The average price of luxury homes sold in the top seven cities of India reached Rs 23 crore during the first half of FY25, reflecting 23 per cent jump from Rs 1 crore in the corresponding period of FY24, according to latest data shared by real estate consultancy firm Anarock.

These top seven cities include Delhi NCR, Bengaluru, Hyderabad, Chennai, Pune, Kolkata, and Mumbai. The report stated that more than 2,27,400 units worth Rs 2,79,309 crore were sold across these cities between April and September 2024.

In contrast, around 2,35,300 units worth Rs 2,35,800 crore were sold during the same period last fiscal year. This shows a 3 per cent drop in overall unit sales. However, the total sales value outstripped that of a year ago by 18% - clearly underscoring the unrelenting demand for luxury homes.

“Amid escalating demand for luxury homes after the pandemic, there have been record new launches and sales of costlier homes across the top seven cities,” the report read.

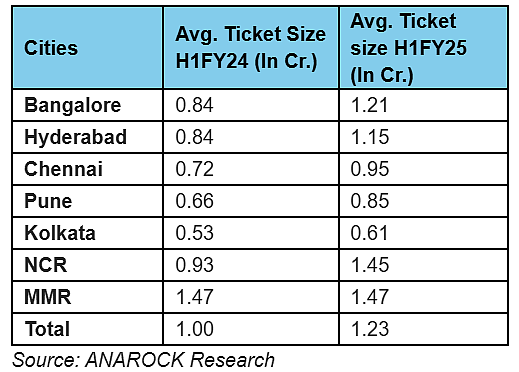

City-wise Luxury Home Sale in H1 FY25

Among these seven cities, Delhi NCR region saw the highest average ticket size growth --- from Rs 93 lakh in H1 FY24 to over Rs 1.45 crore in H1 FY25. In terms of units, India’s capital city witnessed a decline in number of luxury homes sold in the first half of this fiscal year.

“Approximately 32,315 units worth Rs 30,154 crore were sold in the region in H1 FY2024; in H1 FY2025, around 32,120 units worth Rs 46,611 crore were sold. While the value of sold inventory increased by 55 revealed in this period, the total number of units sold declined by 1 per cent,” the data revealed.

On the other hand, Mumbai saw no change in average ticket size during this period, standing at Rs 1.47 crore in both H1 FY24 and H1 FY25.

Despite this stability in pricing, the Maharashtra’s capital city witnessed a marginal increase in sales volume, that is, 76,410 units worth Rs 1,12,356 crore sold in H1 FY2024, compared to about 77,735 units worth Rs 1,14,529 crore sold in H1 FY2025.

The data showed that Bengaluru experienced the second highest jump at 44 per cent in average ticket size among the top seven cities. It rose from Rs 84 lakhs in H1 FY24 to Rs 1.21 crore in H1 FY25.

As many as 31,440 units worth Rs 26,274 crore were sold in Bengaluru during the same period last year, and H1 FY25 saw nearly the same number of units but the total value was higher at Rs 37,863 crore, the report said.

In Hyderabad, the first half of FY25 saw the average ticket size of sold units at Rs 84 lakhs, an increase by 37 per cent to Rs 1.15 crore in H1 FY 2025 The report stated that Chennai witnessed a jump of 31 per cent in average ticket size, followed by 29 per cent in Pune and 16 per cent in Kolkata.