The past two years haven’t exactly been a walk in the park for the pharma sector. Steep price erosion of generic drugs in the US and higher regulatory scrutiny by the US Food and Drug Administration (US FDA) kept revenue from the industry’s largest market under significant pressure. A stronger rupee and disruptions in the domestic market in the form of demonetisation and destocking owing to the GST further compounded the problem for Indian pharma.

It’s no surprise that the Nifty Pharma index came off 30% over the past two years (up until October 9, 2017). During this period, the sector’s one-year forward multiple contracted from 34x to 22x as companies found it difficult to sustain its growth rates on a larger base. Over the past five years, the aggregate earnings and revenue of companies that feature in the index have gone up by an average of 18% and 19%, respectively, every year.

Some analysts and fund managers feel that the earnings forecasts factor in most of the risks and challenges that lie ahead for the sector. According to estimates, earnings of pharma companies are likely to grow at an average of 10% over FY17-FY20

While numbers put the earnings picture in perspective, it may be difficult to gauge the full impact from regulatory scrutiny of the US FDA or from the price erosion of generic drugs. Given the size of the market and number of drugs going off-patent, a slew of new players entered the US generics market in recent years, making it highly competitive. And if that is not enough, top three distributors now control 90% of the market thanks to the consolidation of buyer groups, taking away the pricing power that the supplier had. There is, however, a silver lining among the dark clouds. Param Desai, analyst at Elara Capital, feels the price erosion is now getting adjusted in the trade channels and unlike the past two years when the erosion was 15-20%, going ahead the impact shouldn’t be more than 4-5%.

Further, some of the pricing pressures can also be offset by Indian companies, which are moving up the value chain by launching complex generics and specialty products. “Indian pharma companies are improving their R&D and shifting focus to niche areas such as biosimilars derma, injectables and complex generics which face less competition,” points out Vinod Nair, head of research at Geojit Financial Services.

However, fund managers believe that as the above-mentioned events play out, Indian pharma companies will gradually emerge stronger. Over the past few years, the number of inspections by the US FDA has gone up. However, one must bear in mind that the share of Indian pharma in the US generic markets has also gone up from 28% in 2014 to 35% as of 2016. India remains an important supplier for the US. As Indian pharma’s market share in the US increases, the inspections and scrutiny will also rise. It is inevitable,” says S Naren, chief investment officer at ICICI AMC. He adds that as Indian pharma companies automate their manufacturing plants, it is quite likely that the regulatory issues would get resolved at a faster rate.

Back in the US, the regulator wants to make drugs more affordable and has expedited its process of approvals leading to a flurry of launches which has kept a cap on prices. However, Naren reckons that as approvals for generics start coming by, it is likely to benefit Indian pharma disproportionately. Faster approvals spell good news for Indian pharma companies since some of them have the largest Abbreviated New Drug Application (ANDA) pipeline among global players. Take the case of Lupin, which has the fourth-largest pending ANDA pipeline (154 ANDAs; includes 28 FTFs) among global generic players targeting a market size of $76 billion. In FY17, 34 of its 37 filings were approved. Similarly, the Ahmedabad-based Cadila Healthcare has a pending pipeline of 200 ANDAs; of which more than 75 are Para IV opportunities. When a generic company intends to sell an innovator’s drug before its patent expiry, it files an additional document called Para IV with US FDA to get the approval. If the generic company is granted a period of market exclusivity of 180 days, it allows the company to enter the market earlier when there is limited competition helping it corner a larger share of the market.

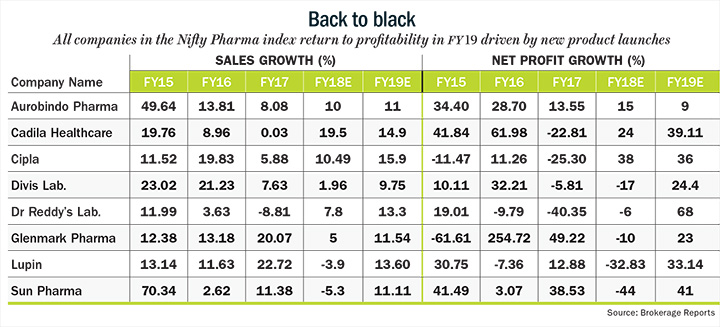

For all the troubles that pharma companies have faced in recent past, it looks like the future holds promise. “From FY19, most of the major regulatory worries facing pharma sector — observation letters for Sun Pharma’s Halol facility and Dr. Reddy’s Duvvada plant — should get cleared and we should start seeing a steady improvement in the operational performance of the pharma sector,” says Amey Chalke, analyst at HDFC Securities Institutional Research. As a result, earnings growth for both companies should recover in FY19 with Sun posting a more 41% increase in earnings after a decline in FY18 and Dr Reddy’s likely to see an earnings growth of 68%. Lupin is also expected to move back into profits in FY19 with earnings growth of more than 33% driven by new product launches in the US. While the premium valuation that pharma stocks enjoyed until two years won’t come back in a hurry, the correction in stock prices does provide investors an attractive entry point from a long-term perspective.