Equity benchmark indices Sensex and Nifty closed with modest losses for the second straight session on Friday, following selling in IT stocks amid a lack of fresh buying triggers.

However, buying interest in banking counters helped the bourses limit the losses, the traders said.

In a highly volatile trade, the 30-share BSE Sensex declined 47.77 points or 0.07 per cent to settle at 65,970.04. During the day, it gyrated 207.59 points, hitting a high of 66,101.64 and a low of 65,894.05.

The Nifty slipped 7.30 points or 0.04 per cent to 19,794.70.

On the weekly front, the BSE benchmark climbed 175.31 points or 0.26 per cent, and the Nifty advanced 62.9 points or 0.31 per cent.

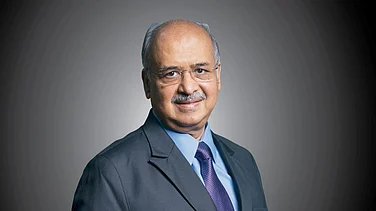

"Global shares drifted on Friday in the absence of guidance from Wall Street, which was closed for the Thanksgiving holiday on Thursday. Investors were sceptical of whether the US Federal Reserve is done with interest rate hikes that kept risk appetite in check," said Deepak Jasani, Head of Retail Research, HDFC Securities.

Among the Sensex firms, HCL Tech, Wipro, Tata Consultancy Services, Tech Mahindra, Nestle, Tata Motors, Infosys, Bharti Airtel, UltraTech Cement and Tata Steel were among the laggards.

On the other hand, Axis Bank, HDFC Bank, ICICI Bank, JSW Steel, Mahindra & Mahindra and Kotak Mahindra Bank were the major gainers.

In the broader market, the BSE smallcap gauge gained 0.14 per cent, and the midcap index advanced 0.13 per cent.

Among the indices, teck fell 0.89 per cent, IT declined 0.88 per cent, FMCG (0.49 per cent), consumer durables (0.36 per cent) and telecommunication (0.25 per cent).

Commodities, financial services, healthcare, industrials, bankex and capital goods were among the gainers.

"The benchmark index traded on a tepid note following the weak German growth data, and trading volume was limited due to the US market holiday on Black Friday and the India market holiday on Monday next week.

"However, the banking index has shown resilience despite the RBI's scrutiny towards unsecured lending by the NBFCs, while the US manufacturing PMI data for November is expected to be below forecast, summarizing caution in the short-term," Vinod Nair, Head of Research at Geojit Financial Services, said.

In Asian markets, Tokyo settled in the green while Seoul, Shanghai and Hong Kong ended lower.

European markets were trading mostly in positive territory. The US markets were closed for the Thanksgiving holiday on Thursday.

Global oil benchmark Brent crude climbed 0.18 per cent to USD 81.57 a barrel.

Foreign Institutional Investors (FIIs) bought equities worth Rs 255.53 crore on Thursday, according to exchange data.

The BSE benchmark dipped 5.43 points or 0.01 per cent to settle at 66,017.81 on Thursday. The Nifty slipped 9.85 points or 0.05 per cent to 19,802.

.jpg?w=200&auto=format%2Ccompress&fit=max)