Gautam Adani, an Indian billionaire on Tuesday addressed US-based short seller Hindenburg research’s January allegations, calling the report combination of targeted misinformation.

Adani called Hindenburg to report a malicious report which brought their stock prices down. He said, “Hindenburg Report was a deliberate, malicious attempt at damaging Adani Group’s reputation and generate profit by driving down its stocks in the short term.”

Adani group has denied all allegations by Hindenburg and is plotting a comeback strategy that includes recasting its ambitions, scrapping acquisitions, pre-paying debts to address concerns about its cash flows borrowings, and scaling back its pace of spending on new projects.

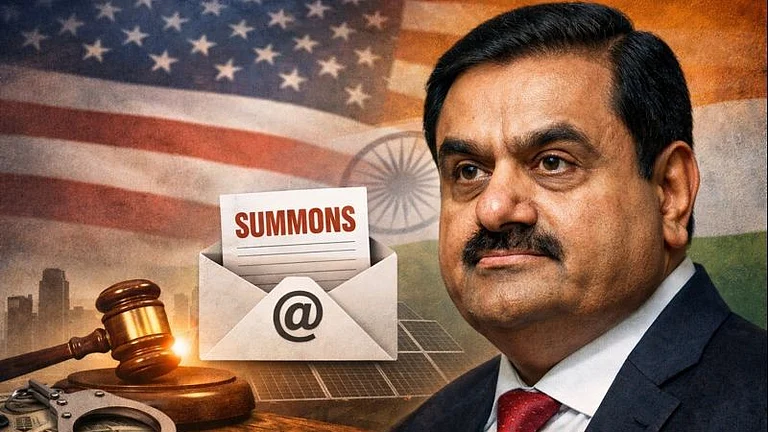

Adani while addressing the annual general meeting of Adani Enterprises virtually, opened up about the US-short seller Hindenburg Research which came out in January this year and shook the stock market with a report alleging accounting fraud and stock price manipulation at Adani Group. It triggered a stock market rout that has erased about $145 billion in the conglomerate’s market value at its lowest point.

Adani said that the report was aimed at damaging the conglomerate’s reputation and generating a profit by diving down its stock prices. He added, “Parties with vested interests encouraged and promoted false narratives across various news and social media platforms, but Adani Group moved to protect investor interest and decided to withdraw FPO despite full subscription.”

Adani Enterprises raised the new debt by pledging 21.4 per cent of the shares of Adani Road Transport, NSDL data showed. It had pledged 1.95 per cent of Adani Road Transport shares during the September 2022 bond issue.

“Our track record speaks for itself. I am grateful for the support our stakeholders showed us while we went through these challenges,” Adani said. “It is also worth noting that during this crisis, not only did we raise billions from international investors, no rating agency cut our ratings,” he added.