Rare Enterprises-backed Concord Biotech on Thursday said it has collected Rs 465 crore from anchor investors ahead of its Initial Public Offering (IPO).

The company has allocated 62.74 lakh equity shares to 41 funds at Rs 741 apiece, which is also the upper end of the price band, according to a circular uploaded on the BSE website.

At this price, the company has mobilised Rs 464.95 crore from anchor investors, it showed.

The government of Singapore, Abu Dhabi Investment Authority, Amundi Funds, Pinebridge Global Funds, Polar Capital Funds, Bajaj Allianz Life Insurance Company, Tata AIF Life Insurance Company, Max Life Insurance Co Ltd and Aditya Birla Sun Life Insurance Company are among the anchor investors.

In addition, fund houses, including Nippon India Mutual Fund (MF), UTI MF, Edelweiss MF, Bandhan MF, DSP MF, and Motilal Oswal Mutual, have been allocated shares in the anchor round.

The IPO of the Ahmedabad-based company is entirely an Offer For Sale (OFS) of 2.09 crore equity shares by Helix Investment Holdings Pte Limited, which is backed by private equity firm Quadria Capital. The offer includes a reservation for subscriptions by eligible employees.

The issue, with a price band at Rs 705-741 per share, will be open for public subscription during August 4-8.

The company through its IPO will fetch Rs 1,475.26 crore and Rs 1,550.59 crore at the lower and upper end of the price band, respectively.

Concord is among the leading manufacturers of fermentation-based biopharmaceutical APIs, focused on niche segments, such as immunosuppressant, oncology, anti-fungal and anti-bacterial. It has three manufacturing facilities, which are -- Valthera, Dholka, and Limbasi, in Gujarat.

At present, the company has 23 Active Pharmaceutical Ingredients (API) products.

The company is backed by Quadria Capital Fund and Rare Enterprises, which was set up by billionaire investor Rakesh Jhunjhunwala, who passed away last year, along with his wife Rekha.

Concord Biotech's revenue from operations rose by 20 per cent to Rs 853.17 crore in the financial year 2023 from Rs 713 crore in the previous year. Additionally, its profit after tax surged 37 per cent to Rs 240 crore in FY2023 as compared to Rs 175 crore a year ago.

Kotak Mahindra Capital Company, Citigroup Global Markets India, and Jefferies India are the book-running lead managers to the issue. The equity shares are proposed to be listed on BSE and NSE.

Concord Biotech Garners Rs 465 Cr From Anchor Investors

The government of Singapore, Abu Dhabi Investment Authority, Amundi Funds, Pinebridge Global Funds, Polar Capital Funds, Bajaj Allianz Life Insurance Company, Tata AIF Life Insurance Company, Max Life Insurance Co Ltd and Aditya Birla Sun Life Insurance Company are among the anchor investors

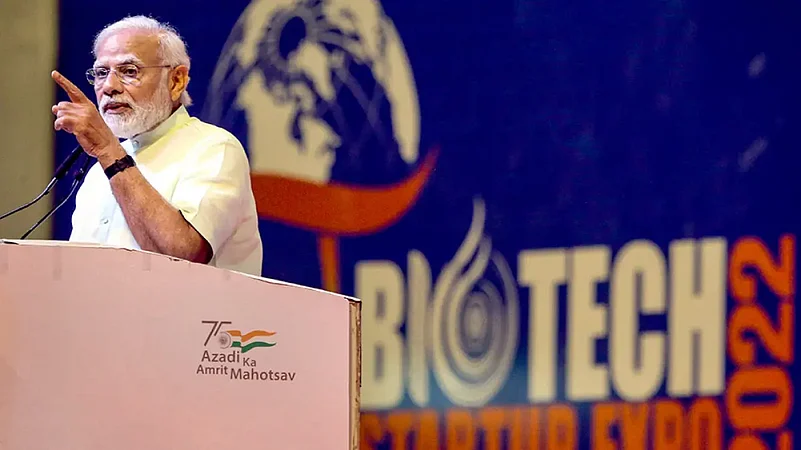

PM inaugurates Biotech Start-up Expo

PM inaugurates Biotech Start-up Expo

Published At:

MOST POPULAR

WATCH

MORE FROM THE AUTHOR

×