The Finance Minister’s (FM's) recent comment that “Rupee has not depreciated but US Dollar has strengthened” implies that the fundamentals driving rupee value are strong and the dollar’s strength is driven by external factors. With the rupee depreciating by about 10 per cent over the last 5-6 months, breaching the Rs 83 mark against the US dollar on October 19, the FM’s statement underlines the dominant influence of the external factors over which we have little control. Further, the assertion that depreciation of rupee was far lower compared to other currencies — Euro, Pound, Yen, Yuan — is yet another way to reassure that our fundamentals are strong.

The increasing interest on the fundamentals is because they determine the macroeconomic targets like inflation, interest rate, growth/output rate and therefore the policy choices. The Reserve Bank of India's (RBI’s) balancing of interest rate and their exchange rate management are indicators of this emphasis on fundamentals.

The fluctuations in exchange rate have caused an increase in inflation, due to which RBI's inflation target has not been met. Not surprisingly, the hike in interest rates by 190 basis points since May 2022 has raised several questions regarding the need for monetary policy to support growth.

Is this rise in interest rate aimed at stemming the net capital outflows caused by the falling interest rate differential between the US and India? Or, is it to correct the domestic inflation rate so as to make exports competitive? Either way, it is an attempt to manage exchange rate fluctuations, by using foreign exchange reserves to stem rupee depreciation. The question that arises is: what are the fundamentals driving rupee value?

Technically, the stability of a currency's exchange rate is determined by the country’s trade flows of goods and services. In India's case, while the exports drive the demand for rupee, the imports play a role in determining the supply of rupee. When exports are less than imports, the supply of rupee exceeds the demand for rupee which causes a depreciation of exchange rate, and vice-versa.

Further, exports are affected by real exchange rate (exchange rate adjusting for inflation) whereas imports are influenced by the nominal exchange rate. So, the imbalances in the Trade and Current account, as well as domestic inflation, together drive the exchange rate fluctuations. On the Capital account, which is debt based (i.e. inflows are borrowings and outflows are investments abroad), currency appreciation will attract net inflows while depreciation results in net outflows. Together, they determine the foreign exchange reserves under the managed exchange rate regime.

To put it simply, when net capital inflows exceed current account deficit (CAD), foreign exchange reserves rise.

Reports indicate that the RBI has intervened by selling $19 billion last month in order to stabilise the fluctuations in the rupee exchange rate. It has also been argued that the interest rate hike by 190 basis points since May 2022 was aimed at reducing the bond yield differences between US and India which was, in turn, triggered by the 275 basis points hike in the interest rate by the US.

The need to bridge the interest rate differential is mainly to stem the FII (foreign institutional investor) outflows, which has the potential to aggravate the slide in Indian rupee.

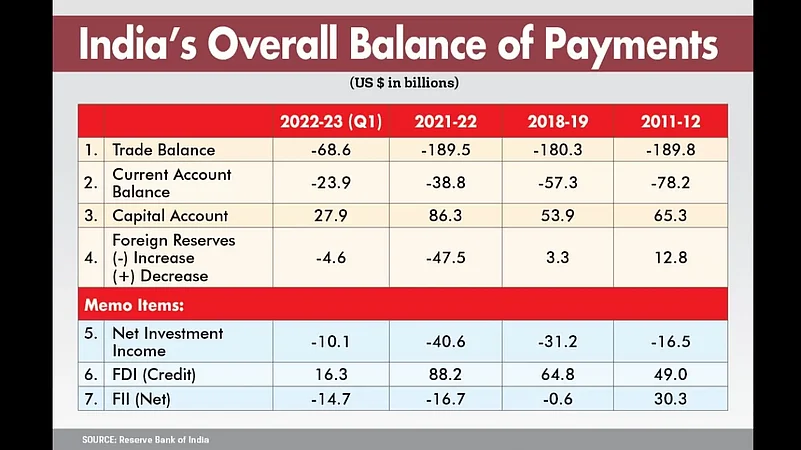

These interventions are seemingly justified by the exogenous factors — high crude prices, food inflation following the Russia-Ukraine war and the interest rate hike by the US — that have affected other major currencies as well, with the US dollar acting as the reserve currency for international transactions. However, for India, this story takes a different turn when we review the overall Balance of Payments situation, summarized in Table 1.

What The Data Suggests

There are three major takeaways from looking at India's balance of payments. First, the CAD is determined by the large trade deficit because the net inflows of 'Invisibles' (services exports) were nullified by large trade deficit in goods. Further, exports being lower than imports of goods did not just happen in 2021-22 or the first quarter of 2022-23 alone, but it has been so in 2018-19 and in 2011-12 as well. This trend points to structural issues in goods trade wherein our exports were not able to finance our imports. The development needs of India will require more imports but we should be able to increase our exports to finance these increased imports.

That is not the case right now. This lacklustre trend in exports needs to be addressed.

The second important takeaway is that the rise in net capital inflows, which is debt-based, needs a closer look. The foreign direct investment (FDI) inflows increased from $49 billion in 2011-12 to $88.2 billion in 2021-22 indicating an improvement in economic activity. However, with subdued exports, it would seem that the focus of FDI is to cater to the large domestic market. Moreover, the trend in net foreign institutional investment (FII) outflows is evident from 2018-19 onwards.

Therefore, the extreme external conditions may not be the only reason for net FII outflows. Finally, the net commercial borrowings (both, medium-term and long-term) remained high at $8.1 billion in 2021-22 and $10.3 billion in 2011-12. High commercial borrowings imply an outflow of interest payments (negative investment income) that are recorded in current account. The negative investment income increased from -16.5 billion in 2011-12 to -40.6 billion in 2021-22. This shows how capital borrowings have had an adverse effect on the current account balance.

An important implication of this trend is the need to enhance FDI and thereby reduce our dependence on FII in the Capital account. Additionally, this trend also points to the need to reduce interest payments by reducing our dependence on commercial borrowings and by repaying the debt.

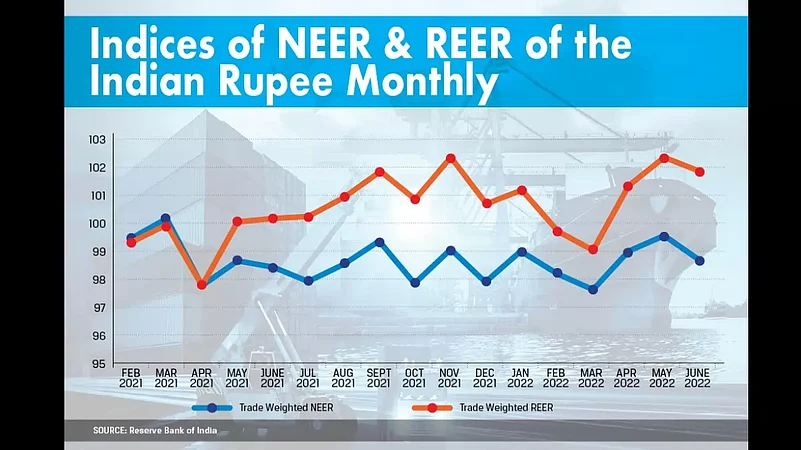

Domestic macroeconomic management and inflation control is equally important for managing exchange rate and overall balance of payment. The higher trend in Real Effective Exchange Rate (REER) relative to Nominal Effective Exchange Rate (NEER), as detailed in Table 2, points to high domestic inflation resulting in overvaluation of rupee. This would mean that Indian exports become expensive in foreign markets and therefore, in order to correct this discrepancy, the depreciation in the rupee should be allowed which will make the imports expensive.

The moot question is whether a tight monetary policy, i.e. increasing the interest rates, can cause the required correction in inflation. Inducing a higher supply response would be a possible medium- or long-term solution, given the high output gap (actual output being lower than potential output). So, the immediate short-term response would be to curtail inflation expectations. RBI’s current stance on managing the inflation and exchange rate is possibly the best option under the given economic situation.

Lessons To Be Learned

These turbulent external conditions bring in lessons for India to adapt and manage domestic economic conditions over medium- and long-term. The priority, as I see, should be to enhance exports. This involves developing a strategy for identifying and diversifying products and markets. The trade policy becomes critical as it projects a path for targets and implementation. Niti Aayog’s recent report on Export Performance Index of states indicates high concentration of exports from few states. Decentralization of export activity as under District Export Hubs needs a strong policy push.

It is also important to have a focussed industrial policy that aims at increasing manufacturing value added(MVA). As per UNIDO’s data, India’s per capita MVA is $ 302 as against $1660 for Thailand, $857 for Indonesia, $620 for Philippines and $ 2520 for Malayasia. This data indicates that India’s manufacturing value addition is less than 25% of Thailand, Indonesia and Malaysia with the difference being much higher for China and other developed countries.

UNIDO’s Competitiveness of Industrial Production (CIP) index assesses and benchmarks industrial production across countries by taking various dimensions like capacity to produce and export, technological upgrading and deepening and world impact. India’s overall global rank in CIP is 39 in 2018 while for China it is 3. The score for “technology deepening and upgrading” for Thailand is 12, Philippines is 11, Vietnam is 31 and India is 40. And the score for “produce and to export” is 46 for Thailand, 81 for Philippines, 72 for Vietnam and 108 for India.

Therefore, developing competitiveness in manufacturing is important for India to enhance its growth and exports. This is why a focussed industrial policy is necessary. Finally, a supportive monetary policy is required to successfully implement the aforementioned goals of enhanced exports and focussed industrial policy. If these three lessons are designed and executed parallelly, India stands a good chance of achieving its growth targets.

(The author is a Professor at Indian Institute of Foreign Trade)