For SBI Card, the year 2023 was on track to bring some relief to the investors in its scrip. Till June 15, the shares of the company had surged to Rs 912, a 15 per cent increase as compared to the price at the start of the year. However, things turned southwards for the shares of India’s largest bank’s credit card business. The shares of the company closed at Rs 736 on November 29, over 7 per cent below their opening price this year.

With the RBI’s notification on November 16 to increase risk weights on unsecured loans leading to panic selling by traders, SBI Card doesn’t seem to catch a break. But for a company which attracted strong attention during its listing, the value destruction in its stocks is puzzling. Notably, the lack of investors’ interest has come at a time when credit cards have been in high demand among consumers.

With an expected moderation in growth of credit card business and unsecured lending, dark clouds hover over the prospects of SBI Card in the coming quarters. But after years of underperformance on the bourses, the company isn’t unfamiliar with bears prevailing over its scrip.

When The Listing Went Wrong

The SBI Card IPO, launched in March 2020, was subscribed 26.54 times on its last day. The IPO had received a solid response from the institutional buyers as the portion booked for qualified institutional buyers (QIBs) was oversubscribed 57.18 times and that of non-institutional investors (NIIs) 45.23 times. The retail portion was subscribed 2.5 times, while that of employees saw a 4.74 times subscription and SBI shareholders 25.36 times.

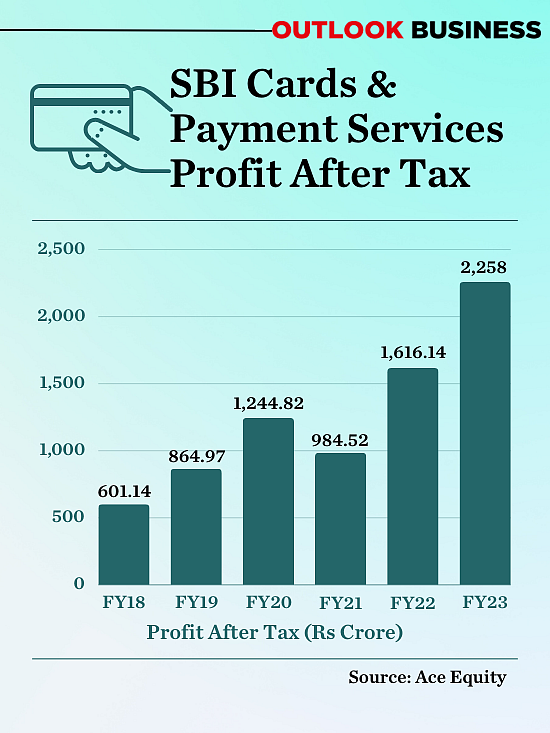

When the IPO was announced, the grey market premium (GMP) for SBI Card hovered around Rs 300-350 per share. As the listing drew closer, the market caught the coronavirus fever, and the grey market premiums slowly slipped down to Rs 50-100. Analysts had predicted that SBI Card shares would list at a 40-50 per cent premium due to the firm’s performance. In the five financial years prior to listing, SBI Card’ total income had increased almost 4 times from Rs 2,493.07 crore in FY16 to Rs 9,752.29 crore in FY20. Profit after tax (PAT) surged from Rs 283.90 crore in FY16 to Rs 1,245 crore in FY20.

The stock fell by over 94 points on the bourses due to subdued market conditions as markets across the world were crumbling due to rising number of coronavirus cases. On 16 March 2020, the Sensex crashed by over 2,700 points.

However, the stock staged some recovery and touched its all-time high of Rs 1,165 on 1 September 2021 but has failed to reach that level again. Its downward spiral is linked to the concerns around costs dragging its growth prospects.

Managing Costs And Margins

The stock has plunged nearly 9 per cent in the last one year, underperforming the Nifty Financial Services index which gained over 2 per cent during the period. SBI Card shares have gained a mere 12 per cent from its listing price of Rs 658.

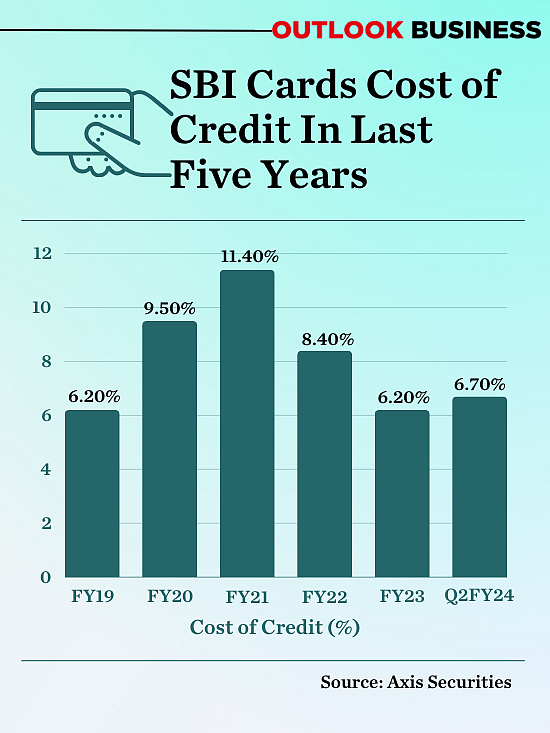

According to analysts, there are multiple factors impacting the stock’s performance. Deepak Jasani, Head of Retail Research at HDFC Securities, says that the performance of the SBI Card was impacted during the COVID-19 pandemic which resulted in high delinquencies.

Consequently, the credit costs of the company have remained at elevated levels. Additionally, the share of the higher margin revolver loans has compressed from 34 per cent in FY21 to 24 per cent. There has been a valuation de-rating in the stock on account of a lack of clarity on credit costs.

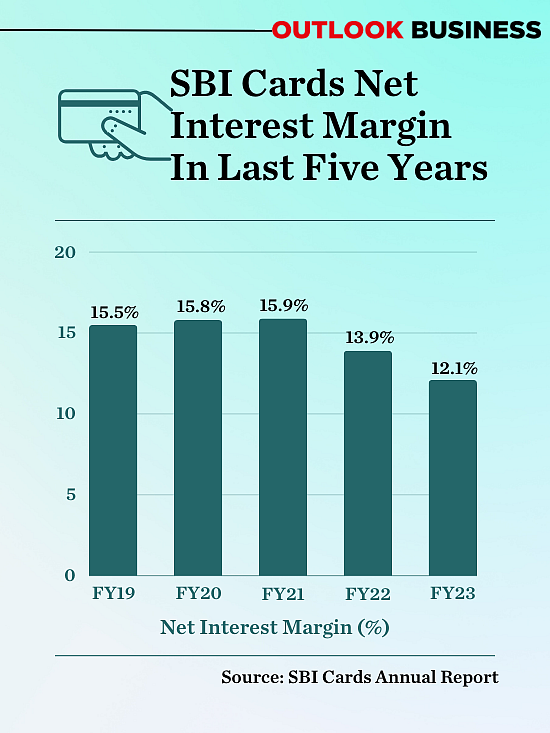

Between Q2FY23 and Q2FY24, credit cost of the company increased from Rs 546 crore to Rs 742 crore. Its net interest margin (NIM) saw a 122 bps compression to 11.4 per cent in the first half of FY24 as compared to the same period last year.

“The company witnessed some stress in Tier 3 and Tier 4 cities, after which, it exited some of those cities. Newer cohorts have started contributing to higher credit costs, which is the cause of concern. Lack of clarity on credit normalisation is resulting in negative investor sentiment towards the stock,” says Jasani.

In the September quarter, the growth in earnings was moderated by a significant 35 per cent YoY increase in provisions. The company attributes this surge in provisions to its proactive measures to enhance the quality of the card it issues, aimed at preventing any worsening of credit costs in the short term, Kotak Institutional Equities said in a report.

Abhijit Chakravorty, SBI Card MD and CEO, said during the Q2FY24 earnings call, “While we will continue to grow, we will continue to take portfolio actions to mitigate the risk. Collections intensity has also been re-strategized with different swim lanes for riskier segments. Our newer sourcing vintages too continue to perform better, and going forward too we will continue to take appropriate measures as needed. Our credit cost has reduced QoQ although industry data is showing stress.”

Comparing the long-term financial performance of SBI Card, the total income and PAT have increased only around 13 per cent and 22 per cent respectively from FY20 to FY23 on a CAGR basis, which is quite slow compared to the level of growth that was expected from the card company at the time of its listing.

“The SBI Card IPO was issued at a very high valuation of P/E 45.5x and P/B value of 14.5x, but the growth of the company’s topline and bottomline was not able to keep up with the expectation, impacting the stock’s performance on the bourses,” says Abhishek Jain, Head of Research at Arihant Capital.

Dnyanada Vaidya, Research Analyst – BFSI at Axis Securities, says that SBI Card has been progressing well on the operational metrics in terms of new card acquisition, Cards in Force (CIF), and spending growth. However, the competitive intensity, particularly from the private banks, has been very high, thereby limiting the company’s ability to aggressively gain market share, especially in terms of spending, while SBIC has been able to defend and improve its market share in terms of CIF.

Between FY20-23, SBI Card revenue grew by 13 per cent CAGR, largely led by fee income (18 per cent) as NIM continued to remain under pressure.

As the portfolio of SBI Card is comprised of totally unsecured loans, the risk to the portfolio also had a very negative impact on SBI Card’s stock performance. But the correction this time is different. Investors and analysts seem to have one concern on their mind: With RBI moving to curb unsecured lending, can the stock manage to return to its previous highs?

No Way Back?

The recent correction in the stock has been on the back of the negative impact of the RBI regulation on an increase in risk weight.

The RBI’s move of increasing weightage by 25 per cent for consumer credit from 100 per cent to 125 per cent has struck a big blow to the company’s future spreads and yields. “We do not see any chance of revival for SBI Card stock performance considering the blow it has received,” Jain says.

According to analysts, new RBI guidelines would lead to increased risk weightage and a 4 per cent reduction in capital adequacy ratio which would impact on its tier 1 capital and dependence on bank credit.

Commenting on the concerns over unsecured loans, Vaidya had said, “The stress in the unsecured lending space, which has been lately visible at a systemic level has also rubbed off on a certain set of SBI Card’s customers. Exercising caution, the firm has stopped sourcing from certain pockets of Tier III and Tier IV cities owing to higher delinquencies. However, on a positive note, the delinquency trend in the new vintage book (~50 per cent mix) remains benign so far.”

While business growth has been healthy, SBI Card continues to face headwinds in terms of NIM and asset quality. With the central bank moving to tighten the noose around unsecured lending, scripting a comeback on the bourses remains a tall order for the credit card business.