We are so used to bigger the better and more the merrier approach to life that when it comes to investing in mutual funds, several investors believe that they should be investing in a fund which manages more money. Until a few years ago, the rush to tom-tom the assets managed by an AMC was the norm, till the regulator put a stop to this practice. Even now, among the distribution community, it is common to hear sales pitch that revolves around the AUM of a fund.

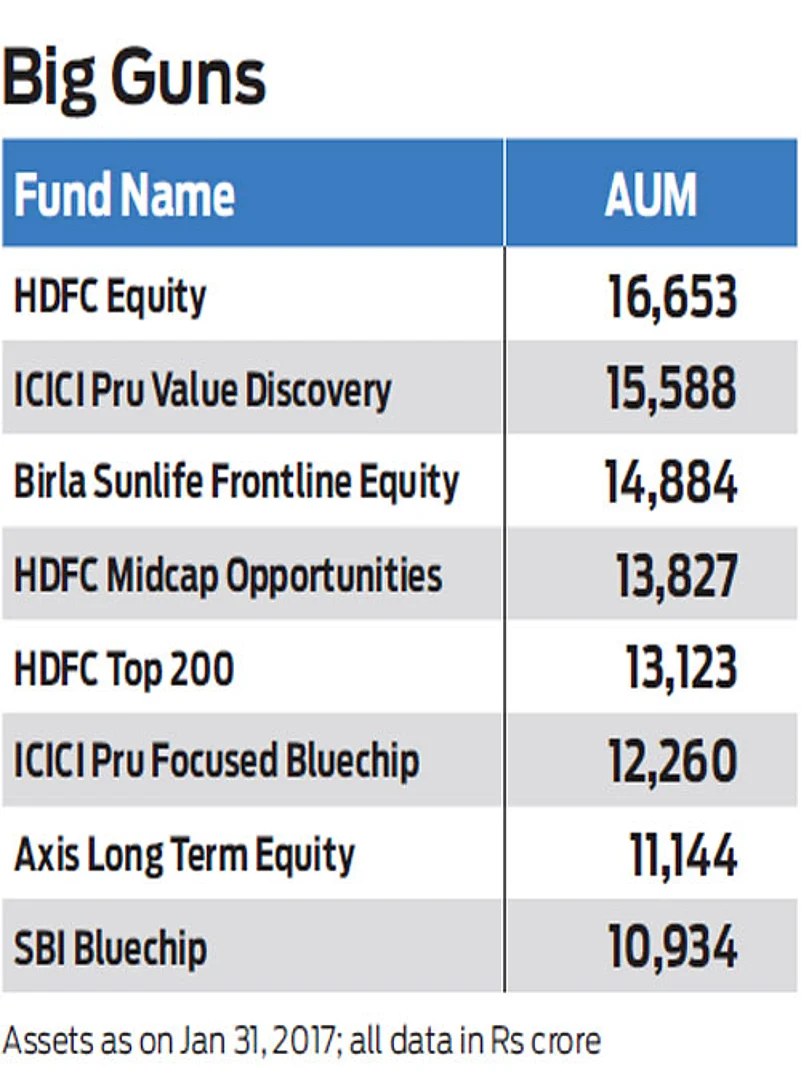

The debate has both sides in equal number and there is plenty of data available to prove both the hypothesis, depending on what time frame you use for the analyses. Size does matter, but it is not the only thing that matters. The performance of a mutual fund is not solely dependent on the assets it manages but how it manages it at different times. There is no clear indication that the performance of a large fund is better than that of a small one. For instance, the last one year performance of the biggest fund by size; HDFC Equity, which manages assets worth Rs 16,653 crore is 42.13 per cent, which is very good. However, it pales in comparison to JM Core 11, which posted 56 per cent returns in the same time with just Rs 32 crore assets to manage.

Size is a myth

There is debate among some investors as well as distributors over the swelling assets of some funds and how it is a cause of concern for those invested in them. Today, there are 8 funds with assets exceeding Rs 10,000 crore each, making them the biggest funds by size. The investments in them have not stopped and there is nothing clear to indicate poor performance in these funds. At the same time, there are instances when fund managers freeze further investments in their schemes. Most recently, on February 20, DSP BlackRock Investment Managers suspended fresh flows into its popular Micro Cap fund, citing the need to protect investors’ interests by restricting large inflows.

The reasoning by the AMC for this pause was the fund’s swelling asset base which had touched Rs 4,751 crore in about a decade since it was launched. This fund had created a niche for itself by exploring investment opportunities beyond the top 300 companies by size. Credit goes to the AMC and the fund manager running it to identify so many winners, which is reflected in its performance.

In the past one year, the fund posted 47 per cent returns. “It is challenging to incrementally build positions, i.e. to increase stock weightage of companies to a meaningful size in the portfolio,” says Vinit Sambre, senior VP and fund manager, DSP BlackRock Investment Managers.

This is not the first time that a fund has stopped taking fresh investments. IDFC Premier Equity, had from time-to-time stopped fresh lump sum flows into the fund, but accepted SIPs. A similar approach was adopted by SBI Small & Midcap fund in 2015, when it stopped accepting fresh investments. What should matter to investors is to track if the fund is going by its investment objective and is consistently faring better than its benchmark. One should also check if the fund meets their investment objective to stay invested or exit their investments.

While investing in a fund that manages lots of money is a great starting point for fund selection. However, it is not the only criteria that one should adopt when looking to invest in mutual funds. There is still a lot of investment opportunity in the Indian markets to worry over investing in funds with huge assets. Nevertheless, do check the performance of your fund once a year to evaluate its performance and the progress of your financial goal for which you had invested in it.