India has received the fourth set of Swiss bank account details of its nationals and organisations as part of an annual automatic information exchange under which Switzerland has shared particulars of nearly 34 lakh financial accounts with 101 countries.

Officials said the new details shared with India pertain to "hundreds of financial accounts", including many cases of multiple accounts associated with some individuals, corporates and trusts.

They did not divulge specifics, citing the confidentiality clause of the information exchange and the adverse impact it may have on further investigations, but asserted that the data would be used extensively in probes of suspected tax evasion and other wrong doings including of money laundering and terror funding.

In a statement, the Federal Tax Administration (FTA) on Monday said that the exchange of information this year saw five new additions to the list -- Albania, Brunei Darussalam, Nigeria, Peru and Turkey. The count of financial accounts increased by nearly one lakh.

While the exchange was reciprocal with 74 countries, Switzerland received information but did not provide any in the case of 27 countries, including Russia, either because those countries do not yet meet the international requirements on confidentiality and data security or because they chose not to receive data.

While the FTA did not disclose names and further details of all 101 countries, officials said India figured prominently among those having received the information for the fourth year in a row and the details shared with Indian authorities pertained to a large number of individuals and organisations having accounts in Swiss financial institutions.

The exchange took place last month and the next set of information would be shared by Switzerland in September 2023, the officials added.

India had received the first set of details from Switzerland under AEOI (Automatic Exchange of Information) in September 2019. It was among the 75 countries to get such information that year. Last year, India was among 86 such partner countries.

According to experts, the AEOI data received by India has been quite useful for establishing a strong prosecution case against those who have any unaccounted wealth, as it provides entire details of deposits and transfers as well as of all earnings, including through investments in securities and other assets.

On the condition of anonymity, the officials said the details relate mostly to businessmen, including non-resident Indians now settled in several South-East Asian countries as well as in the US, the UK and even some African and South American countries.

Switzerland had agreed to the AEOI with India after a long process, including a review of the necessary legal framework in India on data protection and confidentiality.

The exchanged details include identification, account and financial information, including name, address, country of residence and tax identification number as well information concerning the reporting financial institution, account balance and capital income.

Besides, Swiss authorities have already shared information on more than 100 Indian citizens and entities so far this year on receipt of requests for administrative assistance in cases involving probes into financial wrong doings including tax evasion, the officials added. This count has been almost same in the past few years.

These cases mostly relate to older accounts that might have been closed before 2018, for which Switzerland has shared details with India under an earlier framework of mutual administrative assistance as Indian authorities had provided prima facie evidence of tax-related wrongdoing by those account holders. The AEOI is applicable only to accounts that are active or were closed during 2018.

Some of these cases relate to entities set up by Indians in various overseas jurisdictions like Panama, the British Virgin Islands and the Cayman Islands while the individuals, include mostly businessmen and a few politicians and erstwhile royals as well as their family members.

The officials, however, refused to share details about the exact number of accounts or the quantum of assets held in the accounts held by Indians, for which the information has been shared with India, citing strict confidentiality clauses governing the exchange framework.

The exchanged information allows tax authorities to verify whether taxpayers have correctly declared their financial accounts in their tax returns.

Switzerland also agreed last year to share details about real estate assets owned by foreigners there, but the information about contributions to non-profit organisations and other such foundations, as also details on investments in digital currencies still remain out of bounds from the AEOI framework.

This is being seen as a key milestone in the Indian government's fight against black money allegedly stashed abroad, as authorities will be able to get the complete information on flats, apartments and condominiums owned by Indians in Switzerland as also on earnings made from such properties to help it look into tax liabilities associated with those assets.

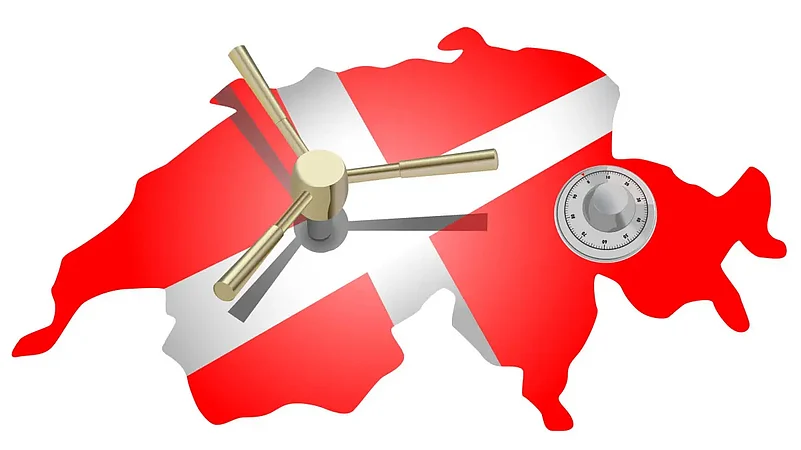

The move assumes significance on the part of Switzerland which is trying hard to reposition itself as a key global financial centre while warding off the long-persisting perception about the Swiss banking system being an alleged safe haven for black money.

Experts and those engaged in the business of attracting investments to Switzerland believe the move would also help clear misconceptions about all fund inflows into Swiss assets being illicit and would go a long way in establishing Switzerland as a preferred investment destination, including for real estate properties.

The FTA said around 9,000 reporting financial institutions (banks, trusts, insurers, etc) collected the data and transferred it to the government.

The FTA sent information on around 34 lakh financial accounts to the partner states and received information on around 29 lakh financial accounts from them.

"The FTA cannot provide any information on the amount of financial assets," it added.

Switzerland's first such exchange took place at the end of September 2018 and involved 36 countries but India did not figure in the list at that time.

The Global Forum of the Organisation for Economic Cooperation and Development (OECD) reviews the AEOI implementation.

India Gets 4th Set Of Swiss Bank Account Details Under Automatic Info Exchange Framework

India Gets 4th Set Of Swiss Bank Account Details Under Automatic Info Exchange Framework

Published At:

- Previous Story

Uber, Ola, Rapido Drivers to Go on Nationwide Strike on Feb 7: What Are Their Key Demands

Uber, Ola, Rapido Drivers to Go on Nationwide Strike on Feb 7: What Are Their Key Demands - Next Story

MOST POPULAR

WATCH

MORE FROM THE AUTHOR

×

.jpg?w=200&auto=format%2Ccompress&fit=max)