Diversify your portfolio with equity mutual funds. Over the long-term, equity mutual funds have historically generated competitive returns when compared to many other asset classes. Long-term investments in equity mutual funds can help investors: 1) generate potentially higher returns by 2) benefiting from the power of compounding while 3) mitigating overall portfolio risk.

What does history tell us?

A monthly SIP of Rs. 5000 started in the Franklin India Prima Fund in 1994 would have grown to an investment value of Rs. 3.70 Crore (as on December 2018). This clearly underscores the growth potential of investment in equity funds.

Three compelling reasons for starting an SIP in an Equity Mutual Fund?

A monthly SIP of Rs. 5000 started in the Franklin India Prima Fund in 1994 would have grown to an investment value of Rs. 3.70 crore (as on Dec 2018).

A monthly Fixed Deposit of Rs. 5000 started in 1994, compounding at the average interest rate of 8.34% pa, would have grown to an investment value of Rs. 49.13 lac in the same time period.

A monthly SIP of Rs. 5000 started in 1994 and compounding at the 12% pa would have grown to an investment value of Rs. 84.26 lac in the same time period.

However, we all know and understand that past performance is no indication of future returns. Here, the power of compounding plays an integral role.

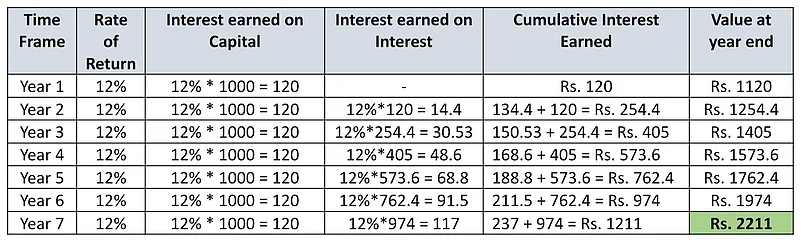

Compounding is a mathematical concept that can exponentially multiply the return on investments. Through the compounding process, an asset can generate returns not only on the original investment amount but also on the cumulative returns earned Essentially, the compounding process ensures that both the capital and the cumulative returns generated on the capital investment earn returns over time.

Exhibit 1: Let’s see how Rs. 1000 invested at 12% CAGR grows over a period of time.

Equity Mutual Fund investments can help you benefit from the power of compounding which has the potential to grow a small amount of money into a whopping sum.