Asia and the emerging economies, especially India, are poised for the next big growth in alternative investment products. In terms of assets under management (AUM), AIFs in India are at the same stage that mutual funds were at, in 2009. The market and the industry is now geared towards a paradigm shift towards alternative investment funds.

Overall investments through AIFs will grow at 25 per cent CAGR between 2022 and 2025, led by wealth managers providing AIF products as alternatives to high net-worth individuals (HNIs), family offices, and insurance firms, according to a report by Anand Rathi.

According to the report, Asia and the emerging economies, particularly India, are primed for the next wave of alternative growth.

As of May 2022, over 900 AIFs had been registered with the Securities and Exchange Board of India (Sebi), with capital commitments increasing at 63 per cent CAGR between 2012 and 2022. Global alternative investment AUM increased from $4.1 trillion in 2010 to $10.7 trillion in 2020 and is anticipated to reach $17.2 trillion by 2025, the report says.

The report further says that in fiscal 2021 and 2022, Indian start-ups raised $38 billion through 1,625 investment transactions. India added 15 unicorns by the first week of May 2022, for a total of 100 unicorns in India. AIFs stand to gain from the rapidly growing proportion of the population joining the "rich" class, the report adds.

“Moreover, major aspects, such as the Russia-Ukraine War, rising worldwide inflationary pressures, rising interest rates (India's 10-year benchmark bond yield has risen to 7.42 per cent), and upcoming elections (at least two general elections by 2030) could derail our expected $400 billion in capital commitments by 2030,” the report says.

Incidentally, the Sebi (Alternative Investment Fund) Regulations, 2012, govern AIFs, which are described as privately-pooled investment vehicles that accumulate funds to invest as per a predetermined policy for the benefit of investors.

Different Categories of AIFs

AIFs can be divided into three categories as listed below.

Category I –These invest in start-ups, early-stage companies, social initiatives, small and medium enterprises (SMEs), infrastructure, other industries, or regions deemed socially or economically acceptable by the government or regulators. Venture capital funds, SME funds, social venture funds, infrastructure funds, and angel funds, come under Category I of AIF.

Category II – These AIFs do not use leverage or borrowing for anything other than day–to–day operating needs. These include private equity funds, debt funds, real estate funds, funds of funds, and distressed assets.

Category III – These are those that adopt various complicated trading tactics and may involve leverage, including investing in public or unregistered derivatives. Examples include hedge funds and private investment in public equity (PIPE) funds.

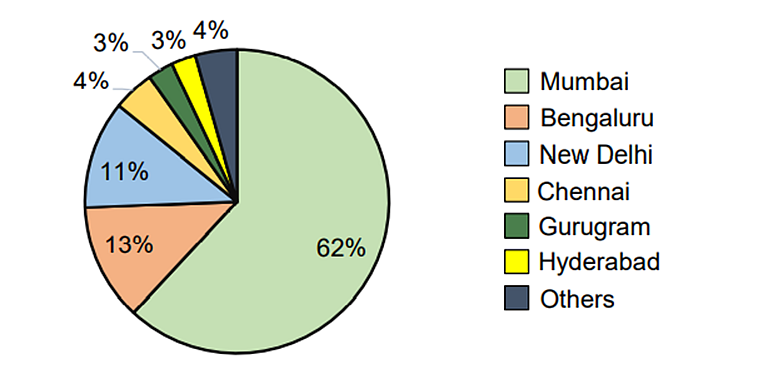

Geographic Distribution Of AIFs In India (percentage count)

• Mumbai and Bengaluru account for 75 per cent of all AIFs (Mumbai accounts for roughly two-thirds)

• Mumbai-based funds are more likely to be Category II and Category III AIFs, while Bengaluru and New Delhi are more likely to be Category I AIFs

Why AIFs Are Getting Popular

According to experts, “traditional investment pools are increasingly getting fragmented and facing challenges in product innovations, differentiation, and alpha generation owing to size and other factors.”, and this is where AIFs are offering novelty in terms of product differentiation.

“Investors are now exposed to conventional investment products (largely direct investments, mutual funds, unit-linked insurance plans (Ulips), and portfolio management services). However, these choices mostly serve to trade securities. As a consequence, investor demand for alternative investments remain unfulfilled.

As a result, because it is difficult to present novel ideas on traditional platforms, AIFs are becoming popular vehicles for launching themed and curated items,” the report says.

“As the number of wealthy people and affluence increases, investors have become increasingly demanding, and need innovative offerings, which have differentiated and a boutique style of managing risk and reward,” says Sunil Singhania founder, Abakkus Asset Manager LLP.

.png?w=200&auto=format%2Ccompress&fit=max)