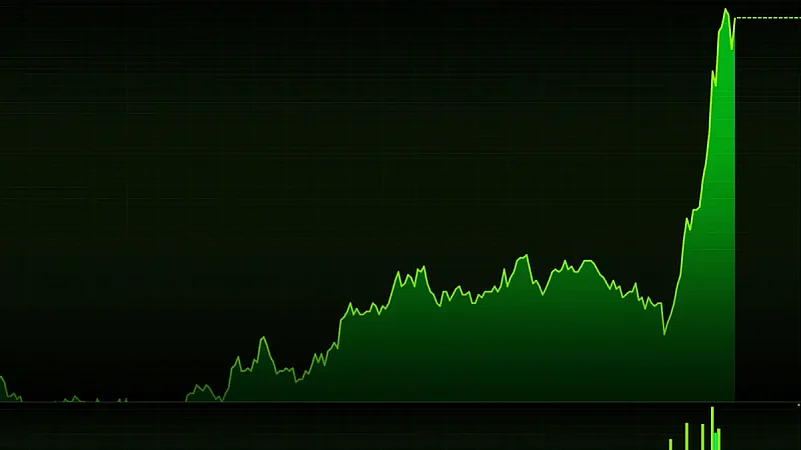

The market capitalisation of BSE-listed firms reached a record high of Rs 297.94 lakh crore in early trade on Monday as the benchmark, Sensex hit the 65,000 mark for the first time ever amid bullish investor sentiments.

The BSE benchmark jumped 514.08 points to hit its record high of 65,232.64 in early trade. The benchmark has been rallying for the fourth straight trading session on Monday.

Thanks to the ongoing rally in equities, the market capitalisation (mcap) of BSE-listed companies jumped to Rs 2,97,94,780.47 crore in early trade.

On Friday, the market capitalisation of BSE-listed firms touched an all-time high of Rs 296.48 lakh crore.

From the Sensex pack, HDFC, HDFC Bank, UltraTech Cement, Tata Steel, Bajaj Finance, ICICI Bank, Mahindra & Mahindra, State Bank of India, Reliance Industries and Bajaj Finserv were the major gainers.

Power Grid, Maruti, Larsen & Toubro, Tech Mahindra, Axis Bank, Hindustan Unilever and Asian Paints were among the laggards.

In Asian markets, Seoul, Tokyo, Shanghai and Hong Kong were trading in the green.

The US markets ended significantly higher on Friday.

Global oil benchmark Brent crude climbed 0.08 per cent to USD 75.47 a barrel.

Foreign Portfolio Investors (FPIs) bought equities worth Rs 6,397.13 crore on Friday, according to exchange data.

FPIs have pumped Rs 47,148 crore into Indian equities in June, making it the highest inflow in 10 months.

GST collections crossed Rs 1.60 lakh crore mark for the fourth time since the roll-out of the indirect tax regime, rising 12 per cent to over Rs 1.61 lakh crore in June, the Finance Ministry said on Saturday.

The BSE benchmark had jumped 803.14 points or 1.26 per cent to settle at its lifetime closing high of 64,718.56 on Friday. The Nifty climbed 216.95 points or 1.14 per cent to end at a record high of 19,189.05.

"After key benchmark indices scaled fresh peaks last week, investors are hoping that FIIs would continue to increase exposure to Indian markets, given the strong growth trajectory. India's record GST collections for the month of June further signifies the improving economic growth momentum," Prashanth Tapse, Senior VP (Research) at Mehta Equities Ltd, said.