We are at the cusp of a significant 3-sigma event that has the potential to destabilise markets across the world and which requires us to pay attention and make sure our portfolios are designed to withstand them. Post the Great Financial Crisis, central banks have engineered a record quantum of printed money. From an investment point of view, it has been one of the most challenging two years; along with record initial public offerings (IPOs) in India and the US, frothy public and private markets and other such euphoric trends are being seen across the world. All of this makes prudent investment management and asset allocation more important than ever before, especially for high and ultra-high networth individuals (HNIs and UHNIs) who are looking to solidify and secure their financial legacies.

Below are a few financial considerations for investors to navigate the choppy waters that lie ahead.

1. Build Anti-Fragile: Drawing from author and mathematical statistician Nassim Nicolas Taleb’s book ‘Antifragile: Things That Gain From Disorder’, we have to learn how to become resilient in the face of unsettling events and not shatter under pressure. In the investment context, this would mean choosing assets that are traditionally known to benefit from volatility and can withstand market stress. This leads us to the question as to which assets stand to become stronger and gain from economic turbulence. And one natural answer here seems to be--Gold. Thought of as a classic safe-haven currency and the resolute bet during a crisis, gold is an asset that gains from inflation and in situations where financial markets are in turmoil.

Historically, from a 300-500-year perspective, every time there has been excessive money printing, gold has seen resurgence. Over the past 13-14 years, post the Global Financial Crisis, even as the world grew at an average of 3-5 per cent per annum (a cumulative 50-60 per cent growth), the G4 central bank assets for the same period grew by 5x (500 per cent) of what they were before that. The strongest case for gold, however, is when confidence in fiat currencies is challenged and we believe the aforesaid central bank excess will slowly but surely lead to such a loss of confidence.

While it may not be the perfect anti-fragile asset, gold and gold mining stocks (considered a more volatile proxy for gold) merit addition to an investment portfolio as they offer sufficient protection. Along with gold, there are other sophisticated tools such as credit long shorts and other non-correlated assets that can come in handy while building an anti-fragile portfolio.

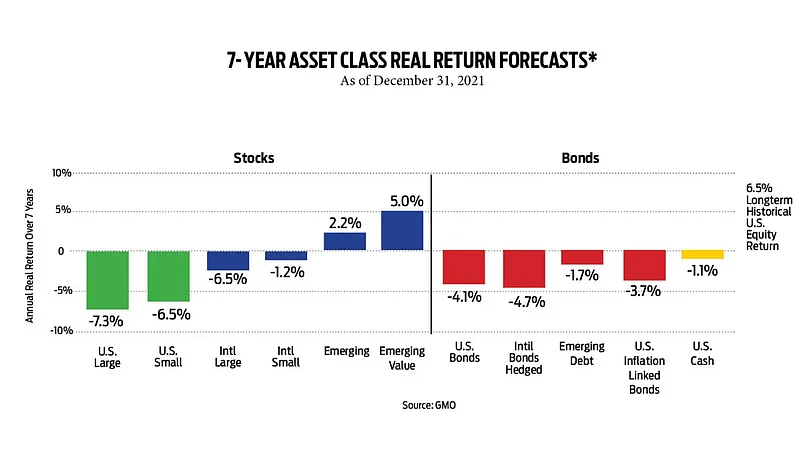

2. International Diversification: For far too long now, investor behaviour has led investments into markets where past performance is good. The US equity markets have had an exceptional past decade. However, going to where the past has been good may not be the right approach anymore, because many developed economies that have continually outperformed are now home to some of the most broken monetary systems. Meanwhile, emerging economies have become much stronger because their central banks have worked to strengthen resilience to capital outflows after having learnt from their past mistakes. Hence, past underperformance, if evaluated properly, can be taken advantage of. From an investment perspective, such emerging markets present the opportunity of creating international value portfolios through high-quality assets and cash flows that are available at very good prices. These assets appear to be an island of avenues for reasonable returns amidst many international financial assets that offer very poor to negative prospective returns.

From time to time markets overreact to political or financial uncertainties. The past year has seen this happen with regard to the Chinese financial markets and volatility which is affecting Russian markets currently. These present opportunities for an astute investor to build positions in high-quality businesses. Given recent events in the US, as we write this article, one cannot rule out such opportunities in the US. However, investors must use the dimension of time to patiently build portfolios with assets from different geographies when markets over-react.

3. High Yield: Over the past decade, fixed-income investments have been known to offer notoriously low returns, and this is true for both domestic and international markets. Investors have gravitated to return-free risks as opposed to risk-free returns! Blind search for yield is dangerous and high-yield investing must be done carefully by buying assets where the price-value equation is right with adequate reward for illiquidity. Asset class managers who are focused on specific asset classes of their expertise backed by decades of experience are the best people to approach while looking to build high-yielding portfolios.

4. High Quality: Unfortunately, most high-quality growth businesses are too expensive currently. However, the impending market turmoil could well present yet another opportunity to buy into high-quality businesses—in India and abroad. The most important lesson is that one need not be rooted to one investment philosophy—value or growth—and being nimble and agile can help build a balanced portfolio and move from one segment to another when the time is right. High-quality growth portfolios, when built at the right time and price, can be held on to for decades, but patience and discipline is the key.

5. Sustainability: We are in a real race to save the planet and sustainability is no longer a catchphrase or a trending fad. We have to be able to leverage the power of business and finance to leave a better planet for future generations. From an investment point of view, there are some rewarding possibilities on the horizon. The most potential lies in tech-powered businesses that are focused on projects such as smarter electrical grids, water conservation, sustainable farming techniques and more. The best opportunities are surfacing where there are exceptionally talented people building ingenious products. However, such investments require patient capital and investors have to approach it keeping in mind a seven to 10-year-long timeframe, at the very least. The bottom line is that sustainability merits our attention and it is probably the most important legacy that we will create.

Overall, in a world that is ever-changing and marked by high levels of uncertainty, investors need to embrace prudence, be more agile, and the focus needs to be on creating value by adopting a long-term approach.

The author is Principal Founder and MD, Entrust Family Office.