There are still some days to go before the tax savings season comes to an end and for tax savers looking for some last minute tax savings, the equity-linked savings scheme (ELSS) is a good option. Among the tax savings option, the ELSS is the only pure equity offering and the one with the shortest lock-in period. Tax breaks aside, the ELSS funds have delivered healthy double-digit returns over the long term.

This scheme seeks to generate medium to long-term capital appreciation from a diversified portfolio that is substantially constituted of equity and equity related securities of corporates, and to enable investors avail of deduction from total income, as permitted under the income tax act.

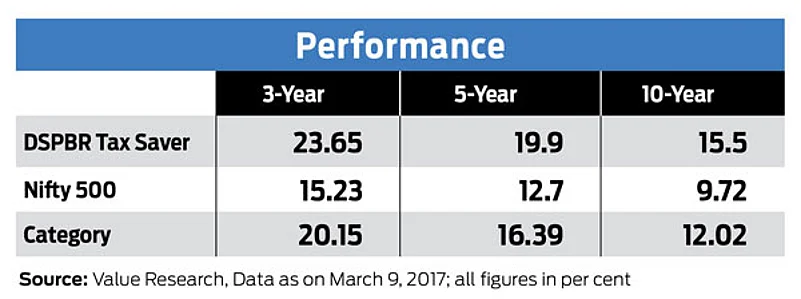

DSP BlackRock Tax Saver witnessed change in fund management in 2015, which was also a factor resulting in this fund’s improved performance since. The fund’s broad investment strategy remains largely unchanged, but Rohit Singhania, Vice President and Fund Manager – DSP BlackRock has shifted the focus towards earning growth for stocks and how its valuations stack up with its own historical valuations and relative valuations with its peers. This along with sectoral and market outlook goes into stock selection. Careful stock selection has helped the fund’s performance over this volatile period.

The fund is currently biased towards large caps. Large cap weight is ~72 per cent, mid cap ~ 8.5 per cent, small cap ~10 per cent and micro-cap ~ 6 per cent. Top 20 stocks would account for about 54 per cent of the portfolio. In terms of sectors today DSP Blackrock is overweight on industrials, materials and energy. When it comes toward investment styles, DSP blackrock is not bias towards any kind of investment styles. They look for earnings growth in the company that is sustainable over next few years. So earnings growth with a reasonable valuation is the key metric which DSP Blackrock look at for stock selection.

The fund manager tends to avoid businesses where predictability is poor and where they have a low comfort with the management. That said, this fund house expect the profitability improvement to continue in the March quarter in line with the third quarter across most companies. Going forward for FY18, from the BSE Sensex point of view, the Fund Manager expect earnings growth of around 17-18 per cent. The fund manager take long term calls, keeping in perspective the near term volatility as well, which augurs well for those invested in this fund.