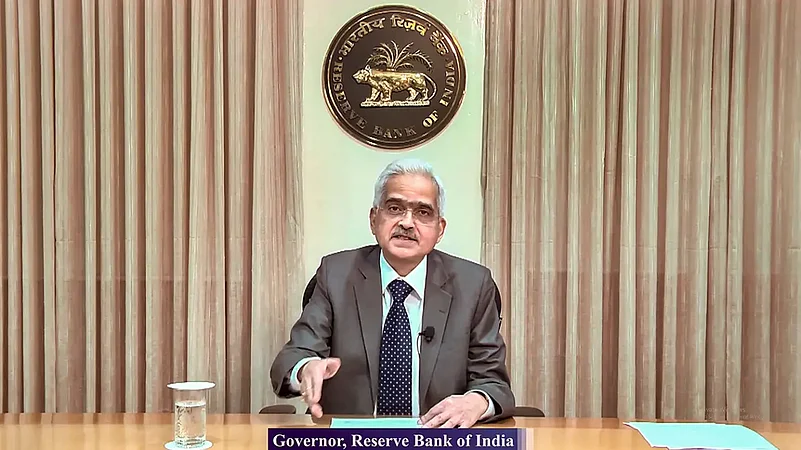

Reserve Bank of India (RBI) Governor Shaktikanta Das has said that de-centralised finance (DeFi), in which financial applications are processed on a Blockchain with limited or no involvement of centralised intermediaries, poses unique challenge to regulators.

“DeFi poses unique challenge to regulators, as its anonymity, lack of a centralised governance body, and legal uncertainties can make the traditional approach to regulation ineffective,” Das said in his speech at a BFSI Summit in Mumbai.

DeFi is a broad term that includes a lot of different functionalities and applications. Such applications involve no regulatory body or central bank or any one person for that matter, and are completely decentralised and void of any control by a single entity.

Previously, the central bank has repeatedly expressed its views against cryptocurrencies, saying that it poses serious threats to financial stability. Das has often reiterated his views against allowing cryptocurrencies, saying they are a serious threat to any financial system, since they are unregulated by central banks.

As with any new financial technology, DeFi, too, comes with its own set of risks.

Recently, a flash loan assault on Inverse Finance, a DeFi exchange, resulted in the theft of $1.26 million in Tether (USDT) and Wrapped Bitcoin (WBTC), by the perpetrators. Only two months prior, a price oracle manipulation hack on the DeFi platform was used by attackers to steal $15.6 million, according to various media reports.

A flash loan attack is one where an attacker obtains an uncollateralised flash loan from a DeFi platform, utilises the money borrowed, and pays it back in one transaction, driving up the price of the crypto asset, before immediately withdrawing his/her investment.

Inverse Finance makes it easier to borrow and lend cryptocurrencies, thus making it vulnerable to flash loan attacks.

Earlier, Chanalyis, a data provider platform, had in its Crypto Crime 2022 report noted that criminals often explored a few cryptocurrency services for their money laundering activities, and DeFi seemed to be the preferred service for most of such illicit and illegal activities. Previously, central exchanges used to receive the majority of funds sent by illicit addresses. But in 2021, DeFi became the preferred service, as it received 17 per cent of all funds sent from illicit wallets in 2021.

With an inflow of a total of $900 million in 2021, there has been a 1,964 per cent year-on-year increase in total value received by DeFi protocols from illicit addresses.

At present, the DeFi crypto market cap is at $39.94 billion, a 34.52 per cent decrease in the last 24 hours, according to Coinmarketcap.com.

.png?w=200&auto=format%2Ccompress&fit=max)