The Delhi High Court has granted conditional bail to former director of Dewan Housing Finance Limited (DHFL), Dheeraj Wadhawan, on September 9. Accused in the multi-crore bank loan fraud case, Wadhawan is given bail on medical grounds following a spinal surgery, according to the Economic Times report.

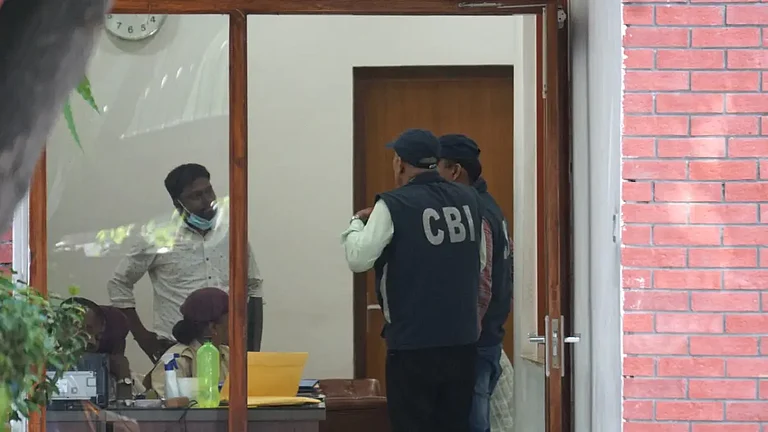

“Bail application is allowed as it falls within the category of sick person. The trial court order is set aside,” said Delhi HC while granting bail. The bench was headed by Justice Sudhir Kumar Jain. Senior advocates Amit Desai and Siddharth Agrawal represented Wadhawan, while Advocate Anupam S Sharma appeared for CBI.

Wadhawan first sought bail in Rouse Avenue trial court in May. However, considering the bail premature, the bench of special judge A K Sarpal at Rouse Avenue declined to grant him the bail. Moreover, Justice Sarpal ordered the CBI to arrest him after May 11.

Following the dismissal by the trial court twice, Wadhawan knocked on the doors of Delhi HC seeking bail.

What is the background of his arrest?

Dheeraj Wadhawan, along with his brother Kapil Wadhawan, was arrested by the CBI in the DHFL case. DHFL cases relate to the alleged frauding of a 17-member lender bank consortium. The CBI’s arrest stemmed from a complaint filed by the leader of the consortium, Union Bank of India. The fraud amounts to Rs 34,000 crore and, so far, is the largest banking loan fraud in India.

Moreover, in February this year, the Securities and Exchange Board of India (SEBI) ordered the attachment of bank accounts, shares, and mutual fund holdings that are owned by former DHFL promoters Dheeraj and Kapil Wadhawan to reclaim dues worth Rs 22 lakh, according to a report in the Mint.

The Wadhawan brothers violated the regulator’s disclosure standards and failed to pay the penalties, prompting SEBI to act.