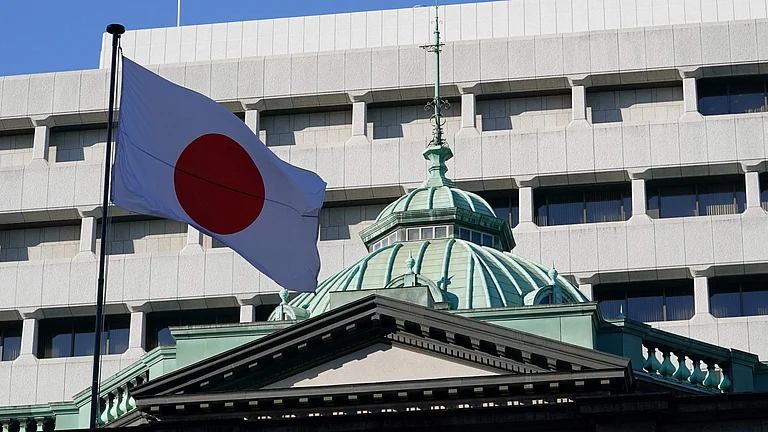

The Bank of Japan (BOJ) announced on Tuesday its discontinuation of the negative interest rate policy, marking a departure from its extensive stimulus measures. This move represents Japan's first interest rate hike in 17 years, dating back to 2007.

The BOJ raised its main interest rate from -0.1 per cent to a range between 0 per cent and 0.1 per cent. This move coincides with an increase in wages. Back in 2016, the bank had reduced the rate below zero in an effort to bolster the country's sluggish economy.

With inflation surpassing the BOJ's 2 per cent goal, there was widespread anticipation among market participants for the central bank to transition away from its ultra-loose monetary stance in either March or April, as per a report by Reuters.

Japan now stands as the last major economy to step away from negative interest rates, signaling the end of an era where policymakers relied on cheap borrowing and unconventional monetary methods to sustain growth.

Japan's economy grew by 0.4 per cent between October and December compared to the previous quarter, which was better than the initial prediction of a 0.4 per cent decline. The fourth-largest economy after Germany, quite evidently, managed to avoid a technical recession.

Capital expenditure rose by 2 per cent compared to the previous quarter, which was an improvement over the government's initial announcement of a 0.1 per cent decrease. However, it fell short of the median market prediction of a 2.5 per cent increase.

Meanwhile, external demand continued to contribute 0.2 percentage points to the real GDP.