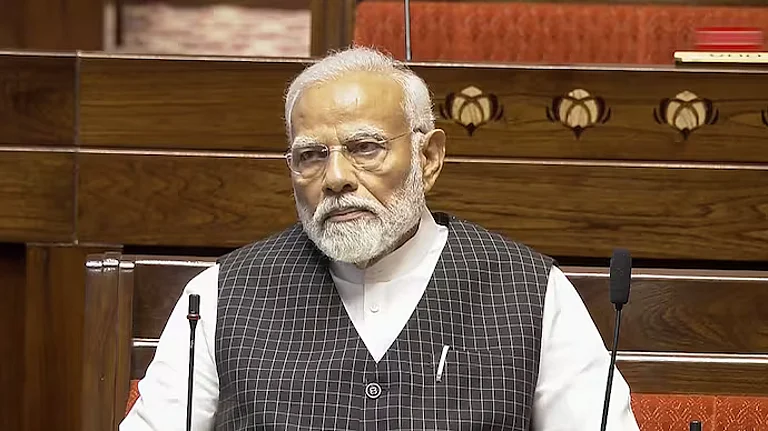

Prime Minister Narendra Modi on August 30 said the government is taking various measures at the policy level to promote the fintech sector, which attracted over $31 billion in investments in the last 10 years, and the abolition of the Angel Tax is also a step towards the growth of the segment.

Addressing the Global Fintech Fest 2024 here, the Prime Minister also asked the regulators to take more measures to stop cyber frauds and further increase digital literacy among people.

"Fintech has played a significant role in democratising financial services," he said, and expressed confidence that it will help in improving the quality of life for Indians. Modi emphasised that adoption of fintech by Indians is "unmatched in speed and scale," and no such example can be found anywhere else in the world.

He said the transformation brought about by the fintech sector in India is not just limited to technology, but its social impact is far-reaching. He also stressed that fintech has dented the parallel economy and is bridging the gap between villages and cities on the financial services front.

The Prime Minister also said that in the last 10 years, the fintech space has attracted investments of more than $31 billion, and fintech start-ups have grown by 500 per cent. He said it is a festive season in India; there is also festivity in the economy and markets, in apparent reference to the robust GDP growth and capital market scaling new highs.

Modi also informed the gathering that loans worth over Rs 27 lakh crore have been disbursed under the Pradhan Mantri MUDRA Yojana, world's largest microfinance scheme.

Additionally, the Prime Minister mentioned that products like Open Network for Digital Commerce (ONDC) and UPI are making the lives of people easier. Modi said at the summit, “Local hain per global hain [it is local, but it is global]."

The government-backed ONDC is seeing a spike in users. In May this year, a survey by the Bank of America (BofA) mentioned that 60 per cent of e-commerce users have tried ONDC to order food from platforms such as Ola and Magicpin. ONDC is also diversifying to offer sachetised insurance, micro-investment services, and loans within six minutes.

(With inputs from PTI)