The Parliamentary session of the Union Budget 2023-24 has started today with President Droupadi Murmu’s address. Soon after the start of the most awaited financial event of the country, the Finance Minister Nirmala Sitharaman tabled the Economic Survey 2023, highlighting important points like the GDP growth, the targets, inflation, employment rate and so on.

Just a few hours after the International Monetary Fund (IMF) projected India to be in a bright spot despite global headwinds, even the Indian Economic Survey has presented a similar outlook. As per the survey, India’s baseline gross domestic product (GDP) is expected to grow at 6.5 per cent in real terms in FY24.

The Economic Survey reads, “Economy has nearly ‘recouped’ what was lost, ‘renewed’ what had paused, and ‘reenergised’ what had slowed during the pandemic and since the conflict in Europe.”

Economic Survey 2023: Key Highlights

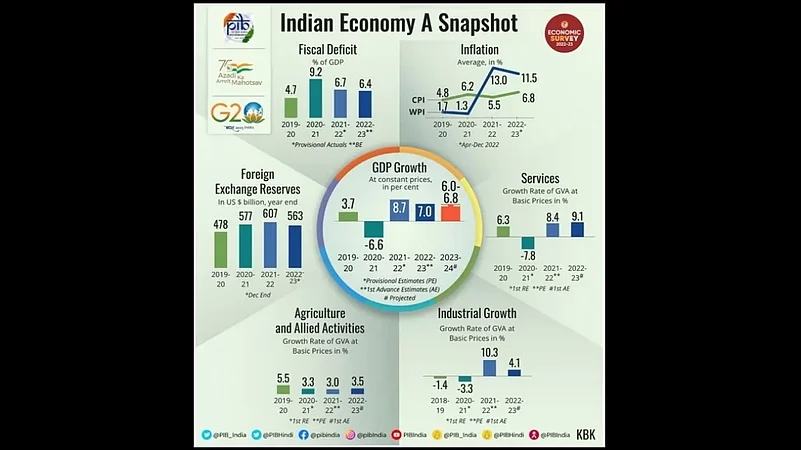

- India's economy is projected to grow at 6.5 per cent in 2023-24 as compared to 7 per cent this fiscal and 8.7 per cent in 2021-22.

- The Real GDP growth is expected to be in the range of 6-6.8 per cent in the next fiscal. However, this will depend depending on the several global economic and political developments.

- India has been called the third largest economy in PPP (purchasing power parity) terms, and the fifth largest economy in terms of exchange rate.

- The Reserve Bank of India (RBI's) projection of 6.8 per cent inflation for this fiscal, outside the upper target limit has been considered to not be high enough to deter private consumption. Interestingly, it has also not been considered too low to weaken the inducement to invest more.

- With regards to the impact of inflation, the borrowing cost may remain 'higher for longer' as entrenched inflation may simply prolong the tightening cycle in this economic outlook.

- Since the rupee depreciation, especially with regards to the US Dollar has been a concern, the Economic Survey reads, "Challenge to rupee depreciation persists with the likelihood of further interest rate hikes by the US Fed."

- The Current Account Deficit (CAD) may continue to widen as global, the commodity prices remain elevated on the backdrop of the Russia-Ukraine war. However, if this CAD widens further, the depreciation pressure on the Indian rupee may also increase.

- As far as the Forex Reserves are concerned, the Survey has added that India has sufficient forex reserves to finance its CAD and intervene in forex market, especially when it comes to managing rupee.

- Since India's exports remain strategically important at a time when global supply chain issues persist, as per the Economic Survey, the growth in exports has moderated in second half of the current fiscal. The surge in growth rate in 2021-22 and in the first half of the current fiscal has also led to the production processes shifting gears from 'mild acceleration' to 'cruise mode.'

- The Bank credit growth is likely to be brisk in FY24 on the backdrop of benign inflation and moderate credit cost.