The month of July saw several fast-moving consumer goods (FMCG) and automobile firms publish their results for the first quarter of financial year 2024. As the Indian economy continues its recovery from the lows of pandemic, the results of several major companies operating in these two sectors have come as a sign of revival in demand.

Experts tracking the economy have pointed out for some time now that the uncertainty over demand has been holding back strong investment in the economy. Following the pandemic disruption, the demand in both rural and urban segments had been subdued which reflected in the weak volume growth for FMCG and automobile companies.

At the end of financial year 2021, the sales of two-wheeler, three-wheeler and commercial vehicles fell by over 30 per cent. Meanwhile, Nielsen IQ data showed that volumes fell for FMCG companies for four straight quarters from Q4 2021 to Q3 2022 due to the impact of pandemic. The largest decline was seen in the rural areas where the volume growth remained elusive for the majority of FY23 as well.

But in recent months, there are signs that the markets might be finally turning around a corner. Noting the improved demand outlook for Indian economy, Prabha Narasimhan, Managing Director and CEO of Colgate-Palmolive (India) Limited, had said following the announcement of Q1 results, “While the domestic sales grew at 12.3% compared to the same quarter of last year, toothpaste sales recorded a high double-digit growth. We are also seeing early signs of recovery in rural markets and remain optimistic about continued improvement.”

Uptick In Demand

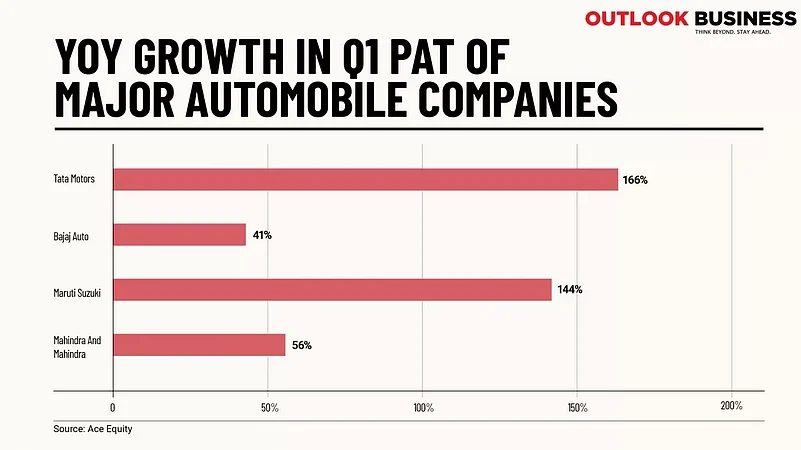

Major automobile players like Tata Motors, Bajaj Auto, Maruti Suzuki, and Mahindra and Mahindra posted strong numbers in the first quarter. While Tata Motors and Maruti Suzuki saw significant growth in PAT, the volume of automobile sales has also seen healthy growth in the last three months.

Data from Federation of Automobile Dealers Associations (FADA) showed that after starting on a tepid note in April, vehicles registrations in two-wheeler category have grown at a steady pace. The sales of two wheelers are closely tracked to gauge the recovery in rural markets. In July, the year-on-year growth of such vehicles stood at 8 per cent.

Commenting on the growth seen in two-wheeler segment, FADA President Manish Raj Singhania said, “Despite challenges like heavy monsoons and a tilt towards EVs due to high fuel prices, two wheelers showed resilience in July, with increased demand and trust in reputable brands.”

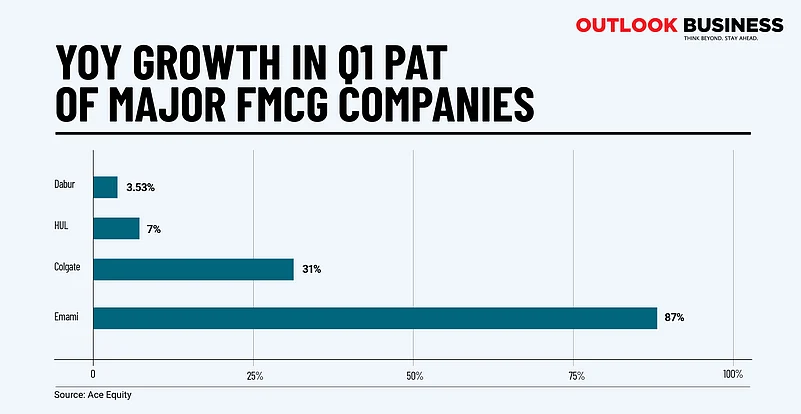

The story of revival in demand played out in the favour of FMCG firms as well. After concerns over volume growth for several quarters, the tide appears to be turning in favour of the brands. Firms like Emami, Dabur, Colgate, and HUL, who have significant exposure to the rural markets, posted profits in the first quarter. Notably, Dabur has seen yoy growth in profits after a few quarters of decline.

Hindustan Unilever CEO and Managing Director Rohit Jawa said after the announcement of results that the FMCG market is seeing gradual recovery in consumer demand. “FMCG markets are recovering gradually although the operating environment remains challenging. In the near term, the FMCG industry will continue to witness rebalancing of the price-volume growth equation and a gradual recovery in consumer demand.”

Pointing to the broader trend of recovery in demand, HDFC Securities noted in a report that the FMCG sector will see gradual recovery in demand due to moderating inflation, improving consumer confidence, and an increase in government spending. CPI inflation had crossed RBI’s 2-6 per cent tolerance band last year and reached 7 per cent in May 2022. High inflation was seen as one of the reasons for weak demand for FMCG firms. The CPI inflation cooled to 4.2 per cent in May 2023 but soaring food inflation led to a rise in the number to 4.8 per cent in June.

Several analysts continue to expect that the volume growth, which has been subdued for some time, will see an uptick in this fiscal.

Ajay Thakur, Research Analyst at Anand Rathi Brokerage, says that urban demand had been steady for the last few quarters, but the FMCG sector was facing weak demand in rural areas. “With recent softening of input prices and improving disposable income, rural demand is witnessing a gradual improvement. Thus, rural volume growth for FMCG industry has moved from a 3-5 decline around a year back to flat volumes in Q4 and a 2 per cent volume growth in Q1.”

While the volume growth remained subdued for FY23, the recovery in rural demand in the last quarter of last financial year sparked hope that the current fiscal might see greater volume expansion. Anuj Sethi, Senior Director at CRISIL Ratings, says, "Revenues for the overall FMCG sector is expected to grow 7-9 per cent in fiscal 2024 led by a 4-6 per cent volume expansion. This will be supported by gradual revival in volume growth in rural markets, after almost two years of subdued volume growth, and continued steady growth in urban markets."

HDFC Securities noted in a report, “We expect divergence between volume and value growth to normalise in FY24 with volume growth back to its historical average of mid-single digit. Moreover, the easing commodity inflation will help sustain gross margin expansion.”

The Monsoon Question

While optimism dominates the sentiment when it comes to the possibility of demand revival, concerns over how the monsoon will pan out in the coming weeks also find a mention.

When the southwest monsoon started this year, the onset of El Nino effect had sparked fears of deficit rainfalls. Data so far suggests that the monsoon has caught up well after starting with a delay in June. India Meteorological Department had predicted that the country will see a normal monsoon this year, despite the El Nino monsoon.

However, experts are now raising concerns about excess rains and the erratic pattern of rainfall which are affecting food inflation. In a recently released report on Indian monsoon, Crisil economists noted that several states have seen excess rains. These included Rajasthan, Gujarat, Himachal Pradesh and Punjab. Due to erratic pattern of monsoon, the sowing of pulses has suffered majorly with a 11.3 per cent lag in acreage till July 28 compared to the year ago period.

India’s inflation has already started to feel the pressure as the CPI inflation rose to 4.8 per cent in June from 4.2 per cent in May. As food prices remain inflated, the pressure on CPI inflation is expected to continue.

While predicting a good volume growth for FMCG firms this fiscal, Sethi had said, “Any adverse impact of El Niño conditions on rainfall pattern this monsoon season will have a bearing on rural demand.”

The FMCG and automobile sectors hope that the positive trajectory in consumer demand, particularly in rural areas, continues to stick as the firms look to improve their margins and expand volume.