The Indian equity benchmarks have crashed over 10 per cent from record highs reached in December last year, on the back of relentless selling by foreign portfolio investors after bond yield started rising in the backdrop of spike in inflation.

The sentiment for Indian equity markets further took a knock after the US-based short seller Hindenburg Research leveled allegations of fraud, stock price manipulation and improper use of tax havens against the Adani Group which led to a massive selloff in Adani shares.

The S&P BSE Sensex fell 9.52 per cent and Nifty 50 index also dropped 10.28 per cent from record highs tested on December 1, 2022.

The foreign institutional investors (FIIs) have so far sold shares worth Rs 28,370 crore against record Rs 1,21,439 crore worth of shares sale in 2022.

Meanwhile, the FIIs have been consistently making heavy short positions in Indian markets and it is time to see for how long they can make short positions in Indian markets, analysts said.

“The FIIs have been completely sellers. Their net long position had been just 11 per cent right now. When March series started they were net long by 19 per cent and short by 81 per cent. They went net long to as low as 8 per cent and short positions rose by 92 per cent. So at the institution level we have to see how much short they can go all together,” said Virendra Singh Rathore, Senior Research Analyst (Derivative Desk) at Prudent Stock Broking.

Explaining the reason behind the excessive selling by FIIs, Rathore says that FIIs are selling because of the interest rate differential that has reversed after the US Fed started raising rates to curb the inflation which shot up to highest in multiple decades.

“It is the turn of economic cycle. FIIs were getting funds at rate of 0.25 at 0.5 per cent and they were investing relentlessly in Indian markets. FIIs are taking out money because the rate of yield has changed altogether and USD-INR has also depreciated drastically,” says Rathore.

“Earlier bond yield in the US was 1.5 per cent and in India it was around 6 per cent there was a differential of around 4.5 per cent but now our yield is near 7.5 per cent and there yield has spiked to 5 per cent. The yield difference has narrowed to 2.5 per cent from 4.5 per cent,” Rathore adds.

Sector and Stock Specific Picture

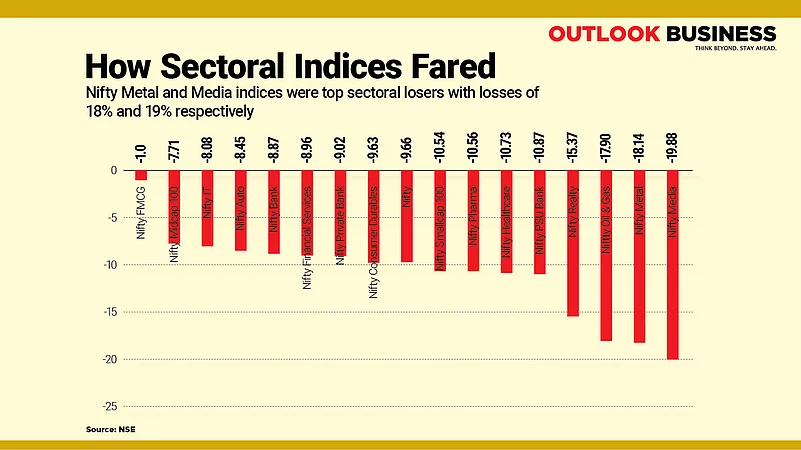

The selling pressure has been so intense that all the 15 sector gauges compiled by the National Stock Exchange are giving negative returns. Nifty Media index is the top sectoral loser with decline of nearly 20 per cent. Nifty Metal, Oil & Gas, Realty, PSU Bank, Healthcare, Pharma, Consumer Durables, Private Bank, Financial Services and Bank indices have also fallen in range of 9-18 per cent.

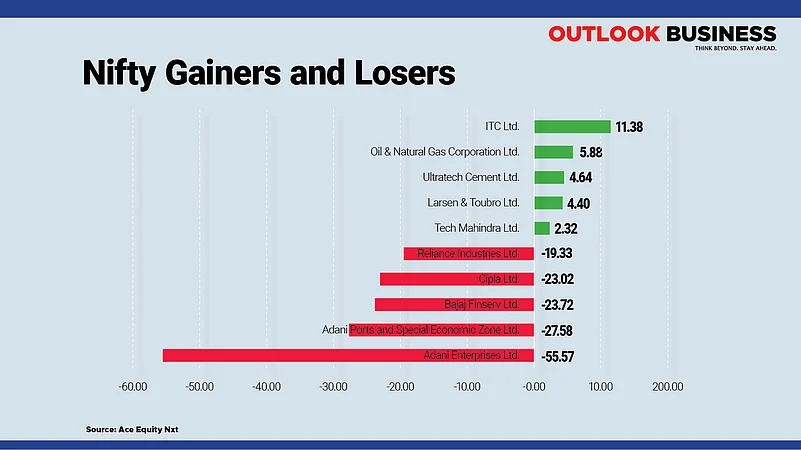

Adani Enterprises is the top loser in the Nifty 50 basket of shares, the stock has since the highs of December dropped a whopping 55 per cent, Adani Ports has tumbled 28 per cent. Bajaj Finserv, Cipla, Reliance Industries, Hero MotoCorp, Divi's Labs, HDFC Life, Eicher Motors, State Bank of India, Bajaj Finance and Infosys have also fallen between 15-24 per cent.

On the flipside, ITC, ONGC, UltraTech Cement, Larsen & Toubro, Tech Mahindra, Bajaj Auto, BPCL and NTPC were among the notable gainers in the Nifty 50 basket.

Metal shares witnessed a major selloff owing to global demand slowdown. China which is a major consumer of metals is in a middle of slowdown chaos which has further impacted the metal sector.

Mid-cap and small-cap shares have also succumbed to the selling pressure as Nifty Mid-cap 100 index has dropped nearly 8 per cent and Nifty small-cap 100 index has tumbled 10.55 per cent.

Mid and small-caps have broken there crucial support levels and Nifty has also been sideways in last 2-3 sessions but stock specific selling pressure in mid and small-caps can be still seen and it is better to stay on sidelines, said analysts.

Is India On The Cusp Of Entering Bear Market?

The markets witnessed a similar selloff in the aftermath of Russia-Ukraine war in February, when shortage of edible oil, crude oil and agricultural commodities in international markets, after sanctions were imposed on Russia, led to spike in inflation globally and investors rushed to safety of bonds. The selloff led to Nifty testing levels of 15,000 but the rebound followed as markets went into oversold zones.

“I think we can call it a corrective phase (not the beginning of a bear market) in the market but the short term trend is down for the market because we have not yet seen significant pullback move,” says Ruchit Jain, lead research analyst at brokerage firm 5Paisa.com.

“In February and March series Nifty saw two sizeable pullback moves one after the Budget when Nifty moved from 17,350 to 18,134 and second during the first week of March when Nifty moved from 17,250 to 17,800 but in both the pullback moves we did not see any kind of long formation rather these were short covering moves,” Jain told Outlook Business.

Jain added that FIIs currently hold significant amount of short positions in Nifty Futures and until any short covering happens from their end market trend is expected to remain on the downside and immediate resistance for Nifty is around 17,200 where technically 20-day exponential moving average is placed.

“In last 11 trading sessions Nifty has been consolidating in range of 17,200-16,850. 17,200 remains the short term trend changing point and till the time Nifty is below this, the trend continues to remain negative. Only on a breakout above 17,200 investors should look at buying opportunities and till then one should look to avoid bottom fishing. It is better to be on sidelines and wait for trend to reverse,” he adds.

Sanjiv Bhasin, director of brokerage form IIFL Securities said that April could turn out to be a relatively good month for markets and the markets are unlikely to enter the bearish phase.

"I think next week onwards markets will get over with the pressure of derivatives expiry. Markets had four consecutive months of negative closing which has not happened in many years. I think we are grossly overdone on the weakness side and we are ripe for a very strong bounce and April will turn out to be a relatively good month for equities," said Bhasin.