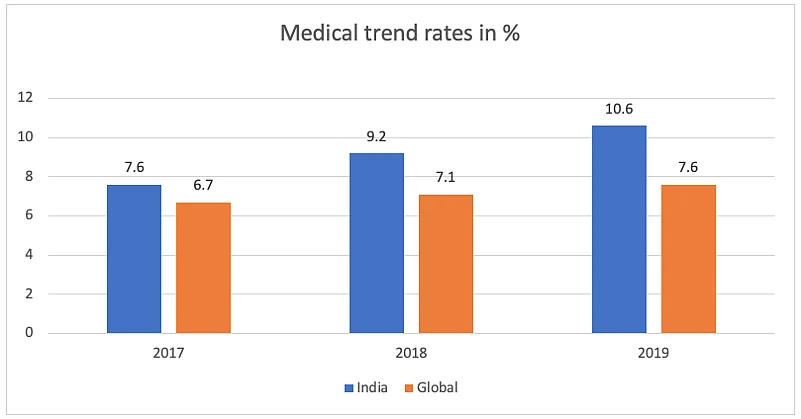

Healthcare expenses are rising and needless to say, the numbers are quite worrisome. India’s medical inflation has been increasingly higher than the global average and significantly higher than other developed economies around the world.

According to a report published by Willis Towers Watson, the gross rate of medical inflation in India over a three-year period from 2017 to 2019 increased steadily. Here’s the number which was recorded over this three-year period –

*Medical trend rates are weighted average based on the GDP per capita.

In order to sail across tumultuous situations, especially medical emergencies it is very important to opt for health insurance. However, many are unaware of the coverage, benefits and exclusions of health insurance plans. Let’s have a look at the inclusions and exclusions within a health insurance plan.

What is covered?

The basic coverage features include the following –

In-patient hospitalisation

The expenses incurred in case of hospitalisation of 24 hours or more are covered. These expenses include –

- Room rent of the hospital

- ICU room rent

- OT charges

- Nurse’s fee

- Doctor’s fee

- Surgeon’s fee

- Anaesthetist’s fee

- Cost of medicine, blood, oxygen

Pre and post hospitalisation

Medical costs incurred before being hospitalised (pre hospitalisation) and after being discharged from the hospital (post hospitalisation) are covered.

Ambulance costs

Costs incurred in taking the insured to the hospital for treatment in an ambulance are covered up to a limit.

Day care treatments

Treatments, which do not require hospitalisation for 24 hours are called day care treatments.

Organ donor expenses

Expenses which are incurred in harvesting the organ from the donor as well as for the transplant surgery are covered under health plans.

AYUSH treatment

Alternative non-allopathic treatments like Ayurveda, Unani, Siddha and Homeopathy are covered under many health plans.

Domiciliary treatments

Treatment taken at home due to non-availability of hospital beds or when the insured is in no condition to be shifted to a hospital is called domiciliary treatment.

Free health check-ups

Almost all health insurance policies allow free preventive health check-ups once in 1-4 claim-free policy years.

Restore benefit

This is a very popular benefit which is increasingly becoming available in many health insurance plans today. Restoration benefit allows you to reinstate the entire sum insured in the policy year when it gets partially or completely exhausted due to claims. However, this benefit does not work for the same illness of the same person and can be exercised once in a year.

Other coverage features

While the above features are commonly found in most health plans, here are some other notable features which are found in popular plans –

- Maternity coverage wherein the cost of childbirth is covered

- New born baby coverage which is usually bundled with maternity cover

- OPD coverage wherein medical costs incurred on an outpatient basis are covered

What is not covered?

While health plans are otherwise comprehensive in their scope of coverage, there are some instances which are not covered under most plans. These are called plan exclusions and include the following expenses and treatments –

- Illnesses which the insured has at the time of buying the policy are called pre-existing illnesses. The waiting period ranges from 1 year to 4 years across plans

- Medical illnesses within the first 30 to 90 days of buying the policy

- Specific treatments like joint replacement, hernia, piles, etc. are not covered in the first 2-4 years of the plan

- Self-inflicted injuries

- Injuries due to alcohol or drug abuse

- Maternity related expenses unless the plan has maternity cover

- Cosmetic treatments

- Dental treatments

- Unproven and experimental treatments

- OPD expenses unless the plan has an inbuilt OPD cover

- HIV/AIDS

- War, riots and related perils and nuclear contamination

The Last Words

Whenever a health insurance plan is bought, the inclusions and the exclusions should be properly understood. When the coverage of the plan is clear, right expectations are set from the plan. So, policyholders should always read the coverage and exclusion details of health plans before finalising the best policy.

The writer is Co-Founder, Turtlemint