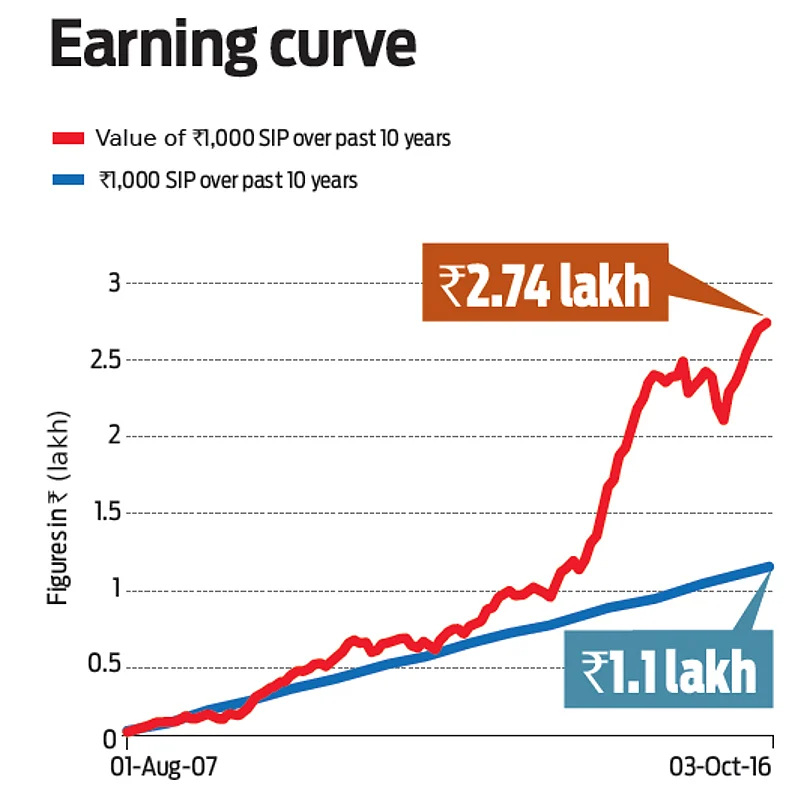

If patience is one of your virtues and you can also stomach some risk, then Franklin India High Growth Companies Fund is the fund for you, which is nearly a decade old and has witnessed the worst of the market phases in recent history, and has yet come up winners. With no restriction on market capitalisation and sectors, here is a fund that invests in companies that have the potential to deliver higher earnings growth than the market over the medium term.

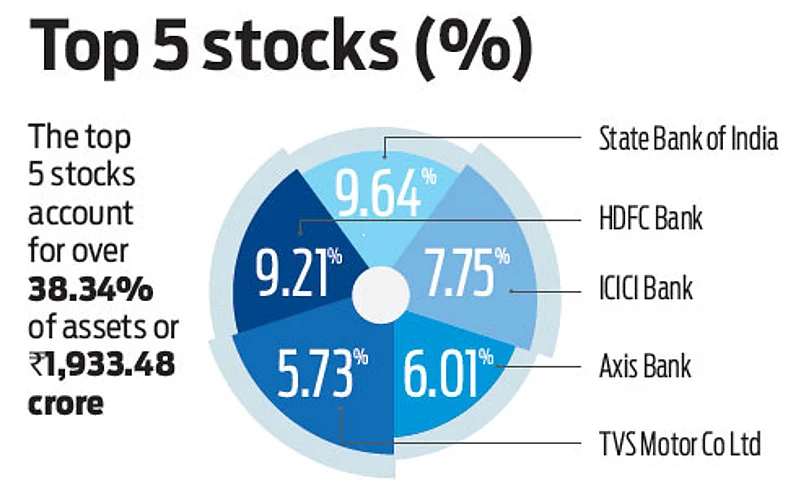

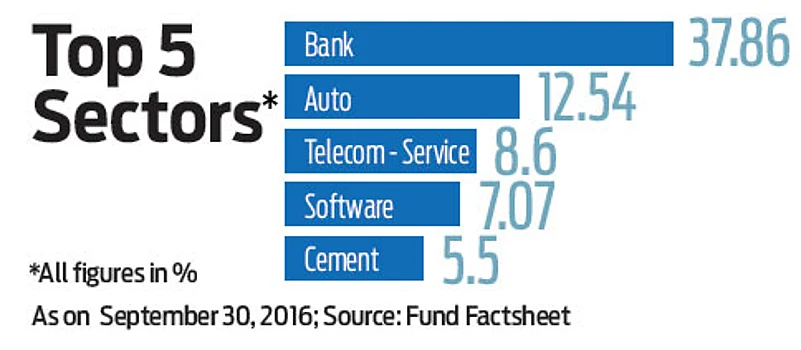

The fund’s stated objective tells it all—it will focus on companies offering the best trade-off between growth, risk and valuation. The fund managers follow an active investment strategy and focus on rapid growth companies which are selected based on growth, measures such as enterprise value, growth rate, price/earnings/growth, forward price/sales, and discounted EPS. All these filters ensure that only quality companies make the portfolio, which can be seen in its top holdings.

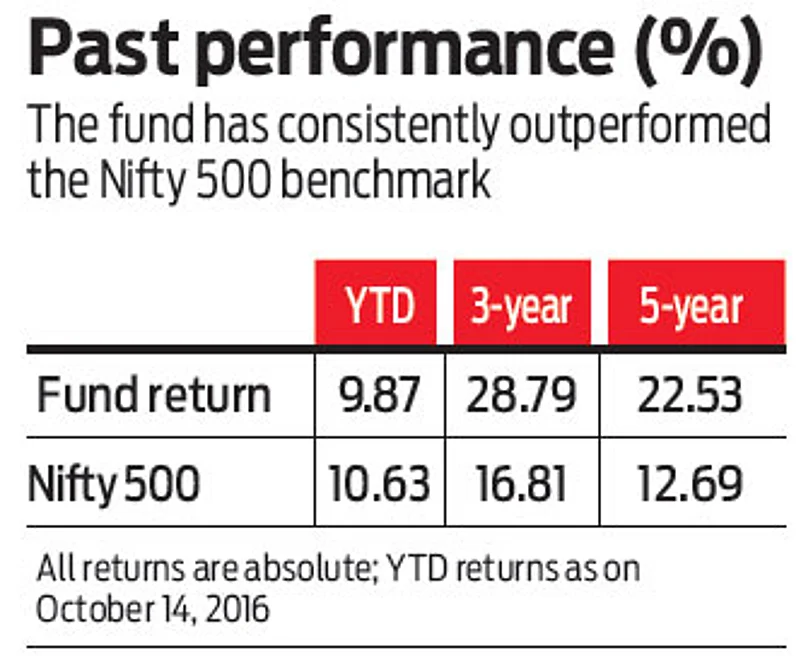

The found house does act conservatively, but in case of this fund scheme you can experience a contrarian stand. For instance, over the past few years, it has increased its exposure to banking stocks such as SBI, Axis Bank and ICICI Bank, who had faced the brunt of loan defaults, thereby impacting their share prices. However, all of these are likely to benefit with the economic revival in sight, which will pay off handsomely to those who have patiently continued in this fund. Use this fund in your portfolio if you are looking for a dash of higher returns over the medium term. The fund’s return in the past one year was 8.75 per cent; however, when you look at the 5-year period, the return is 22.53 per cent, which is way more than its peers and benchmark.