The GST council meeting that will commence today is expected to discuss issues such as taxation of insurance premiums, the Group of Minister (GoM)'s suggestions on rate rationalisation and a status report on online gaming. This is as per the Economic Times.

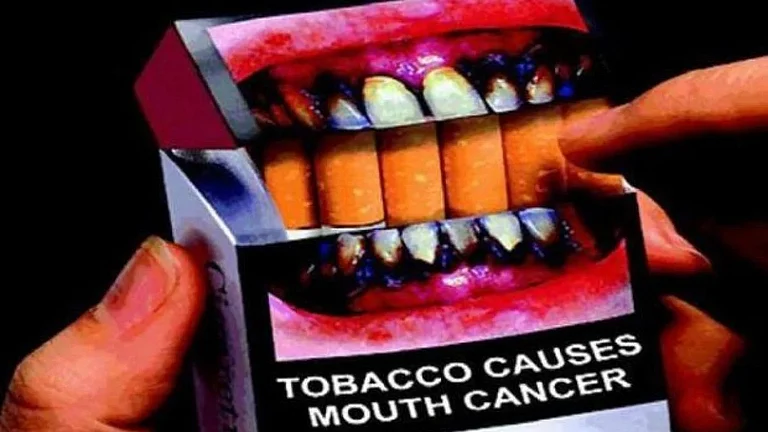

The fitment committee, consisting of Centre and state tax officials will reportedly present a report on goods and services tax (GST) applied on health and reinsurance premiums and the revenue implications.

The Parliament discussed the issue of taxation on insurance premiums with opposition parties demanding that health and life insurance be exempt from GST. Even Nitin Gadkari, the transport minister reportedly wrote to Niramala Sitharaman on the issue.

It is reported that the Finance Minister, who heads the GST council, which consists of state ministers, will deliberate on reducing the tax burden on health insurance from the current 18 per cent or exempting certain categories of individuals like senior citizens.

The council will also look forward to discussing the GST cut on life insurance premiums.

For 2023-24, the Centre and the states had collected Rs 8,262.94 crore through GST on health insurance premiums. Similarly, Rs 1,484.36 crore was collected on the account of GST on health reinsurance premiums.

On the issue of online gaming, the Centre and the state tax officers will present a "status report" before the GST council and the report will include GST revenue collection from the online gaming sector before and after October 1, 2023.

The GST council in its meeting in August 2023 had reportedly clarified that online gaming platforms were required to pay 28 per cent tax followed by which, the central GST law was amended to make the provision clear.

Entry-level bets on online gaming platforms and casinos were subject to 28 per cent GST from October 1, 2023. Before that, many online gaming platforms were not willing to pay 28 per cent stating that there were differential tax rates for games of skill and games of chance.

Offshore gaming platforms were also mandated to register with GST authorities and pay taxes, failing which the government would block those sites as per ET.

The council had then decided that the taxation on the online gaming sector would be reviewed after six months of its implementation.

Nirmala Sitharaman reportedly said in reply to the discussion on the finance bill that 75 per cent of the GST collected goes to the states and asked opposition members to bring the proposal to the GST council.

Chandrima Bhattacharya, West Bengal's finance minister, had also raised the issue in the meeting of the Group of Ministers (GoM) on rate rationalisation last month and the matter was taken to the fitment committee for further data analysis.

GoM had also expressed their opinion against the tinkering of the four-tier GST slabs of 5, 12 18 and 28 per cent for the time being. However, the panel had reportedly asked the fitment committee to see if there is any purview for rationalisation of rates of goods and services.