The goods and services tax (GST) regime will complete five years in July. The euphoria that greeted the new tax system at its inception was based on the belief that it would give a boost to the country’s economy and lead to cooperative federalism. Much against the meat of that narrative, things have turned thorny at the near arrival of the first milestone of the new system, and Centre-state relations have turned sour.

The bone of contention between the two sides is the 14 per cent compensation on revenue for state governments that the Centre promised for the initial five years of the new tax regime. This period ends in June. While the Centre is happy that it will no longer have to arrange for any shortfall in taxes to provide a 14 per cent year-on-year growth in revenue to state governments, the latter are coming together to demand an extension because of their deteriorating finances.

What began with the collective demand of opposition states, like Rajasthan, Tamil Nadu, Chhattisgarh, Kerala, West Bengal, Delhi and Punjab, is now getting support from at least one BJP-ruled state in Madhya Pradesh.

While Chhattisgarh chief minister Bhupesh Baghel has categorically said that the Centre owes Rs 13,000 crore to the state’s exchequer against GST compensation and other Central taxes, Madhya Pradesh has demanded more money from the Centre citing its deteriorating fiscal condition.

Talking exclusively to Outlook, Manoj Govil, principal secretary, department of finance in Madhya Pradesh government, explained the challenges the state was facing in managing its finances. “Covid-19 has impacted the country's economy to a great extent. This is likely to reduce the revenue of state governments in the coming years. To avoid this situation, we have requested the Centre to extend the GST compensation by another five years,” said Govil.

How GST Backfired on States

The NDA government had guaranteed a 14 per cent year-on-year increase in GST revenue to all state governments in India from July 2017 to June 2022. The guarantee was given to convince the states that they will not lose revenue due to the implementation of the new tax regime. The lure of a handsome compensation also convinced many states that were apprehensive about surrendering their federal power of taxation to the Centre.

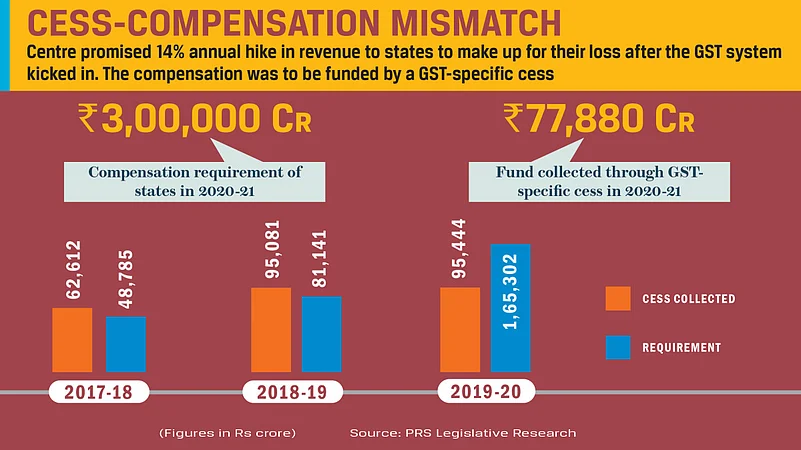

Any shortfall, the Centre proposed, in the 14 per cent yearly increase of revenue would be met through the collection of GST cess on sin goods in the country. Since the average growth in revenue for state governments was less than 10 per cent before they agreed to accept the new system, it looked like a great deal to them. However, after the first two years of implementing the GST, the Centre started struggling to keep its promise of compensating state governments at the guaranteed rate of 14 per cent of revenue growth.

Challenge for Centre

While state governments want the extension to the GST compensation period by another five years, the Centre fears that it will distort the entire structure of the GST and render it useless. In its original form, the GST was to be implemented in the form of one nation, one tax. But, to compensate states with a fixed amount of revenue growth, the Centre ended up creating four slabs of taxes, with the highest one pegged at 28 per cent, keeping the cost of certain goods extremely high. The Centre also believes that agreeing to the demand of the states this time can become a loop that will be difficult to come out of even in the future. But with important state elections lined up this year, can the Centre allow the narrative of states suffering due to the GST to flourish?

To understand this conundrum read: https://www.outlookbusiness.com/category/magazine/Februay-01-2022/Februay-01-2022-263