The rate of return for the financial year 2022 on the government’s ambitious Sukanya Samriddhi Yojana (SSY) is the highest among all government-backed investment schemes, including the much well-known Public Provident Fund (PPF).

It is offering an annual return of 7.6 per cent for FY 2022 as against 7.1 per cent for PPF.

So, if you have some investments still to make for the financial year ending 2022, and if you also happen to be the parent of a young girl, then you could be in luck. SSY should be the right investment vehicle to save some taxes under Section 80C of the Income Tax Act.

Way back in 2015, Prime Minister Narendra Modi had launched the SSY under the Beti Bachao Beti Padhao campaign to encourage parents to invest in a government-backed scheme for the education and other expenses of their girl child.

As with any other government investment scheme, the government announces the rate of interest on the scheme every year. For the year ending 31 March, 2022, the rate of interest is 7.6 per cent annually. When launched in January 2015, the annual rate of return was 9.1 per cent per annum.

So, is this a good investment vehicle to park your money? And how can you open an account under the scheme?

To begin with, investments made in SSY are eligible for tax benefits under Section 80C of the Income Tax Act. But that’s not all, SSY falls under those rare government schemes that come with the EEE benefit.

Contributions made under SSY are exempt from tax, the interest earned is also tax exempt, as are the maturity proceeds. It is quite similar to Public Provident Fund in terms of investment and EEE status, but offers more in terms of return as compared to PPF.

The minimum amount required for opening an account, and for deposit each year for maintaining the account is Rs 250. The maximum deposit allowed in a financial year, however, should not exceed Rs 1.5 lakh, whether invested in a lump sum or in instalments.

In comparison, the minimum deposit for opening and maintaining a PPF account is Rs 500.

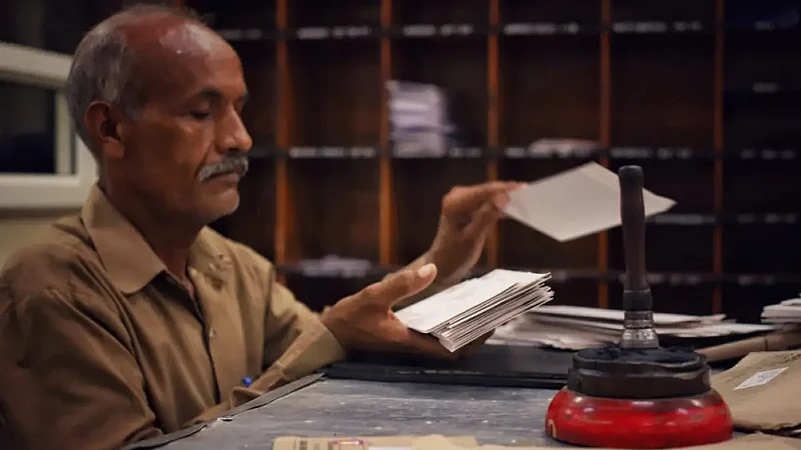

Parents can open up to two accounts for their daughters at either one of the specified banks named under the scheme, or at a post office.

There are certain conditions that need to be fulfilled though to open an SSY account.

The age of the girl child should not exceed 10 years at the time of opening the account. The account needs to be maintained for 15 years, and matures after 21 years from the date of opening. For the remaining six years, the account keeps earning interest on the investment made. Parents can operate the account till the girl is 18 years, after which the girl child has to operate the account by submitting the necessary KYC documents.

Premature withdrawal is allowed only in case of wedding of the girl where the girl herself furnishes a self-attested declaration also attested by the notary that she is 18 years and above on the date of her wedding.

Parents can open an account under SSY with relative ease. The documents include an SSY account opening form, the birth certificate of the girl child, identity and residence proof of the parent, and a photograph of the parent and the child.

Given the benefits, it is indeed a safe and secure investment option to make for your girl child.

.png?w=200&auto=format%2Ccompress&fit=max)