The Author is Ashwini Dubey, Head, Motor Insurance Renewals, Policybazaar.com.

Purchasing a car is as much a pragmatic decision as it is an emotional one. Hence, it’s important to keep your vehicle safe, protected and insured. The law, therefore, has made it mandatory for all personal and commercial vehicles to have valid third-party insurance in place before they hit the road. But to keep your vehicle totally protected, it is important that you have a comprehensive policy in place, including add-on covers. These additional covers come at an additional premium. So, from the plethora of options, here are the best add-on covers available for car insurance:

Zero Depreciation Cover

Also known as "bumper-to-bumper" insurance, this add-on cover plays a significant role during claim settlement calculations or reimbursements. The value of the car depreciates with every passing month, and the insurance policy does not factor this in thus, the claim amount calculated is after deducting the devaluation cost. However, by including nil or zero depreciation cover, the policyholder is protected from non-inclusion of the depreciation cost, which facilitates getting a higher claim amount.

Roadside Assistance Cover

Regardless of how sturdy or dependable a car is, it can break down anytime. If it happens in the middle of a city road, you can face a great deal of inconvenience. Though this cover can’t guarantee that there will be no breakdowns, what it does is shorten that period by providing immediate assistance. Moreover, it is also handy when travelling in a remote area where finding a mechanic becomes challenging. With road assistance cover as a safety net, all you need to do is inform the insurance company about the situation, and they will arrange for the required service and mechanic.

Consumables Cover

A car is a piece of sophisticated machinery that requires consumables like bolts, coolant, oil and grease, etc., that help run the metal body of the four-wheeled vehicle smoothly. Yet, a comprehensive car insurance policy does not cover this aspect, and any cost pertaining to repair or replacement of these has to be borne by the car owner. Hence, by shielding yourself with this supplementary cover for an additional premium, the insured can get reimbursed for expenses incurred towards consumable items during the repair.

No-Claim Bonus Protection Cover

A no-claim bonus (NCB) is a gratitude offering for those policyholders who have not filed a single claim during their entire tenure of the car insurance policy period. The benefit of this cover is that it can get accumulated for five years if no claims are filed and provide you with an attractive discount on the insurance premium amount. However, you could lose it all even if you file a small claim. Therefore, it is advised to pay for small damages out of your pocket instead of making a claim to keep the NCB benefit intact.

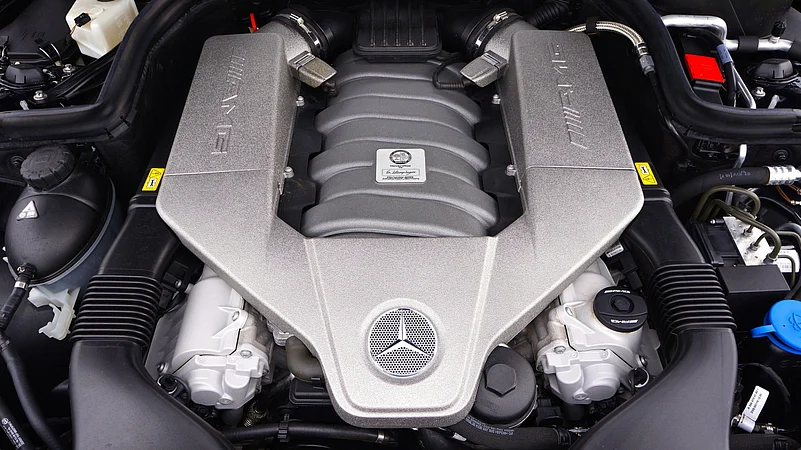

Engine Protection Cover

The engine is the heart of the car that holds power to assist its function. But this integral part is not safeguarded from non-accidental damages under any insurance policy. Hence, an add-on cover becomes vital as it provides insurance against any damages caused due to issues such as an oil spill or water ingression, etc. Hence, if your automobile is less than five years old, get this cover without fail.

Tyre Protection Cover

Tyres are as essential as an engine as they take the maximum brunt and wear and tear from the road. Hence, by opting for this add-on feature, any damages caused to the tyres get covered. Furthermore, having these covers shields from any damage from burst to cut on a tyre and considers labour charges and replacement cost. This might, however, not cover a minor puncture or a manufacturing defect.

Return to Invoice Cover

The market value of a car depreciates as soon as it is driven out of the showroom. This additional coverage provides the policyholder with the market value of the vehicle in case of total loss.

To recapitulate, add-on covers provide the policyholder with complete coverage that guards the automobile and the policyholder from financial losses in more ways than a standard motor insurance policy. Hence, opt from any of these supplementary covers or choose your own set by checking the various options available online. Also, check the claim settlement ratio and read the terms and conditions carefully. After all, a car is not merely a mode of transport but a cherished purchase that needs to be safeguarded from all mishaps.