The toughest things are forged in fire, and National Organic Chemicals (Nocil) has taken its fair share of heat. Whenever adversity struck, it responded by cutting out dead weight and building on its strengths. It is a strategy that has worked impressively well. Today, the company has a significant presence in the global stage and is prepared to make the best of supply-chains unmooring from China.

The toughest things are forged in fire, and National Organic Chemicals (Nocil) has taken its fair share of heat. Whenever adversity struck, it responded by cutting out dead weight and building on its strengths. It is a strategy that has worked impressively well. Today, the company has a significant presence in the global stage and is prepared to make the best of supply-chains unmooring from China.

The company comes from a group with a long history.

The Mafatlal Group had been in business for over a century. Mafatlal Gagalbhai had left school to walk through villages with his father and sell textiles. In the early 20th Century, when the Swadeshi movement inflamed patriotism in many hearts and people burnt British-made goods, Gagalbhai’s business thrived. He soon expanded in Mumbai and, since then, the enterprise has grown despite the Great Depression, the World Wars and tragic deaths in the family.

Till the 1960s, the business was largely in textiles. But, in 1961, Arvind Mafatlal, the grandson of Gagalbhai set up India’s first petrochemical complex for manufacturing plastic and chemicals in Thane. Then differences in the family cropped up and the enterprise was split into two, one of which was Arvind Mafatlal Group, with part of textiles and chemicals units.

Over the years, there have been mistakes made but they were promptly corrected. During the Licence Raj, the group entered multiple unrelated sectors such as machinery, electronics, medical equipment, software and finance. Post-liberalisation in 1991, most of the businesses were rendered uncompetitive and Arvind Mafatlal’s son Hrishikesh decided to divest all the non-core businesses. He decided to focus once again on textiles and chemicals. The recession of the late 90’s drove even these two businesses into bankruptcy.

Nocil was the polymer and petrochemical arm of the group. Post-liberalisation, competition had intensified and Nocil’s revenues from commodities such as polyethylene and polypropylene, which contributed the largest to the top-line, took a hit. Shell’s subsidiary offered a fund infusion but the business had to be split into three — petrochemicals, rubber chemicals and plastics from petrochemicals — before that could go through. The split was done but Shell’s subsidiary backtracked because there was a reorganisation at its group level. Nocil adapted to this quickly enough by selling off the petrochemicals and plastics business to Reliance, which was already a major producer. The remaining rubber chemicals business though small was profitable and growing.

Rubber chemicals are essentially used for accelerating the vulcanisation process and for increasing the strength and quality of the final product. This business has some inherent pluses.

Competitive advantages

More than 60% of the demand comes from tyre manufacturers. Despite being an integral part of the final product, rubber chemicals contribute only 4% of the cost of tyre. This substantially decreases the likelihood of tyre manufacturers switching suppliers. Another entry barrier in this business is high approval times ranging between 18 months and two years.

So, there is considerable customer stickiness.

Then there is the wide moat. The capital and technology intensity of making rubber chemicals is prohibitive. With fixed asset turns of around 2x at best, life for new entrants is difficult. Extensive research and development (R&D) capabilities and/or tie-ups are required to develop products and to build commercially viable capacities. Nocil has fostered a culture of developing technology, products and processes in-house, through a strong emphasis on R&D. In an industry where China is a dominant player, reducing the cost of production is crucial. With its R&D capabilities, Nocil has managed to strike the right balance. It has kept its raw-material consumption levels much lower than the largest player China Sunshine, while maintaining highest standards of environmental compliance. Therefore, Nocil has managed to sustain its profitability despite competition’s aggressive pricing. Any new player hoping to make a dent in the market has to be significantly efficient right from the start to match up. Further, the available market opportunity is too small to accommodate newer players — the global market size is around Rs 200 billion.

Pandemic-hit industry

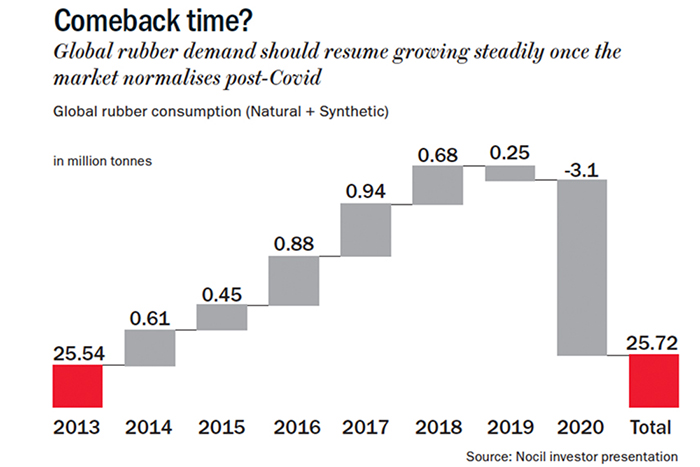

Global rubber demand was growing at a steady rate of around 2% to 2.5% before 2020, when COVID-19 struck and demand took a hit (See: Comeback Time). But, the market is expected to normalise and continue growing steadily over the coming years. In fact, Nocil has an edge over its international competitors because Indian demand should grow faster than the global market, and the Arvind Mafatlal company is the only player of scale here with around 40% share and the rest of the market largely serviced through imports.

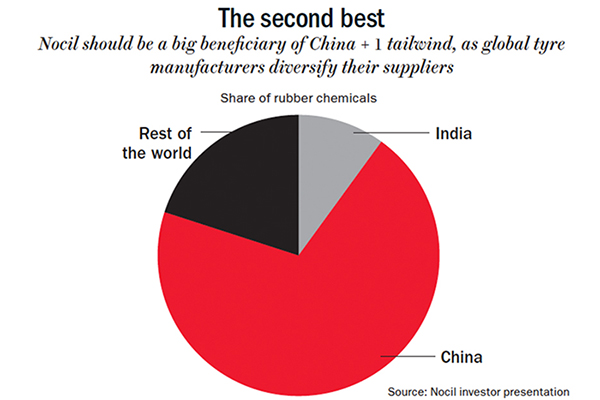

Nocil is also likely to be a big beneficiary of the China-plus-one strategy that global tyre manufacturers are employing, to diversify their suppliers. Exports contribute to around 30% of the company’s revenue at present. With disruption in global supply-chains and companies looking at alternative suppliers, China’s share of rubber chemicals is expected to come down from 75% over coming years (See: The second best). Nocil is among the top four globally and has established itself as a dependable supplier. It has relationships with most of the major tyre manufacturers and has around 5% of the global market share. Even a small shift away from China will result in a big demand uptick for Nocil, which already has capacities in place.

Nocil is also likely to be a big beneficiary of the China-plus-one strategy that global tyre manufacturers are employing, to diversify their suppliers. Exports contribute to around 30% of the company’s revenue at present. With disruption in global supply-chains and companies looking at alternative suppliers, China’s share of rubber chemicals is expected to come down from 75% over coming years (See: The second best). Nocil is among the top four globally and has established itself as a dependable supplier. It has relationships with most of the major tyre manufacturers and has around 5% of the global market share. Even a small shift away from China will result in a big demand uptick for Nocil, which already has capacities in place.

The company has been expanding its capacity at Dahej in phases, with an intention to double it from 55,000 MTPA to 110,000 MTPA for a total capex of Rs 4.5 billion. Phase 1 (for Rs 1.7 billion), Phase 2A (Rs 1.4 billion) and the last phase (Rs 1.4 billion) have already been commissioned.

With the additional capacity, Nocil becomes the third largest player globally. At peak utilisation levels, post-expansion, Nocil is expected to generate sales of around Rs 20 billion and reach a global market share of 8% to 9%. This should happen by H1FY23 as per management guidance.

The capital for this upgradation is being managed efficiently too. The entire capex has been covered through internal accruals and the R&D team has ensured that Nocil is able to develop processes for introducing new specialised products completely in-house, without any technical collaborations. Even the setting up of the plant was done entirely in-house. It is a telling feat considering only two to three companies in the world have this capability.

Drivers of profitability

Currently, Nocil produces a basket of 23 rubber chemicals. It is a one-stop shop for the rubber-chemicals requirement of tyre manufacturers. Though 75% of the revenue now comes from commoditised chemicals and 25% from specialised, with increasing exports, the share of revenues from specialised chemicals will improve and lead to better gross margins. Moreover, as utilisation ramps up, operating leverage will kick in and drive substantial improvement in operating margins.

While it is not a core thesis, the company could make a windfall after the ongoing anti-dumping investigations. Nocil had filed a complaint with the Directorate General of Trade Remedies (DGTR) about the dumping of a rubber chemical PX-13 by Chinese manufacturers and the investigations are on. The company produces over 70% of the chemical’s supply in the country and PX-13 contributes about 25-30% of its top-line. While Nocil got a favourable interim order, the final order from the agency is awaited. If Nocil gets another favourable outcome, its profitability can coast into another orbit.

While it is not a core thesis, the company could make a windfall after the ongoing anti-dumping investigations. Nocil had filed a complaint with the Directorate General of Trade Remedies (DGTR) about the dumping of a rubber chemical PX-13 by Chinese manufacturers and the investigations are on. The company produces over 70% of the chemical’s supply in the country and PX-13 contributes about 25-30% of its top-line. While Nocil got a favourable interim order, the final order from the agency is awaited. If Nocil gets another favourable outcome, its profitability can coast into another orbit.

Value for shareholders

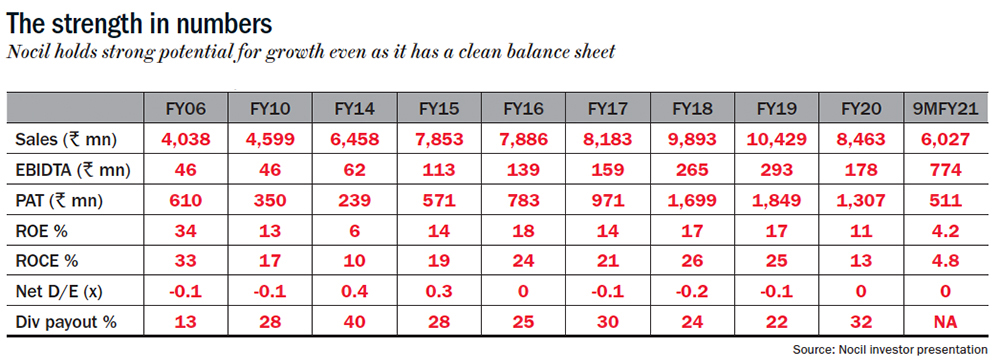

With capex behind and a debt-free balance sheet, Nocil is expected to generate substantial free cash flows. It has a strong dividend track record and has been maintaining payouts of an average ~28% over the past decade (See: The strength in numbers). We expect this to be maintained or improved going forward.

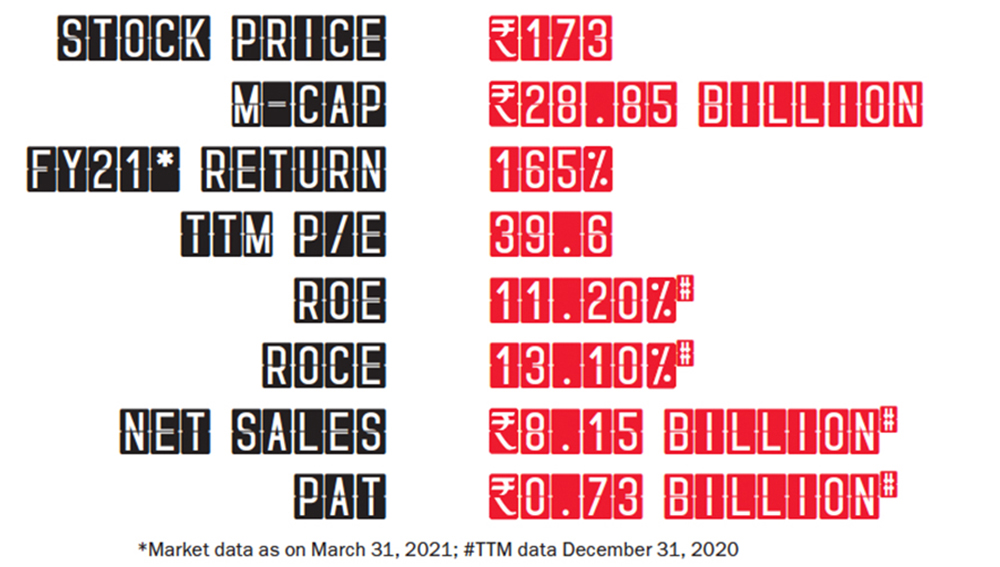

At a market cap of Rs 30 billion, the company gives us access to large growth (domestic and export) tailwinds, a business with strong competitive advantages, top-notch management and a robust balance sheet at highly favourable valuations.

There are risks of course. The major ones arise from the company’s inability to drive volumes due to external or internal circumstances, more aggressive pricing strategies adopted by Chinese competitors, and/or steep raw-material-cost fluctuations.

Disclosure: Equirus PMS holds the stock in its client accounts but neither the fund manager nor his employees have long/short position on the same.