Finance Minister Nirmala Sitharaman unveiled the union budget for the fiscal year 2022-23 on Tuesday. For any taxpayer, it becomes extremely important to know how taxes they pay are being managed and how each rupee is being spent. While increasing the capital expenditure this year, the budget also notified about how every rupee of the taxpayer’s money will be utilised this fiscal year.

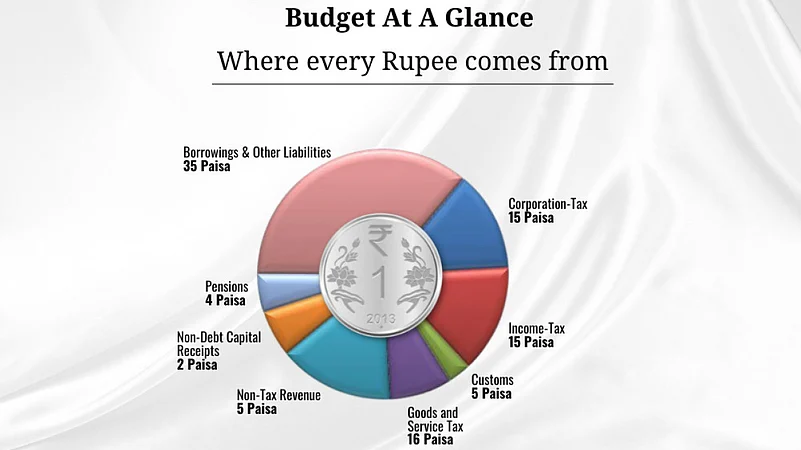

Where Every Rupee Comes From

According to the budget document, borrowings and other liabilities will contribute 35 paisa--the highest--for every rupee. Following this, Good and Service Tax (GST) will contribute 16 paise for every rupee. Corporate Tax and Income Tax will contribute 15 paisa each, whereas customs and non-tax revenue will contribute 5 paisa each for every rupee. Pensions and non-debt capital receipts will only contribute 5 paisa and 2 paisa respectively, for every rupee, according to the budget document.

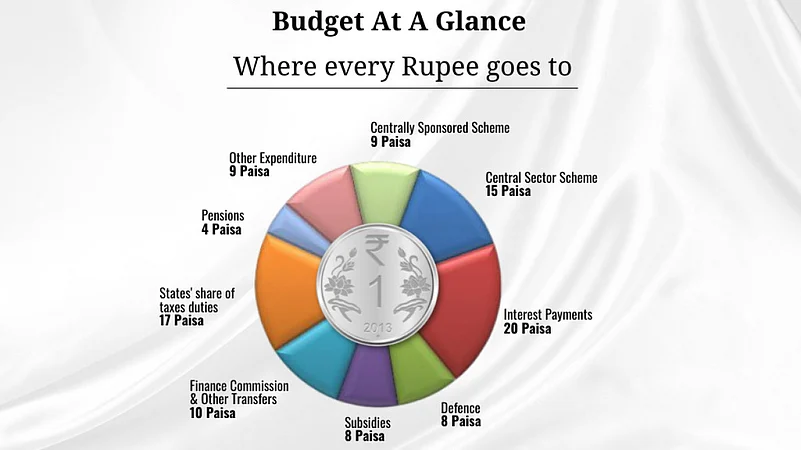

Where Every Rupee Goes To

According to the budget document, for every rupee, 20 paisa will be utilised for interest payments, which is the highestStates share of taxes duties will get 17 paisa, whereas Central Sector Scheme will get 15 paisa for every rupee. While 10 paisa is allocated for the finance commission and other transfers, centrally sponsored schemes and other expenditures will receive 9 paisa each for every rupee. Subsidies and the defence sector are allocated 8 paisa each, whereas pensions will receive only 4 paisa for every rupee, as per the budget document.

Notably, the government has not increased taxes for the fiscal year 2022-23 as well. But, needless to say, for the money that taxpayers contribute, it becomes important to understand how every rupee will benefit them in the future.