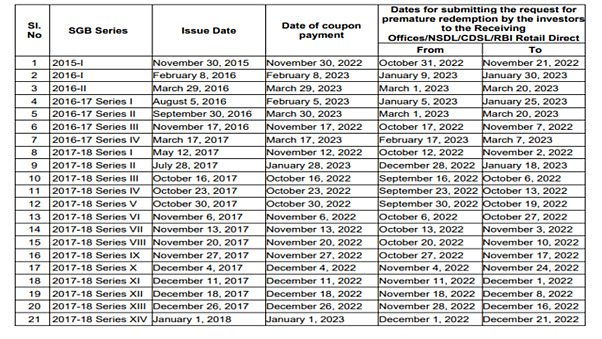

The Reserve Bank of India (RBI) has released dates for the premature withdrawal of Sovereign Gold Bonds (SGB) issued under different tranches. SGBs are available for premature redemption through RBI’s buyback window from the 5th year onwards of the respective bonds.

The dates for premature redemption of every SGB that falls on October 1, 2022, till March 31, 2023, were published by the RBI in a release dated October 14.

Source: RBI

Do You Wish To Prematurely Withdraw Your SGBs? Know Your Options

An SGB is a type of gold bond issued by the central government and hence has a sovereign guarantee behind it. Each SGB is issued for an eight-year term, and interest upon it is paid semi-annually. Currently, the interest rate stands at 2.5 per cent. If you have bought an SGB, and wish to sell it before the full term or eight years, then you have two options.

Option A: Secondary Market Transfer

You can sell the SGBs at the stock market if you have them in demat format; otherwise, you will have to convert the SGBs into demat format first and then try to sell the SGBs in the open market. However, note if you choose this option, then the incidence of taxation arises, and the price for SGBs will not be the same as the price you bought it for.

“The bonds can be held in demat account. A specific request for the same must be made in the application form itself. Till the process of dematerialization is completed, the bonds will be held in RBI’s books. The facility for conversion to demat will also be available subsequent to allotment of the bond,” the RBI said in its answer to a frequently asked question.

The price for secondary market trading of SGBs will be lower than the price you bought the SGB because of various factors, including the time value of money since these are long-term bonds with a fixed timeframe lock-in, no market maker to stabilise the price, demand-supply mismatch, and other factors.

Option B: RBI Buyback Redemption

If you wish to hold the SGB till maturity or at least till the 5th year of the SGB, then you have the option of selling it at the prevailing gold prices and in a tax-free manner through the specified RBI buyback window.

When selling the bonds in secondary markets, you are transferring the ownership of the said SGB to another person or entity. But when you sell the bonds in option B, i.e., through RBI’s buyback window, you redeem the SGBs.

“The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long term capital gains arising to any person on transfer of bond,” mentioned the RBI in a FAQ.

So if you want to go with option B, approach your concerned bank, post office, agent, or others from whom you bought the SGBs and ensure there are at least 30 days before the interest payment for the specific SGB.

“In case of premature redemption, investors can approach the concerned bank/SHCIL offices/post office/agent thirty days before the coupon payment date,” said the RBI.

However, the RBI has specified in a FAQ that no request for premature redemption will be accepted if it is not given at least one day before the interest coupon payment.

“Requests for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon payment date. The proceeds

will be credited to the customer’s bank account provided at the time of applying for the bond,” added the RBI.

So if you want to go with option B, then approach your concerned bank or post office or agent or others from whom you bought the SGBs and make sure there is at least 30 days time before the interest payment for the specific SGB.

“In case of premature redemption, investors can approach the concerned bank/SHCIL offices/post office/agent thirty days before the coupon payment date,” said the RBI.

However, the RBI has specified in a FAQ that no request for premature redemption will be accepted if it is not given at least one day before the interest coupon payment.

“Requests for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon payment date. The proceeds will be credited to the customer’s bank account provided at the time of applying for the bond,” added the RBI.

.png?w=200&auto=format%2Ccompress&fit=max)