“Knock, knock!”

“Who are you?”

“Inflation”

“Inf… do I know you?”

“We’ve never met, but your parents and I grew up together. Are they home?”

“They’re not. How come they never mentioned you?”

“We kind of fell apart.”

“How can I help you?”

“I’ve been on a whirlwind tour across continents. I thought I could meet old friends and get some rest.”

“I don’t know man…you look weird.”

“What if I told you I’m partly responsible for the fall in cryptos you hold in that digital wallet? And how things could turn around for the better?”

“Hmm, be quick dude… and don’t mention anything about crypto to dad.”

“Thanks!”

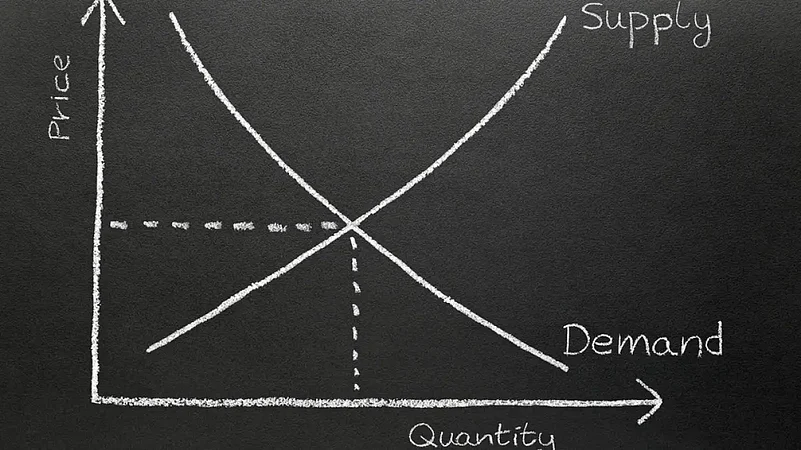

“First, how did I enter your life? Well, if you and your friends were given a lot of money to spend, you would naturally increase your spending on eating, music, gaming, travel, sneakers, etc. And if everyone in the world starts to increase their spending, the folks who produce this cool stuff will charge more and more, thereby increasing prices.”

“You’re making this stuff, aren’t ya?”

“No, this is what’s happening in the US and Europe. To cope with the hardships of Covid, their governments transferred “benefits” or extra money into people’s bank accounts. Once the lockdowns were lifted, people started to shop more and more, thereby pushing up prices. This is called ‘demand-led’ inflation.”

“There’s more. Something called ‘supply-led’ inflation."

“The iPhone you bought is manufactured in many countries and then shipped to buyers. If any part of this chain is broken, it leads to shortages of the final product. And shortages lead to…”

“Increase in prices?”

“You got it. Covid disrupted the ‘supply chains’ of everything, from automobiles to computers.

“That explains the 8-month long wait period for mom’s new car!”

“Exactly!”

“That’s not all. The world needs the energy to run in the form of petrol, coal, or cooking gas. When energy prices go up, everything goes up! After Covid and the Ukraine war, we had a bad situation of more demand and less supply. This badly affects countries that need to import their energy supplies, like India who have to pay more for crude oil now.”

“You’re losing me dude… what about crypto?”

“Getting there. When prices increase too much, poor people have to stretch to make a living. Many dip into their savings. This results in less money being spent on iPhones, gadgets, eating out, travel, etc. Now, companies that create these products and services see businesses declining, and they respond by cutting down salaries, and jobs, and by slowing any investments in new plants, etc. People who work at these companies further reduce their consumption. At the same time, governments swing into action. To help out, they can cut taxes on poor people and increase taxes on rich people. Now, the rich reduce their spending, further reducing business for companies, and thus reducing the incomes of people who work there!

Governments have also begun to increase interest rates. People who have taken loans for houses, gadgets, or education, now need to pay more every month. This is done to ‘cool’ demand. As prices increase, some countries stop exports of food and other items, and provide more for their citizens, which results in even higher prices in other countries.

When the environment becomes negative, people take fewer risks. They begin to sell any assets, such as houses, stocks, or cryptos. It is considered risky. Prices go down further, forcing more people to sell the same things. We have a stampede or a bear market. It’s a spiral! ”

“That’s nasty! How does this get solved? Sort out supply problems…increase energy production?”

“Global coordination is an important step. You now have the tech to remotely study, connect and work – use that a lot more. Recognize! I could be here to stay longer than you think. Don’t buy that crypto or that stock because it always used to go up after a dip. Remember, after every upheaval, some things are altered forever. There are no easy solutions, other than the world slowing down a bit before it starts to race again. You are young, you’ll figure it out!

I am just an unwelcome guest who’s decided to stay a bit longer! "

PS: triggered by a question from my kids.

The author is head – investment management at Edelweiss Wealth Management.

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)