Stock market indices have been on the rise since January 2017. Going by the several IPOs that have come up in recent times and those lined up for this year are all visible signs that investors are thronging the investment bandwagon. In the midst of all the noise, inflows in mutual funds have been growing each passing month. Suddenly, everyone is looking to make money by investing in the markets. At Outlook Money, the number of queries being posted have gone up, asking which stock to invest in or where to invest now.

The two ways to ride the stock market rally are to directly invest in stocks or to invest in mutual funds, which will in turn invest in stock markets. There are many benefits of investing in mutual funds—convenience, professional management, diversification, liquidity—and the fact that these are highly regulated makes the case of using the mutual fund route to riding the stock markets. But first, the key to wealth creation is to know two things—what kind of investor you are and which funds to invest in. In this page and the next, you will get answer to both.

Choosing a fund

There are more than 2,000 mutual funds to select from. And, every first time or new investor searches for the best fund to invest in, without realising that the performance of every fund is dynamic and changes at the end of each and every day. To make investing in mutual funds as easy as navigating a smartphone, we have evolved three distinct categories of investor groups that are reflective of an investor’s state of mind when it comes to investing. It is a mix of the risk they can take and the investment time frame that they have.

These groups are: Beginner, Safe Player and Adventurer. Each investor stereotype addresses a core investment need without being constrained by the number of funds to meet those needs. While there are several funds that can fall under these heads, we have hand-picked five funds under each category to bring in a mix of choice and varying investment style. An investor will do well by investing in any two funds from the list.

In a rising market, every stock and almost every fund looks for a good bet to invest in. However, the real test of an investment can be gauged by how it fares at times of volatility, uncertainty and market lows. This is one of the best ways to evaluate mutual funds which have a long performance history to go by. A lot of rigour and research has gone into short-listing the five funds that are suggested to first time investors. Each has a long performance history to go by, through different market conditions to successfully invest in them.

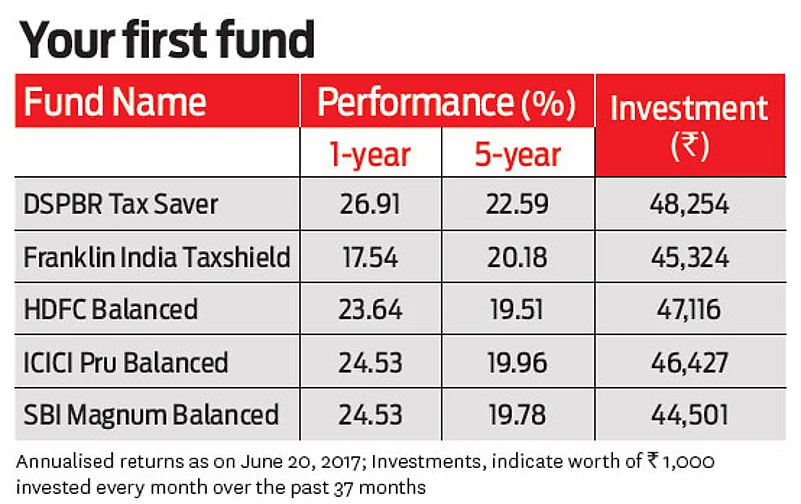

To reiterate the performance, an investment of Rs 1,000 every month by way of SIP over the past three years has been tracked and its worth can be gauged in the table (Your First Fund). So, on an investment of Rs 37,000 over the past 37 months in each fund, the value of the investment ranges between Rs 44,500 and Rs 48,254 as on June 20, 2017.

The choice of investments include equity-linked savings scheme (ELSS) in which investments qualify for tax deduction under Section 80C up to Rs 1.5 lakh in a financial year. These are funds in which investments have a lockin period of three years, which instils discipline to stay through the lock-in and not make an exit in haste. At the end of three years, the investments when redeemed are not subject to any tax.

Then there are balanced funds, which are basically equity funds that maintain a defined asset allocation between equity and debt. To maintain this range of investment in equity and debt, the fund automatically rebalances its investments from time to time and maintains the balance. So, when equities go up, the fund manager books profits by selling equity and investing the gains in debt instruments and vice-versa. The simple principle of asset rebalancing keeps a check on emotions and has proven to work wonders on investment gains over period of time.

Successful investing

To succeed with investing, be regular and systematic. Also, be realistic with the returns you are expecting from the investment. For instance, do not be swayed by the high returns that some funds post, without realising the risk involved when investing in such funds. Set a realistic goal to invest in funds that will beat inflation and in the long run build wealth.

If selecting a good fund is important, it is equally important to know when to exit a dud or under performing fund. One way to know if the fund in which you have investments is no more on the buy or stay invested list is to check how it has fared over the previous year compared to its benchmark and peers. Evaluate the performance of the fund you have invested in twice a year to get a clear indication. A steady fall in performance compared to the benchmark and peers is a clear sign to exit investments in the fund.

A good way to benefit from mutual funds is to adopt the less is-more approach, by investing in a few equity mutual funds to have the necessary exposure to some of the best performing stocks. For instance, the average stock holding of most funds ranges between 35 and 45; with some going above 50. Given so many benefits and conveniences, it makes immense sense in investing with mutual funds in every market condition than chase for stocks when the markets are fast rising.