When an investor is putting money into equity mutual funds, he or she is often struck with a question in their mind - which category to put the hard-earned money in?

This might sound like a simple decision but I am sure everyone who has gone through this will vouch otherwise. Should I invest in large caps or should I invest in mid-caps is the biggest question. Usually, it is very difficult to catch the cycle as to which will do better and most professionals also fail at this. So how do we still optimise the returns?

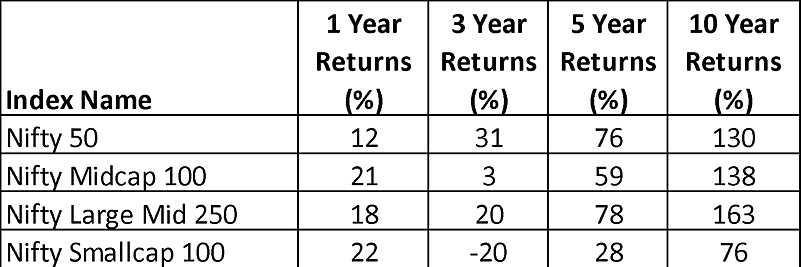

Let us see in the table below how different indices have fared on different time frames.

*As of 14th November 2020

Last 3 years the broader markets including the small-caps/midcaps have not done as well and the large caps have done much better. So any investor who would have a large allocation in small/midcaps would have felt left out. Similarly, the next 3 years could belong to small caps/midcaps but who knows for sure. Hence, a better strategy always is to have a balanced allocation. In the Nifty Large-Mid 250 Index above, the aggregate weight of large-cap stocks and mid-cap stocks is 50 per cent each and is reset on a quarterly basis. Hence the index has a 50:50 allocation to large and midcaps. And we can see that the index has given the highest returns on longer time frames of five and ten years beating the large-cap, midcap as well as the small indices. Hence we can observe that 50:50 allocation towards large and midcaps could be an optimum allocation.

A couple of years back, SEBI had carried out a re-categorisation exercise of different mutual funds categories and in that exercise was born this category of large & midcap mutual funds. All funds in this category have the index Nifty Large Mid Cap 250 Index as its benchmark, hence exposure to any scheme in this category should give investors closer to an optimum allocation in large and midcaps.

In a car, shock absorbers help in making the journey comfortable, but it is the power of the engine which helps us reach our destination on time. Similarly in our investing journey, large caps give stability to the portfolio in bad times, but the midcaps help us reach our financial goals on time. Hence, funds under the category of large and midcap could be the right choice offering both stability and growth in one product.

Let me address one more question which could exist in investors mind. Generally, people perceive midcaps as risky and hence the allocation of 50 per cent could be risky in their minds. But the risk does not depend on whether a company is large-cap or midcap but it depends more on the business model of that company. If the business model is good and steady and management is competent, the company would do well irrespective of its category. Hence even in the last 3-4 years when the economy was going through a lot of mini disruptions like demonetisation, IL&FS crisis led financial market freeze, GST introduction and currently COVID, we have seen many midcaps perform well and become large-caps on the way.

Hence one should not extrapolate midcaps as risky. Also, there are a lot of categories like tiles, diagnostics, luggage, speciality chemical, staffing solution, where the largest company in that space is still midcap. So buying these leaders when they are young is the perfect recipe for multibagger returns.

The author is Fund Manager, Motilal Oswal AMC