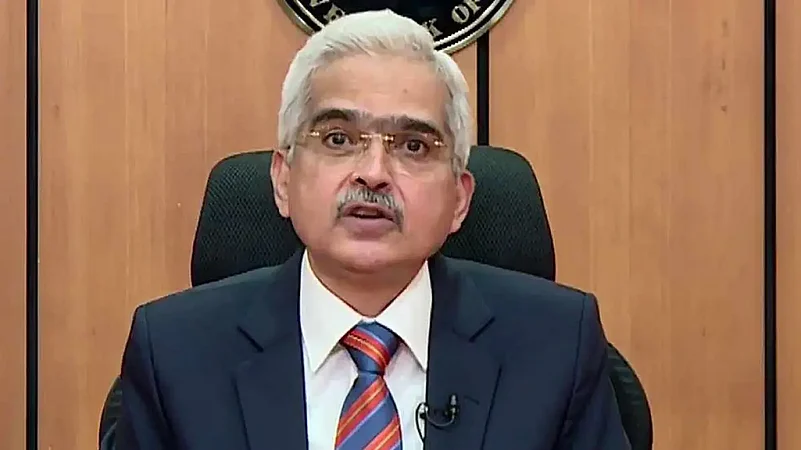

Reserve Bank of India Governor Shaktikanta Das-led six-member Monetary Policy Committee (MPC) decided in ratio of 5:1 to hike key interest rate - repo rate - by 50 basis points to 5.9 per cent to tame the inflation which has been above its tolerance level of 6 per cent for eighth consecutive month.

The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 5.65 per cent and 6.15 per cent, respectively.

While announcing rate hike, Governor Das said, world has been confronted with one crisis after another while Indian economy remains resilient.

"World is in midst of third major shock from aggressive monetary tightening by central banks and there is nervousness in financial market, global economy in eye of the new storm," Governor Das added.

Das said the world has witnessed two major shocks in the last two and half years - the COVID-19 pandemic and the conflict in Ukraine. "These shocks have produced a profound impact on the global economy."

And now, the world is in the midst of a third major shock, in form of a "storm" arising from aggressive monetary policy actions from advanced countries' central banks, he said.

"Despite this unsettling global environment, the Indian economy continues to be resilient. There is macroeconomic stability. The financial system remains intact, with improved performance parameters," he said. "The country has withstood the shocks from COVID-19 and the conflict in Ukraine."

The RBI cut the India’s economic growth projection to 7 per cent from 7.2 per cent for current fiscal while inflation is expected to remain elevated at 6.7 per cent, RBI said.

The MPC has already hiked the key policy rate by 140 bps since May to 5.4 per cent to cool off domestic retail inflation that has stayed above the RBI's upper tolerance limit since January.

“The outcome of the MPC meeting was on expected lines as RBI raised the repo rate by 50 basis points. The central bank gave a very balanced guidance emphasizing on continuing resilient domestic economic growth with risks being rising instability in the global economic and financial environment. Overall the markets have reacted positively to the policy announcement,” said Ritika Chhabra- economist and quant analyst at Prabhudas Lilladher.

The government has tasked the central bank to ensure the consumer price index (CPI) remains at 4 per cent with a margin of 2 per cent on either side, but retail inflation has stubbornly stayed above the RBI's comfort zone since January.

As per the latest data, the inflation was at 7 per cent in August.