A poor and blind old woman lived in a village. One day, an angel appeared and asked her to make a wish. She was in a dilemma whether she should ask for wealth, a grandson, or her eyesight. She finally told the angel that she wanted to see her grandson drinking milk from a gold bowl. The angel knew she had asked for three wishes in one, but still granted her the same.

Similar to the old woman’s dilemma, investors too are confused about how much they should invest in debt, equity and/or gold.

THE SOLUTION

Hybrid funds could offer the solution to this dilemma. Hybrid funds offer a combination of asset classes (also called asset allocation) in a single product.

The most common are those offering a combination of equity stocks and debt securities (largely, high-quality corporate bonds, government securities, and money market instruments). The key benefits offered by these funds include reduction of risk by diversification across asset classes, and hassle-free rebalancing, which is needed to reset the weightages of each asset class to the original state in case they change over a period.

If a 60 per cent equity and 40 per cent debt portfolio (60:40), changes to 70 per cent equity and 30 per cent debt (70:30) when equity markets go up, rebalancing resets the weightages back to 60:40 by selling some equity and replacing it with debt.

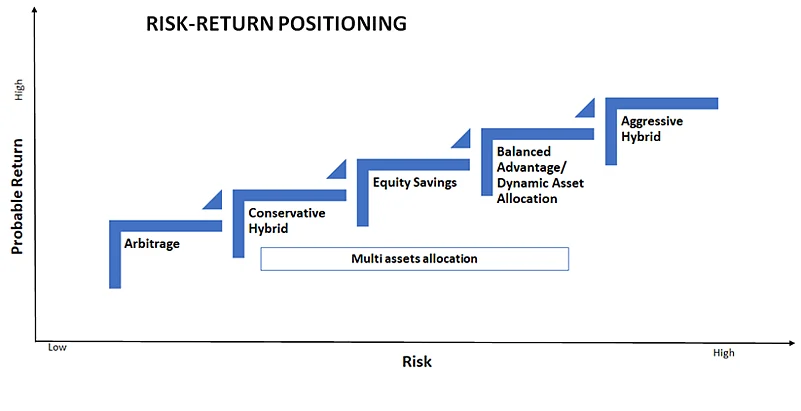

Hybrid mutual funds offer a plethora of options for investors, too.

For instance, a conservative investor could choose a combination, which is heavily into debt, while a relatively aggressive investor could choose a portfolio which is heavily tilted towards equity.

Conservative hybrid funds invest 75-90 per cent in debt securities and 10-25 per cent in equity stocks, while aggressive hybrid funds invest 65-80 per cent in equity stocks and 20-35 per cet in debt securities.

The former could be ideal for retirees, who are relatively risk averse and are looking for regular cash flows, while the latter could be a good starting point for first-time mutual fund investors, who are not comfortable with the volatility associated with standalone equity products.

With interest rates on traditional fixed income products on the decline, those seeking regular income, especially retirees, are in search of avenues, which can provide marginally higher returns with a marginally higher risk. A debt-oriented hybrid fund, which invests 75-90 per cent in debt, and 10-25 per cent in equity, has the potential to meet this requirement. The predominant debt component helps in providing stability, while the marginal equity component allows for growth.

While mutual funds are popular for wealth accumulation, very few are aware of their wealth decumulation (regular cash flow) features. The latter is possible through systematic withdrawal plans (SWP), which ensure a regular flow of income by redeeming units at predetermined intervals.

In addition to convenience, this arrangement is also tax efficient, compared to traditional deposits.

Some hybrid funds also offer flexible allocation of 0-100 per cent between equity and debt. Then, there are equity savings funds, which invest a minimum 65 per cent in equity (including derivatives), and the rest in debt. Those wanting equity fund taxation need to choose funds where the equity component is greater than 65 per cent, while the rest would offer debt fund taxation. Not just this, hybrid mutual funds also offer a combination of equity, debt, and gold in a single fund called multi-asset allocation funds, which invest in three or more asset classes.

Overall, hybrid funds are a good avenue for investors seeking to diversify across asset classes to reduce risk. Among the variety of hybrid funds available, choose the one that matches your risk and returns expectations. By availing yourself of systematic features for accumulation or decumulation, you can attain your various goals through hybrid funds.

The author is head – content development, India at Franklin Templeton

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)