The US economy shrank in the first three months of the year, and faces threats from high inflation and rising interest rates, yet economists foresee a return to growth for the rest of 2022, based on the strength of the job market and consumer spending.

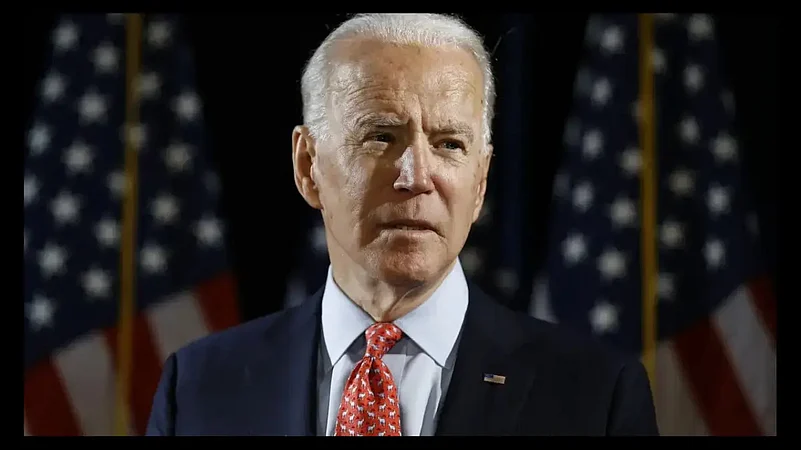

The 1.4% quarterly decline in gross domestic product — the first contraction since the pandemic hit in 2020 -- is not likely a prelude to recession, economists say. That may bring little comfort to President Joe Biden and Democrats, who face mid-term elections this year in which rising prices for food, energy and other essentials will be a major theme of Republican opposition.

Two trends drove the U.S. economy's decline last quarter, according to Thursday's report from the Commerce Department:

— Imports soared nearly 20% as Americans bought more foreign-made goods, while exports fell almost 6% as growth slowed overseas — a widening of the trade deficit that subtracted 3.2 percentage points from GDP.

— After furiously restocking their inventories ahead of last year's holiday shopping season, businesses did so at a slower pace at the start of this year.

As a result, first quarter GDP — the nation's total output of goods and services — fell far below the 6.9% annual growth in the fourth quarter of 2021.

However, rising wages bolstered spending by households, and higher profits drove investment by companies. Together these factors suggest strong fundamentals for the U.S. economy, even in the face of challenges from the pandemic, the war in Ukraine and the Federal Reserve's plans to raise interest rates to fight inflation.

“The report isn't as worrisome as it looks,” said Lydia Boussour, lead U.S. economist at Oxford Economics. “The details point to an economy with solid underlying strength that demonstrated resilience in the face of Omicron, lingering supply constraints and high inflation.”

The U.S. economy is in an unusual and challenging position.

The job market — the most important pillar of the economy — remains robust, with the unemployment rate near a 50-year low of 3.6%, and wages rising steadily. And in the January-March quarter, businesses and consumers increased their spending at a 3.7% annual rate after adjusting for inflation.

Economists consider these trends a better gauge of the economy's core strength than the latest GDP figure.

Still, serious threats have emerged. Supply chain disruptions in China and elsewhere are still a pandemic-era reality, and the war in Ukraine is contributing to higher inflation, which erodes consumers' spending power. Last month, prices jumped 8.5% from a year earlier, the fastest such rise in four decades.

“We are at a turning point in the economy,” said Gregory Daco, chief economist at tax advisory firm EY-Parthenon. “The pace of growth is moderating.”

The first quarter's weak showing also reflected a slowdown from last year's robust rebound from the pandemic, which was fueled in part by vast government aid and ultra-low interest rates. With stimulus checks and other government supports having ended, consumer spending has slowed from its blistering pace in the first half of last year.

Last quarter's negative GDP number also undercuts a key political message of President Biden. The president has pointed to rapid growth as a counterpoint to soaring inflation. Compounding Biden's difficulties, Russia's invasion of Ukraine and rising COVID cases overseas are weighing on the economy and heightening inflation pressures. Many companies are also still struggling to obtain the parts and supplies they need from tangled supply chains.

The Plano, Texas-based burger chain MOOYAH faces higher costs for food and packaging supplies, and has raised wages to attract and keep workers.

“Just about every aspect of doing business has gotten significantly more expensive,” said Doug Willmarth, the company's president.

Yet despite supply chain snags tied to the pandemic, MOOYAH still plans to open 20 more restaurants this year. “We are big believers in American consumers and the American economy,” he said.

Imports surged in the first quarter, a sign that some of the supply snarls have eased. But ongoing lockdowns in China, including at its largest port, Shanghai, are likely to perpetuate shortages this year. Ford and General Motors have both said this week that they still can't obtain all the semiconductor chips they need to build vehicles, costing them sales and forcing temporary plant closures.

A broader global slowdown is also expected this year, according to estimates last week by the International Monetary Fund. The 190-nation lending organization now foresees the disruptions of the Ukraine war and COVID slowing global growth to 3.6% this year from 6.1% last year.

Thursday's GDP report showed that consumers are adjusting their spending patterns as the pandemic fades and as higher costs for food and gas eat into household budgets. Adjusting for inflation, spending on clothes, gasoline, and groceries fell in the first quarter. But Americans spent more on services, including travel and dining out.

The Fed had hoped that such a shift would bring down inflation, as goods prices have shot up more than services in the past year. But now prices for airline tickets, hotels, and restaurant meals are also rising.

Fed Chair Jerome Powell has signaled plans for a rapid series of rate increases to combat higher prices. The Fed is set to raise its key short-term rate by a half-percentage point next week, the first hike that large since 2000. At least two more half-point increases – twice the more typical quarter-point hike -- are expected at subsequent Fed meetings. They would amount to one of the fastest series of Fed rate hikes in decades.

Powell is betting that with job openings at near-record levels, consumer spending healthy and unemployment unusually low, the Fed can slow the economy enough to tame inflation without causing a recession. Yet most economists are skeptical that the Fed can achieve that goal with inflation as high as it is.

.jpg?w=200&auto=format%2Ccompress&fit=max)