Consider this: As of October 2016, prepaid instruments, primarily mobile wallets, had registered transaction volume of 59 million; exactly a year later, this figure has shot up to 96.2 million, a steep growth of 63%. Mobile banking too followed a similar trajectory as it notched up transaction volumes of 130.9 million during the month compared to 72.3 million in the year ago period. Unified Payments Interface (UPI), touted as the mobile wallet killer at the time of its launch, shot up to 76.8 million from 0.3 as of November 2016 last year. “There is no doubt that it (note ban) has increased the level of the digital economy significantly. Last one year has seen significant growth in usage and adoption of digital channels for making payment transactions,” said Ram Sarvepalli, Partner and National Leader, Advisory Services, EY India.

Transactions using USSD, which is primarily suited for executing low value transactions even through feature phones crossed volumes of 184.6 million in October 2017. Card payments – both debit and credit put together – have touched a transaction volume of 255.7 million, up by 24% compared to the same period last year. “Physical acceptance infrastructure at merchants has nearly doubled from 1.5 million POS terminals in October last year to over 2.9 million now,” he said, adding that debit cards are being increasingly used to make purchases rather than only ATM withdrawals. “Debit cards which were primarily used for cash withdrawal with less than 8% usage at POS pre-demonetisation spiked to 29% during the cash crunch phase and has now stabilised at 13-14% in a steady state,” he said.

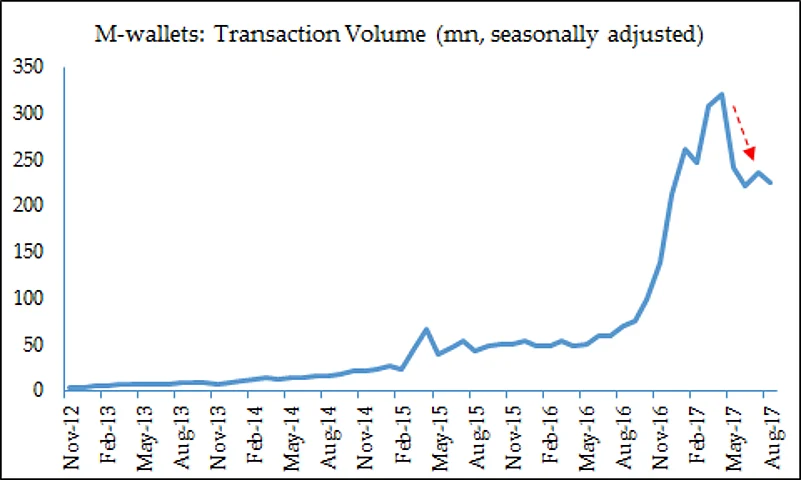

While the growth figures look impressive, some industry-watchers warn against complacency. “After an initial spike in digital payment methods, there is anecdotal evidence that some smaller merchants are reverting to cash. With easing of the liquidity crunch, transaction volumes for overall retail electronic payments have seen a marginal dip. For M-wallets too, there has been a gradual tapering after the initial bounce. This prima facie would suggest a slow reversal in the usage of digital platforms,” said an HDFC Bank report. However, a complete return to the pre-November 8 trends has not yet happened. “This holds out the possibility that there has been some behavioral change in the transactions patterns. Whether the big jump above trend represents a short-term blip, or whether demonetisation has given a structural push to the already rising trajectory of digitization, remains an open question,” the report sums up.

M-wallets and retail electronic payments picked up initially. However, the fizz is settling

Source: HDFC Bank report