As investors, many of you might have experienced amplified volatility in the Indian stock market in recent times. After rallying remarkably since the low of March 2020, the equity markets have hit turbulence, eroded wealth, and overall, it’s been a spine-chilling experience.

The key factors that have caused this intense volatility have been Russia’s invasion of Ukraine (it’s been more than 70 days that the two nations have been at war), a rise in the price of crude oil, a weak Indian rupee, a rise in COVID-19 infections once again in the country (given that many of the restrictions are relaxed), the power crisis in the country (due to dwindling supply of coal), supply-chain disruptions, spiralling inflation, and major central bank across the world, including the Reserve Bank of India (RBI), raising policy rates to control inflation. The markets are weighing the detrimental impact of all these factors on the industry, corporate earnings, and the overall economy.

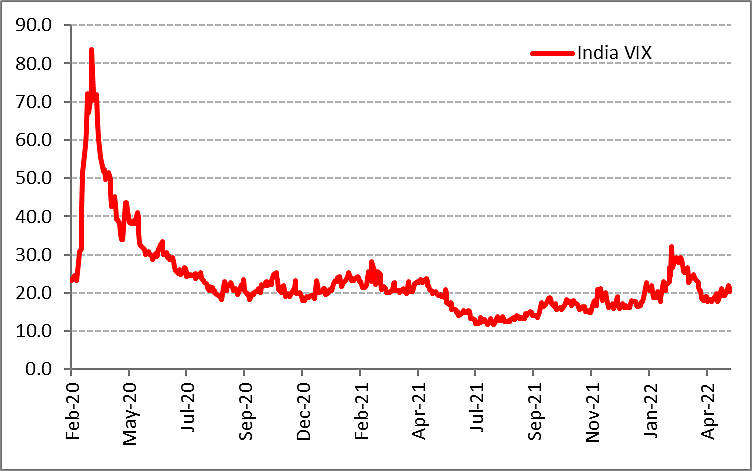

Graph 1: India VIX

Data as of May 6, 2022

(Source: NSE)

At present, no one really knows the direction for the equity market from here on. But broadly, it looks like the intense volatility will continue. In such times, one cannot time the market. All it would do is risk your health and wealth; timing the market is nearly impossible!

Instead, it would make sense to tactically invest across other asset classes as well, such as debt and gold. This shall help you diversify (which is one of the basic tenets of investing), and possibly limit the downside risk.

“There is a close logical connection between the concept of a safety margin and the principle of diversification,” said Benjamin Graham, the father of value investing.

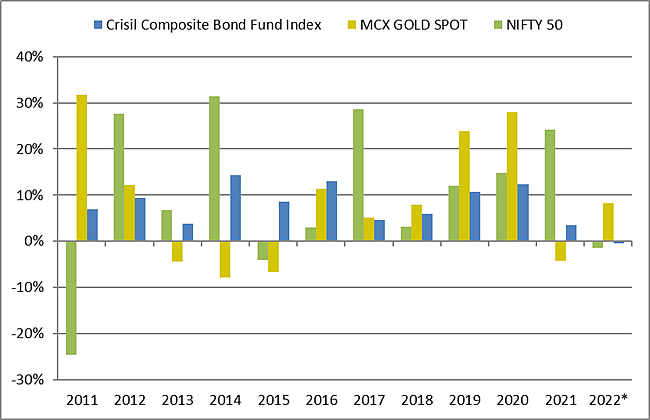

Graph 2: Year-on-year performance of equity, debt, and gold

Data as of April 30, 2022

(Source: ACE MF)

The graph above shows that equity, debt, and gold do not move in the same direction always. In times when there are tailwinds and favourable macroeconomic conditions, equity as an asset class does well. But when there are headwinds in play and macroeconomic uncertainty, as what we are witnessing at present, it is gold that displays its trait of being a safe haven, store of value, and an effective portfolio diversifier.

Likewise, when interest rates begin to increase as a consequence of the RBI’s policy action to tame inflation, debt and fixed income investment instruments, such as bank fixed deposits and short duration debt funds (such as liquid funds, ultrashort-term debt funds, and short duration debt funds) generate good returns.

Hence, there is no point in being predisposed to only equities –whether in stocks or equity mutual funds-as it would not enable you to reduce risk and optimise the gains. What is required is tactical asset allocation.

A multi-asset Fund of Fund will help you allocate your investible surplus to all three asset classes –equity, debt, and gold –with appropriate exposure to each asset class and benefit therefrom. You don’t need to worry about how much to allocate to each asset class, including doing the research to pick the best securities. The professional fund manager and the fund management team will take care of all this rather than you having to do this by yourself with a single fund. This will also save you the hassle of looking at multiple statements and trying to rebalance the portfolio yourself.

The capital market regulator, the Securities and Exchange Board of India (Sebi) mandates that a multi-asset fund allocates at least 10 per cent each in equity, debt, and gold- the three asset classes. But as regards the maximum allocation, it is a research-backed call depending on the outlook for each asset class, wherein factors such as price-to-earnings (P/E) ratio relative to the historical average, the relationship between earnings yield to bond yield relative to historical averages, and macroeconomic factors prevailing globally and within India, among a host of other parameters, are considered.

The performance of the mult-asset fund of fund is benchmarked against a combination of indices- Crisil Composite Bond Fund Index + S&P BSE Sensex Total Return Index + CRISIL Liquid Fund Index + Domestic price of Gold, and is based on how the total assets are allocated.

The primary objective of the multi-asset fund of fund is to generate modest capital appreciation while trying to reduce risk (by diversifying risks across asset classes) from a combined portfolio of equity, debt/money markets and gold schemes.

A multi-asset allocation fund does not maintain a static allocation; it is dynamic. It is reviewed regularly by the fund manager and his team depending on the outlook for each asset class. So, there is enough flexibility as well to invest in asset classes that share a very low positive correlation.

In comparison to an aggressive hybrid fund – which often fails to offer the required balance because the allocation to equity should be minimum of 65 per cent in terms of Sebi guidelines to qualify for tax status of an equity-oriented fund, a multi-asset fund is truly balanced.

To sum it up, investing in a multi-asset fund of fund adduces the following five key benefits:

1) Optimum diversification with just one investment that aims to protect the downside risk.

2) Enables timely portfolio rebalancing, based on the performance and the outlook of each underlying asset by a professional fund manager.

3) Provides relief from timing the market, instead helps you focus on your financial goals (by giving enough time in the market).

4) Benefit from the strong research capabilities of a fund management team.

5) Lowers the cost of investing.

In times when you cannot depend on a single asset to create wealth and accomplish the envisioned financial goals, consider investing in a multi-asset fund of fund.

Happy Investing!

The author is chief business officer at Quantum AMC

(Disclaimer: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.)