Many taxpayers would have received an email from the income tax department about a series of discussions on how the provisions announced in Budget 2022 will affect taxpayers.

The sessions are online and will be held today, February 11, by Pragya Sahay Saksena, member-legislation and systems, Central Bureau Of Direct Taxes. You can catch the sessions on the official social media handles of the tax department.

To understand your tax choices in FY2022-23, it is important to start from the basics, which includes making a choice between the old and the new tax regime.

To know more about how your income and investments will be taxed in FY2022-23, read Outlook Money’s Income Tax Guide For FY23 here.

In this article, we take a close look at:

1. What do the old and the new tax regimes mean?

2. What are their advantages and disadvantages?

3. Which is the regime that works best for you?

What Do The Old And The New Tax Regimes Mean?

Despite high expectations, Budget 2022 did not change the income tax slabs or the two tax regimes for individual taxpayers. Therefore, when you plan your investments for FY23, you still need to choose which tax regime works the best for you.

This choice is especially relevant for those taxpayers who don’t have major investments—for example, you may be a senior citizen who no longer has a need to invest in products that offer tax benefits, such as Public Provident Fund (PPF) or Employees’ Provident Fund (EPF) for retirement planning; or you may have just joined the workforce and don’t have expenses such as home loan or tuition fees, in which case a higher-in hand income is better.

Since FY2020-21, taxpayers have had the choice to pay income tax either under the new tax regime or stick to the old tax regime.

Tax slabs: If income is up to Rs5 lakh per annum, tax rates in both regimes are the same (Nil till Rs2.5 lakh and 5 per cent from Rs2.5 lakh to Rs5 lakh). The difference starts at incomes above Rs5 lakh till Rs 15 lakh. If your income is between Rs 5 lakh and Rs 7.5 lakh per annum, the income tax rate is lower at 10 per cent in the new tax regime versus 20 per cent under the old tax regime. Similarly, those earning between Rs 7.5 lakh and Rs 10 lakh would pay lower tax at the rate of 15 per cent under the new tax regime compared with 20 per cent under the old regime. If your income is Rs10 lakh-12.50 lakh, then too the new tax regime is better as the tax rate then is 20 per cent—a full 10 per cent lower than the 30 per cent in the older regime. In the slab of Rs12.5 lakh to Rs 15 lakh annual income, the difference in the tax rates of the two regimes is lower at 5 per cent—30 per cent in the older regime versus 25 per cent in the new regime. For income above Rs15 lakh, tax rate is the same in both regimes.

What Are Their Advantages And Disadvantages?

Tax Deductions Allowed: While the new tax regime has lower tax rates, you cannot claim tax deductions on investments and expenses such as premium paid for life insurance and health insurance, investments in equity-linked investment schemes (ELSS), PPF, etc., home loan repayment, and many more. In all, there are about 70 exemptions and deductions. So, if you have, say, a home loan, a life insurance policy, a health insurance plan, EPF and PPF investments, then you may be better off choosing the old tax regime because that will allow you to save on taxes on these.

To compare how much tax you pay under the two regimes, go here.

Advantages Of New Tax Regime: Lower taxes (for incomes Rs5 lakh to Rs15 lakh; for those under 60 years), more in-hand income, less paperwork involved (as you don’t have to submit proof of investment).

Disadvantages Of New Tax Regime: No tax benefit for expenses such as life cover, health cover, home loan etc. or investments such as EPF, PPF, ELSS, etc.

Advantages Of Old Tax Regime: Tax benefit can be availed for expenses such as life cover, health cover, home loan etc. or investments such as EPF, PPF, ELSS, donations etc.

Disadvantages Of Old Tax Regime: Higher taxes (for incomes Rs5 lakh to Rs15 lakh), less in-hand income, more paperwork involved as one may have to give proof of investment to the employer.

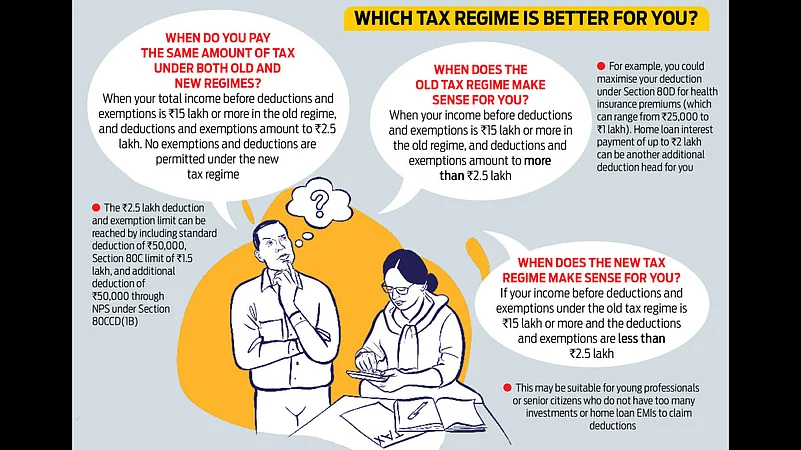

Which Is The Regime That Works Best For You?

Broadly speaking, this depends on your income tax slab and the investments you have made. If the investments are heavy and offer tax benefits, then the old tax regime is more suitable. If you are in a lower tax slab, or have fewer investments with tax benefits, then the new regime may be more suited for your needs. Look at all the details carefully before making a choice.

.png?w=200&auto=format%2Ccompress&fit=max)