Indian stock markets witnessed a tumultuous journey in the year 2023, marked by several highs and lows, primarily driven by concerns about a looming recession in US, inflation, and impending rate hikes. Markets started the year on weak ground and fell around 7 per cent till March. Post this, it started its rally and surged 26 per cent from the lowest point of March, during the last nine months.

In April, the Reserve Bank of India’s (RBI) pause on interest rate hikes and the falling crude oil prices boosted the market sentiment.

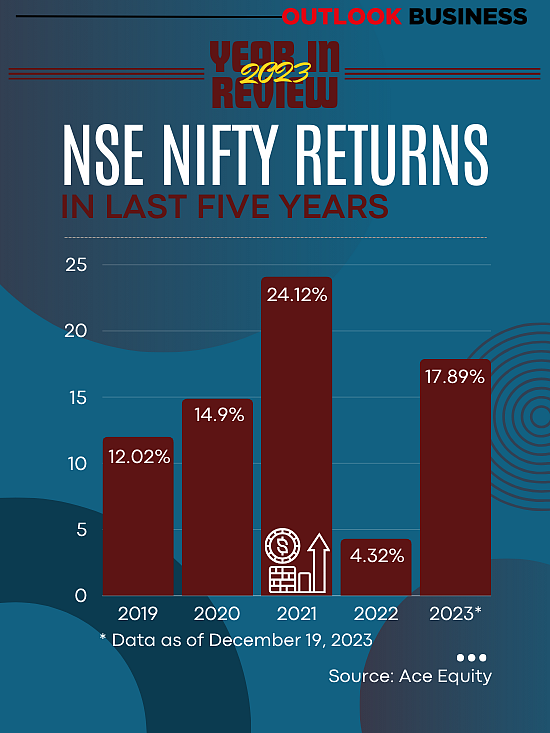

Overall, 2023 has been a strong year for Indian equities, where the Sensex and Nifty have shown mid-teen growth while the smallcap and midcap index has significantly outperformed the benchmark indices on the back of strong corporate earnings, a stable political climate, and sustained domestic flows.

The period from July to September remained relatively stagnant, but October and November propelled the market to unprecedented heights.

Kranthi Bathini, Director at WealthMills Securities, says that 2023 has been a fabulous year for the Indian markets as both Sensex and Nifty touched their all-time highs despite escalating geopolitical tensions, the Israel-Hamas war, and the rising crude oil prices. Markets have shown resilience with the total market cap breaching the $4 trillion mark.

In 2023 so far, the BSE Sensex has surged over 10,500 points or 17 per cent to breach the 71,700 points mark and the NSE Nifty50 has jumped over 3,350 points or 18 per cent to hit the 21,500 mark. The BSE Midcap index has jumped 42 per cent and the small-cap index has increased 45 per cent as of 26 December 2023.

What Drove The Growth?

Resumption of FPI inflows, surge in retail investors, robust earnings of India Inc and the expectation of policy continuity emerged as the major factors for bulls prevailing this year.

Foreign portfolio investors (FPIs) turned net-buyers in 2023 and invested Rs 163,596 crore in Indian equity markets. In 2022, FPIs remained net-sellers and withdrew Rs -121,439 crore from the markets. Fresh flows were witnessed as the market anticipated a halt and then a gradual decline in interest rates.

After withdrawing Rs 39,000 crore from the Indian markets in September and October this year, FPIs have made a major comeback in December.

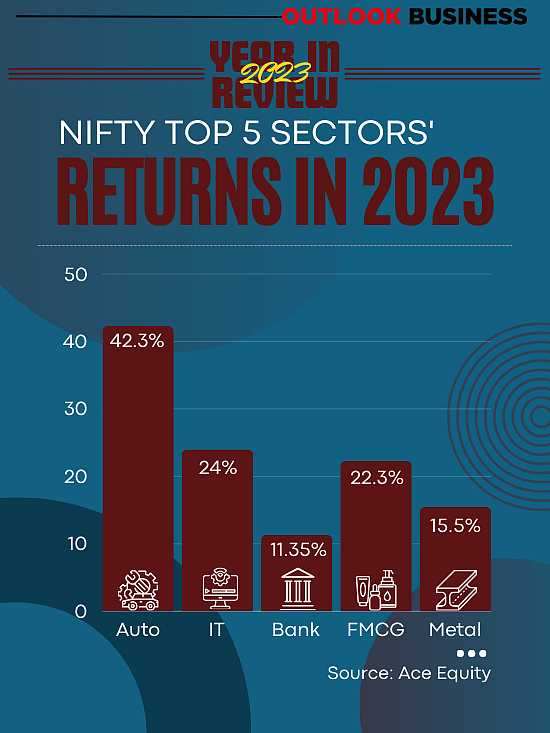

Higher inflows were seen in Capital goods along with Auto and Power sectors. IT and Metals remained laggard as their performance remained subdued, according to a report by ICICI Direct.

“The point to cherish is that the markets are not much reliant on the inflows from foreign portfolio investors (FPIs) despite the exodus of foreign funds. The Indian equities have remained strong throughout the year,” says Bathini.

This could be attributed to the surge in domestic investors, who appear to be more confident of the performance of the market. The active participation of retail investors has been a key driver of growth, a sign of growing appetite for equities among retail investors and a heightened confidence in the Indian Economy.

After the Covid-19 pandemic, there has been a significant boom of retail investors’ holdings in largecap and midcap stocks. According to a report by Economic Times, retail investor’s stake in NSE Nifty50 companies has increased from 6.16 per cent in September 2019 to a record 6.98 per cent in September 2023. In NSE 100 companies, ownership of retail investors has surged from 6.34 per cent in September 2019 to 7.22 per cent in September 2023.

Outperforming Sectors

Among the key sectors which have seen a surge this year, the Nifty Auto index witnessed a sharp spike of over 42 per cent on a year-to-date basis, driven by strong demand on the back of improving economic conditions and an increase in personal incomes.

Improvement in the supply of semiconductor chips and lower steel and aluminum prices also contributed to the increase in gross margins for auto manufacturers. Tata Motors jumped over 85 per cent and Bajaj Auto witnessed 80 per cent growth in 2023 so far. The two-and three-wheeler manufacturer Hero MotoCorp also showed record growth of over 42 per cent.

PSUs, infra, railways, engineering, and defense have also emerged as the high-performing sectors for investors. “Along with these, a new segment which has come is the SMEs and there are many stocks which are growing at 20 per cent with ROCE of 20 per cent, would be interesting to buy; and all these stocks are available at a reasonable price, which allows us to make good money in this segment,” says Sandeep Raina, EVP, Professional Clients Group at Nuvama Group.

Analysts tracking the market expect 2024 to continue the momentum witnessed in the stocks in 2023.

Expectations For 2024

According to experts, with inflation trending within the threshold limits worldwide, the markets seem to have weathered the storm on a global level. The US Federal Reserve’s unexpected indication of three rate cuts for the next year contrasts with its prior stance, fostering optimism.

The US Fed rate cuts are likely to trigger substantial credit expansion in both urban and rural areas of India. This growth is expected to be driven by increased consumption and capital expenditure, resulting in a boost for the financial services sector.

“We believe that 2024 has the potential to be another good year for the markets as we expect corporate earnings growth to be sustained at mid- to high-teen levels. After the recent assembly elections in five states, the market is factoring in a greater probability of continuity in government policies, leading to higher multiples of the market to sustain,” says Nishit Master, Portfolio Manager, Axis Securities PMS.

Though 2024 is expected to be a good year for the markets, the volatility of returns will be higher in 2024 compared to 2023, mainly on the back of higher valuations compared to other economies, he adds.

Various factors like strong corporate earnings, investment from both the government and private players, and the recent dovish stance of the fed government is positive for the markets. Besides, considering the upcoming general election, the market is likely to find a new positive direction but there would be some correction along with the rally. Investors should watch for the outcome of general elections, central banks’ stance on interest rate hikes, and crude oil prices.