the market over the same period. Between June 2015 and August 2019, the stock has given negative CAGR of 12%, adjusted for dividend, while Sensex compounded at 8.2% over the same period.

In FY19, Coal India’s image as a high dividend paying stock took a hit as its dividend yield and payout ratio fell to 5.53% and 46.23% respectively, the lowest in five years, because of the capital expenditure of about Rs.120 billion undertaken to boost its output and meet volume growth of 5%. However, the stock’s long-term underperformance means that it’s trading at an inexpensive valuation. And analysts believe the company — with cash balance of Rs.311 billion — will dole out higher dividend in FY20.

Coal India also expects to see an improvement in profitability driven by volume growth of 8.7%. The profit after tax is expected to increase to Rs.182 billion and Rs.193 billion in FY20 and FY21 respectively, compared to Rs.174 billion in FY19.

“We see better profit growth and expect dividend yield of over 10% due to improvement in pricing, volume, flat employee cost and better realisation,” says Rusmik Oza, head-fundamental research, Kotak Securities. He also sees favourable risk-reward on the back of historically low valuation of 6.6x FY20 estimated EV/Ebitda due to sharp correction in the stock price.

Another reason why PSUs are expected to pay higher dividend this year is the government’s attempt to reduce the fiscal deficit. The government is banking on cash-rich PSUs to pay dividends, which can help ease its fiscal constraint. “In our view, the fiscal deficit target of 3.4% would be maintained with a higher dependence on non-tax collections (such as dividends and disinvestments),” states an Emkay Global report. Hence, these PSU dividends will act as an income source for the government to meet its revenue target. Analysts state that the dividend payout of PSUs have gone up sharply due to the government’s decision to stick to its fiscal deficit target. “They need to pay more dividend to help the government meet its fiscal target. So, investors can get maximum dividend yield from PSUs in the current scenario,” says Oza. Investors need to be remember though that one cannot chase dividend yield mindlessly, a point which we will come to in a while.

Mining money

If you are not a fan of PSUs and would rather avoid government-owned companies, there are private sector options to pick from. Hindustan Zinc and Vedanta have consistently paid good dividends to investors over the past five years.

Analysts are placing their bet on these companies. “Hindustan Zinc is the largest zinc producer and has net cash on books,” says Jasani. But he cautions that investors may see some volatility in earnings and dividend payout due to the cyclical nature of business. While zinc supply is expected to rise, demand remains muted due to economic slowdown in China. This will keep the price of the commodity under pressure and volume growth will remain subdued, denting profit and offering only limited safety of margin for the stock despite cheap valuation (5.7x FY20 estimated EV/Ebitda). But with net cash and equivalents of Rs.183 billion, the company could deliver dividend yield of 6-7% this financial year.

However, analysts are not completely convinced about Hindustan Zinc’s ability to pay high dividend this year and instead feel parent company, Vedanta, makes for a more secure option. Oza points out that the metal giant has robust free cash flow after deducting capex and other expenditure. “Around 70% of their net profit was turned into free cash flow in FY19. If their free cash flow is so high even after spending on capex and other expenses, it will translate into higher dividend,” he adds.

After reporting consolidated profit before tax of Rs.122 billion in FY19, earnings are expected to be around Rs.150 billion in FY20, estimates Oza, due to the ramp up in volume of zinc, oil and gas. The company has another incentive to offer high dividend payout. Since its parent Vedanta Resources struggles with high debt, dividend yield from Vedanta will help ease that stress. “We estimate 10% yield based on the stock price of Rs.164. Also, they have a dedicated dividend payout policy,” says Oza. The company has a debt-to-equity ratio of 1.2x with robust return on equity of 14%. And with the stock trading at a reasonable valuation of 4.5x FY20 estimated EV/Ebitda, Vedanta ticks all the boxes as a dividend play.

Buyer Beware

While several PSUs and private sector companies pay dividend each year, analysts emphasise that investors must be stock specific. Financial performance impacts the stock price and a company’s ability to pay dividend. Investors could end up making losses despite dividend payments due to fall in the stock price.

“In a sharply falling market, some investors look for high dividend yield companies without realising that the loss in the stock price could be more than the dividend earned,” says Jasani. He points out that most of the PSUs are dependent on cyclical nature of commodities and that “one will have to be aware of the possibility of capital loss (due to stock price fall) in these PSUs”.

Ambani concurs with Jasani and warns that every investor must be wary of capital erosion in a turbulent market. “If your initial investment has halved, then what’s the use of receiving a dividend? If you invest Rs.100, and the stock falls to Rs.50, then a dividend yield of 10% will also not be enough to cover the loss,” he explains.

Taking all factors into consideration, analysts are zeroing down on Coal India and Vedanta as pure dividend plays. They believe these stocks can give some comfort to investors in a bearish market. They come at cheaper valuation with the promise of strong dividend this fiscal. Besides offering a safety margin, there is also possibility of stock appreciation. And while these stocks are not the Ethan Hunt investors are looking for, the saviour that could #SaveTheBull, they are probably bets to take shelter under, until the storm blows over.