It is always recommended that when you buy Term Insurance, you must cover yourself up to the age of retirement. Retirement is the age when you have done away with large financial responsibilities and have a sizeable financial corpus to bank on for the living expenses of your and your partner’s retirement life. The number that usually comes to your mind when you think of retirement is 65 years and even experts recommend buying term insurance up to the age of 65. However, in the fast-changing world, this may no longer hold true. Here are a few reasons;

You may have dependents and financial liabilities beyond 70 years:

People who aspire to retire by 40 or 50 will hate me for this, but I have bad news for you. Look around and you will see that with increased career focus and prevalence of nuclear families, the average age of marriage and hence the age of becoming a parent has moved up by around 4-5 years in the last decade or so. Added to it, with larger disposable income and growing aspirations, your children are likely to study for higher number of years after they have hit adulthood (and hence continue being dependent on you) than what you or I did. In all probability, if you are currently in your 30s right now, all this is likely to push the retirement age to around 70-75 years. Apart from this, you need to take into consideration any long-term loan or liability that goes beyond such an age. For instance, if you are a businessman, and have taken a large business loan which has personal liability attached, you need to ensure you have a term plan that covers you for that too.

You may have to keep earning beyond 65 years:

With advanced medical science and increased safety all around us, you may just end up living for more years, albeit with a chronic or critical illness. This may result in increased recurring medical expenditure in addition to your planned living expenses. Your retirement corpus may not be enough for you to take care of such increased living expenses for 35 years (from 65-100 years), which may force you to continue earning beyond your current mental retirement age of 65. Now, if it is likely that your partner is a dependent then, you will need to cover yourself with a term insurance till you are required to keep earning.

A smart legacy planning strategy:

Apart from the need of taking a long cover, plans that cover you up to 100 years, has also been recognised as a smart legacy planning strategy. This is because it can turn out to be the guaranteed and most effective strategy for leaving behind a sizeable financial corpus for your family. Here you take a term insurance up to the age of 100 years, and depending on the age you pass away, you could actually leave behind a corpus which gave a return of close 8-10% annually on the term insurance premiums you paid. It also serves the purpose of many who do not understand the concept of risk management and want even their insurance premium to pay back, this could be a good alternative. Here’s an example that can help you understand this better.

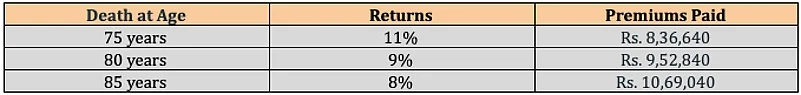

Suppose, Mohan aged 40 wants to provide financial protection and leave a legacy for his loved ones, he can get a term insurance plan for 100 years. Now, if he has a sum assured of Rs. 1 crore and he passes away at the age of 75, his nominee will get Rs. 1 crore, which is a good 11% returns against the total premium payment of Rs. 8.36 lakh.

Please find below sample calculation for a 40 year old male, non-smoker for a cover of Rs 1 crore up to 100 years:

Term Insurance offers various choices and flexibilities, hence there is no one size that fits all formula which can be applied here. In order to get the best protection at pocket-friendly rates, one has to properly analyse his or her needs and then select a suitable term insurance plan. With the new features like whole life cover and riders in a term plan, besides being a protection plan, term insurance now helps one to do legacy planning for his loved ones that provides a guaranteed life cover. So, if you feel that, a term insurance plan with a cover till the age of 99 or 100 years meets all your requirements, then you should definitely go for it.

The author is the Director - Health, Life and Strategic Initiatives, Coverfox